Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience

Audio : Listen to This Blog.

Robust Resilience and Sustained Growth in Q3 2023

“In the dynamic landscape of the global FinTech industry, where caution prevails, and funding experiences a modest decline, it is resilience that sets the stage for success.”

The third quarter of 2023 witnessed a paradigm shift in the FinTech landscape, yet the industry remained robust and adaptive, as revealed by this comprehensive analysis by MSys Technologies: “Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience.” Amid cautious investor sentiment and a slight funding dip, the FinTech sector showcased its unwavering appeal. The State of FinTech Q3’23 Report by CB Insights reported that global FinTech funding reached $7.4 billion during this period, demonstrating relative stability with a marginal 3% decline from the previous quarter.

Within this dynamic environment, significant investments made their mark across various subsectors, with digital banking, lending, fraud prevention, and financial inclusion leading the way. Notably, the United States emerged as a frontrunner in FinTech funding, accounting for a substantial 47% of all quarterly FinTech funding in Q3’23. While the overall funding experienced a decline, late-stage investing remained resilient, with prominent FinTech players embracing pragmatic approaches, including down rounds, to ensure sustained growth. This resilience demonstrated the sector’s attractiveness and potential to investors, even amid economic uncertainties.

Moreover, despite the decline in overall funding, the FinTech industry’s unwavering dedication to enhancing essential areas such as customer-centric value propositions, digitalization, and technology-driven solutions reaffirms its commitment to innovation and highlights its immense growth potential.

An in-depth analysis of GlobalData’s Financial Deals Database reveals that the United States cemented its position as an investor favorite, accounting for 35.6% of the total number of global venture capital (VC) funding deals announced during Q1-Q3 2023. Remarkably, the US also represented 48.8% of the whole deal value during this period, standing tall as a beacon of confidence and opportunity.

Commenting on the landscape, Aurojyoti Bose, Lead Analyst at GlobalData, states, “VC funding activity faced significant setbacks across global markets, including the US, due to macroeconomic challenges, conflicts, and uncertain market sentiments. Nevertheless, the US continued to shine brightly, attracting the highest share of deal volume and value throughout Q1-Q3 2023, showcasing its resilience amidst adversity and solidifying its position as a prominent player in the FinTech industry”.

The US FinTech ecosystem remained a beacon of hope, with a staggering 9,132 VC funding deals announced during Q1-Q3 2023. These deals amounted to a disclosed value of $164.3 billion, reflecting the unwavering confidence of investors in the US market and its potential for growth and innovation.

As the global FinTech landscape faced challenges and uncertainties, the resilience of the US FinTech sector prevailed. Despite macroeconomic headwinds and ongoing conflicts, the US maintained its stronghold, demonstrating the ability to navigate turbulent times and attract significant investments.

The US accounted for 35.6% of the total number of VC funding deals announced globally during Q1-Q3 2023, reinforcing its position as a preferred investment destination. In terms of the corresponding deal value, the US held an impressive 48.8% share, highlighting its significance in the global FinTech funding landscape.

The robustness of the US FinTech sector stems from its ability to adapt, innovate, and overcome challenges. The industry’s continued focus on customer-centric value propositions, digitalization, and anticipation of evolving customer needs underpins its resilience and sets the stage for sustained growth and success.

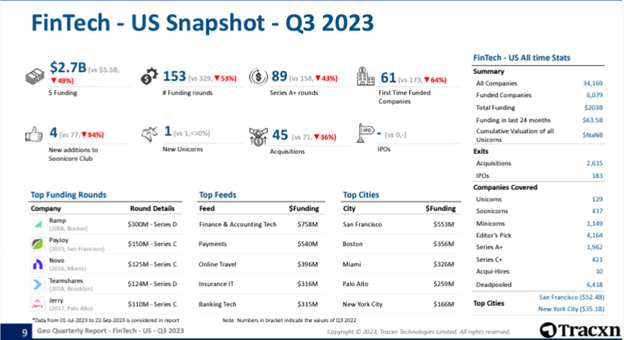

The Geo Quarterly Report: FinTech US – Q3 2023 by Tracxn highlights that September, following a year of global economic slowdown, increased interest rates, and banking crises, marked the least funded month in 2023 after February. These factors made it more challenging for investors to make investment decisions. Despite experiencing a 5% drop in funding quarter-over-quarter, US-based FinTechs continued to play a significant role in driving global FinTech funding, accounting for almost half (47%) of all quarterly FinTech funding in Q3’23.

FinTech US Snapshot (Source: Tracxn)

On a global scale, the State of FinTech Q3’23 Report by CBInsights emphasizes that global FinTech funding demonstrated relative stability during the third quarter of 2023, experiencing a modest decline of 3% compared to the previous quarter. The total international FinTech funding during this period amounted to $7.4 billion.

In this context, companies recognized the need to showcase profitability and development prospects in a clear and detailed manner to attract investor attention and belief in their vision. To achieve this, multiple firms adopted strategies focused on expanding their operations and optimizing customer experiences. This included streamlining processes, leveraging AI technologies, and introducing new features to enhance their offerings.

In conclusion, the global FinTech industry experienced a dynamic landscape in Q3 2023, characterized by cautious investor sentiment and a modest decline in funding. However, the US FinTech sector stood firm, showcasing robust resilience and attracting substantial investments. With its unwavering focus on innovation and customer-centric solutions, the US remains at the forefront of the global FinTech revolution, and we’ll further unravel these revolutions as we delve deeper into the blog – ‘Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience.”

Venture Capital Boosts Enterprise Fintech: A Tale of Caution and Capital Deployment

“In the ethereal realm of enterprise fintech, venture capital activity in Q3 dances like a nimble breeze, weaving cautious optimism and capital with graceful precision. B2B models stand tall as majestic pillars, commanding attention, while the subtle sway of B2C ideas adds a delicate harmony to the grand orchestration. Amidst this symphony, investors gracefully wield their batons, guiding the flow of funds with masterful precision and an unwavering devotion to the harmony of the enterprise fintech stage.”

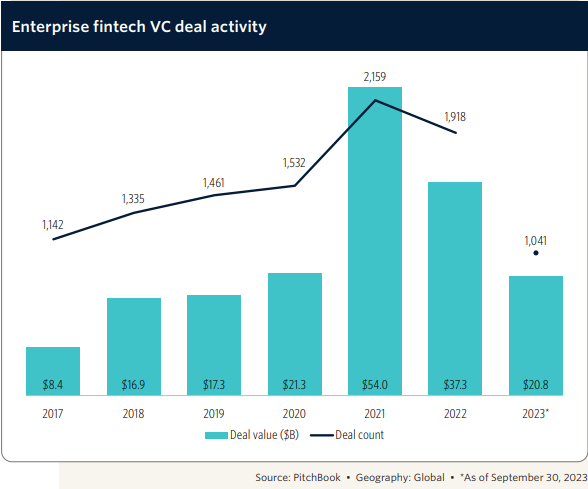

In Q3, there was a slight uptick in venture capital (VC) activity in the enterprise fintech sector, as established in research by PitchBook. The total deal value rose from $3.9 billion in Q2 to $4.1 billion, representing a 5.1% increase quarter over quarter (QoQ). However, on a year-over-year (YoY) basis, the deal value was down 33.0%, indicating investors’ more cautious approach to capital deployment.

Fewer deals were observed in Q3, with a total of 296 deals compared to 361 in Q2, suggesting that higher amounts of capital were deployed in each deal. B2B enterprise fintech companies continued to receive a majority share of the VC funding, with 63.0% allocated in Q3. This slightly retreats from the 71.0% captured in Q2, indicating that B2C models are still receiving attention.

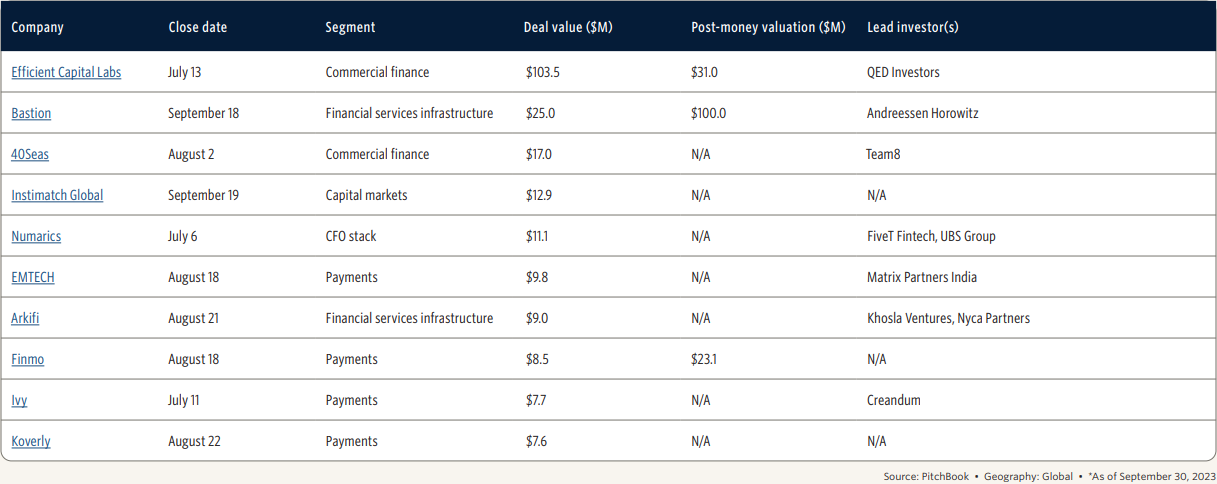

Late-stage companies were the recipients of top deals in Q3. This includes Micro Connect’s $458.0 million Series C, Ramp’s $300.0 million Series D, Perfios’ $229.0 million Series D, AlphaSense’s $150.0 million Series E, and Teamshares’ $130.2 million Series D. Notable deals were also seen for earlier-stage companies, such as Defacto’s $182.4 million third VC round and Efficient Capital Labs’ $103.5 million seed round.

Exit activity remained depressed, with an exit value of $1.4 billion recorded in Q3. However, most of this was due to Visa’s $1.0 billion acquisition of Pismo. Year-to-date, exit value for enterprise fintech companies stands at $2.3 billion, representing an 87.4% drop compared to the same period in 2022. Nevertheless, two notable enterprise fintech IPOs were on the Tokyo Stock Exchange, with Netstars and Fast Accounting recording exit values of $157.3 million and $42.5 million, respectively.

Unleashing the FinTech Revolution: Fueling Innovation, Empowering Growth

“Where challenges meet innovators, possibilities become the new norm. The FinTech industry continues its forward march, fueled by transformative investments, relentless innovation, and a steadfast resolve to redefine the future.”

The third quarter of 2023 witnessed a surge of transformative investments in the FinTech arena as leaders embraced the enormous potential within the industry. Among the notable assets, TP24 secured a remarkable USD 368 million in debt funding aimed at providing lending solutions to SMEs in the UK, the Netherlands, and Australia. Simultaneously, StoreConnect raised USD 9 million in a seed round, addressing the challenges faced by SMBs in the dynamic e-commerce landscape.

These substantial funds empowered companies to enhance their product suites, launch pioneering solutions, and elevate customer experiences. Nomad, a Brazil-based FinTech, utilized its USD 60 million investment to expand its investment platform and introduce new services, including credit cards. In a similar vein, Ramp, a finance automation platform, raised USD 300 million in a Series D funding round, enabling product development and expansion into adjacent categories. Perfios, an India-based FinTech, secured USD 229 million in a Series D funding round to fuel its global expansion into the US and Europe. Notably, Zepto, an Indian FinTech, secured a noteworthy USD 200 million, earning the prestigious distinction of India’s first unicorn of the year.

Investments extended beyond borders, with France-based Defacto raising USD 178 million, empowering the improvement of their development process and product suite. Similarly, Germany-based FinTech MODIFI secured a USD 100 million debt facility, optimizing efforts for growth.

The fervor continued in September 2023, as Momnt received USD 15 million in capital raise, driving optimization of their payment and lending solutions for businesses. Additionally, Curve, a UK-based company, raised USD 71.2 million in a funding round to expand offerings, forge new partnerships, and deliver an unmatched customer experience.

Passion and dedication sparked innovation on a global scale. Spain-based Payflow unveiled a USD 21 million funding round, leveraging a partnership with BBVA Spark to expand their financial super app. In Peru, Rextie attracted investment from Citi, incorporating their FX technology into a suite of currency exchange services. Meanwhile, Rightfoot launched Connect Magic, a zero-login consumer-permissioned data product, and secured a USD 15 million Series A funding round.

These transformative investments showcase an exciting trend of swiftly evolving FinTech companies laser-focused on product development, technological advancements, and strategic partnerships. US-based Clair leveraged a substantial investment of USD 175 million, revealing an on-demand pay service and a customer lending program backed by Pathward Bank. Moreover, Apron, a UK-based company, raised USD 15 million in their Series A funding round to enhance their invoice processing solutions for small companies and launch new products.

This invigorating wave of investments paints a vivid picture of the resilience and attractiveness of FinTech companies. Despite hurdles like data security, aging legacy systems, and stringent regulations, the potential for impactful investments remains robust as the FinTech industry tirelessly works to improve key areas like customer-centric value propositions, digitalization, and forward-thinking technologies that anticipate the needs of their diverse clientele.

The Q3 2023 investment reviews further elucidate the resilience and appeal of FinTech companies. Amidst challenges, pioneering firms have actively leveraged their funding for innovative product development strategic partnerships and to accelerate their growth trajectory. The current investment trends solidify the resilience, dynamism, and vast potential of the FinTech industry, illustrating an optimistic future that thrives on innovation, sustainable growth, and an unwavering commitment to transforming the global financial landscape.

Enterprise FinTech VC Activity (Source: PitchBook)

Prominent Pre-Seed/Seed Deals Shape Enterprise Fintech Landscape in Q3 2023 (Source: PitchBook)

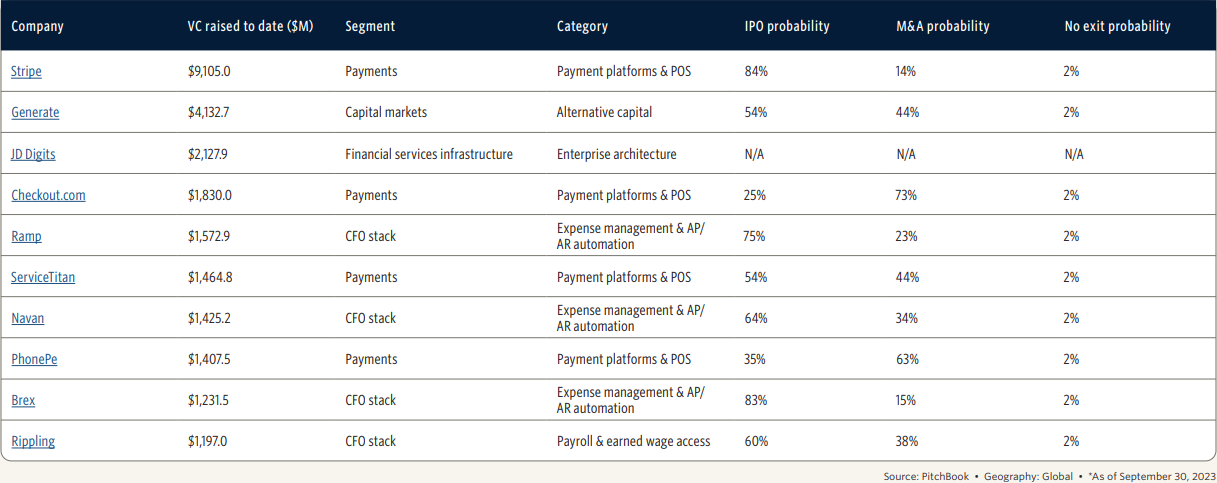

VC-Backed Titans Defining Enterprise Fintech Success through Remarkable Funding (Source: PitchBook)

Digital Payments Unleashed: Igniting the Era of Seamless Transactions

“In the era of digital payments, a world of possibilities unfolds, where friction fades, and commerce thrives. Embrace the path to seamless transactions and unlock the untapped potential of the future.”

The third quarter of 2023 bore witness to a significant focus on digital payments, signaling the FinTech industry’s dynamic evolution and its response to shifting consumer preferences and technological advancements. As the world continues to embrace digital transformation, the realm of finance stands poised for a fourth era, characterized by “decoupling” and offering untapped opportunities for financial institutions and payment players. Let’s try to delve further in our report – “Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience.”

Notably, the global digital payments market is projected to experience robust growth, with a forecasted value of USD 2,476.8 trillion by 2023, and an anticipated compound annual growth rate (CAGR) of 14.3% over the forecast period.

This trajectory underscores the increasing adoption of digital payment solutions, as businesses and consumers alike gravitate towards secure, seamless, and efficient transactional experiences.

The finance industry, cognizant of this paradigm shift, focused on digital development during Q3 2023. Banks and financial institutions directed their efforts toward meeting the growing expectations for digital banking, reflecting a broader trend of digitalization and the desire for modern, frictionless payment options.

Real-time payments and Open Banking technologies gained prominence, highlighting consumer demand for instantaneous services and aligning with the preference for advanced technologies that enable frictionless experiences.

These insights paint a vivid picture of the industry’s trajectory towards digitalization, highlighting the potential for continuous growth and innovation within the digital payments and FinTech sectors. As businesses seek to optimize checkout experiences, provide choice and flexibility in payments, and enhance overall transactional efficiency, the digital payment landscape will continue to serve as an enabler of innovation and economic progress.

Thunes, a cutting-edge B2B payments platform headquartered in Singapore, continuously seeks to revolutionize the payment landscape. To address the inefficiencies of international money transfers and create a forward-looking payment system, the company successfully secured USD 72 million in its Series C funding round in July 2023.

In a bold move to bridge the gap between traditional finance and the world of cryptocurrency, Orbital, a US-based platform, garnered significant attention by raising USD 6.4 million in August 2023. This strategic investment propels the platform’s commitment to providing innovative solutions at the intersection of these two realms.

South Africa-based startup Revio, on the other hand, raised USD 5.2 million in a seed round in September, demonstrating its dedication to tackling failed payments head-on and strengthening its efforts in resolving associated challenges.

In parallel, Splitit, a US-based company, secured a substantial USD 50 million growth commitment, fueling its accelerated development and positioning it as a key player in the evolving payment landscape.

Understanding the importance of international expansion and staying at the forefront of innovation, Switzerland-based B2B FinTech platform GenTwo successfully raised USD 15 million in a Series A funding round. This investment aims to bolster their global presence and further develop their advanced solutions.

As businesses in the industry operate across multiple countries and accommodate various payment methods, they must remain vigilant regarding potential issues, risks, and operational complexities that may arise. With the rapid pace of digitalization across the market, investors are increasingly attracted to modern, efficient payment options that promise enhanced customer experiences. Embracing these innovative solutions paves the way for an improved and seamless payment journey, meeting the evolving needs and expectations of users worldwide.

Empowering Communities: Unlocking the Path to Financial Inclusion

“In the mesmerizing symphony of finance, sustainability emerges as the virtuoso, captivating the audience with unrivaled melodies of responsible investments, like flowers blooming in a harmonious garden. It paints a vibrant landscape, where the seeds of resilience are sown, nurturing a future that stands tall like an unwavering oak, defying the winds of change and embracing the transformative power of sustainability.”

Q3 2023 witnessed a remarkable emphasis on initiatives aimed at fostering financial inclusion and expanding services to underserved individuals globally. The International Monetary Fund (IMF) unveiled its fourteenth annual Financial Access Survey (FAS), revealing a sustained level of financial inclusion propelled by the growing adoption of digital financial services. The survey results indicated that microfinance institutions played a vital role in meeting the financial needs of vulnerable segments of society, successfully advancing financial inclusion.

However, a concerning dip in the outstanding value of commercial bank loans extended to small and medium enterprises (SMEs) relative to GDP highlighted potential constraints in their access to bank financing.

Experian’s analysis of financial inclusion trends emphasized the growing significance of financial inclusion as a vital aspect of a broader conversation around diversity, equity, and inclusion. The report underscored that financial inclusion enables individuals to access essential financial services, tools, and systems safely and effortlessly. It acknowledged that financial inclusion has become a permanent pillar in the ecosystem, signaling a shift towards a comprehensive and sustainable approach to fostering inclusive finance.

The IMF report underscored the persistent gender gap in financial access across many economies, highlighting it as a pressing concern that requires immediate attention. Additionally, the report shed light on the remarkable potential of financial inclusion in driving entrepreneurial endeavors and supporting small businesses as they invest, raise funds, and scale their ventures.

These insights reflect ongoing efforts and challenges surrounding financial inclusion, the role of digital financial services in advancing inclusion, and the importance of addressing persistent gaps, including those related to SMEs and gender disparities.

Igniting Change: Sustainable Finance and the Pursuit of a Resilient Future

Q3 2023 witnessed a surge of remarkable commitments and investments in sustainable finance, reflecting an intensified interest in responsible investing and environmental, social, and governance (ESG) considerations. Prominent institutions such as Goldman Sachs, BNP Paribas, and HSBC Group announced ambitious sustainable finance plans amounting to billions of dollars, demonstrating their commitment to advancing sustainability goals.

In the embrace of this transformative shift, visionary companies like Starling Bank, Triodos Bank UK Ltd., Clarity AI, Arabesque Partners, Aspiration Partners, Inc., Refinitiv, Acuity Knowledge Partners, and many others also made substantial strides in sustainable finance and ESG investing, raising millions of dollars to foster sustainable development and address pressing environmental and social challenges.

- Goldman Sachs – Orchestrating a $10 Billion Symphony of Sustainable Finance: In a mesmerizing performance, Goldman Sachs, a global investment bank, takes center stage with a virtuosic $10 billion initiative, harmonizing the realms of sustainable finance and ESG investing. This grand composition reflects the growing chorus of interest in responsible financial practices and sets the stage for a symphony of transformative impact.

- BNP Paribas – Unveiling the $30 Billion Tapestry of Sustainable Finance: BNP Paribas, the French multinational bank, weaves a stunning tapestry of sustainable finance in a resplendent display. With a $30 billion plan, the bank’s commitment to sustainable practices illuminates the financial landscape, intertwining environmental and social considerations in every thread.

- HSBC Group – Charting a $100 Billion Expedition of Sustainable Finance: HSBC Group, the British multinational investment bank, embarks on a majestic expedition through the realm of sustainable finance. With sails unfurled, their $100 billion plan unfurls before them, navigating uncharted waters as they display their unwavering dedication to responsible financial practices and ESG investing.

- Starling Bank – Riding the $200 Million Wave of Sustainable Finance: Starling Bank, the UK-based digital bank, catches the crest of a $200 million wave, propelling itself forward on the tide of sustainable finance. Their journey goes beyond traditional banking, riding the currents of ESG investing and expanding their offerings to embrace the ethos of sustainability.

- Triodos Bank UK Ltd. – Cultivating a $50 Million Garden of Sustainable Finance: Triodos Bank UK Ltd., the UK-based sustainable bank, nurtures a flourishing garden of sustainable finance, tending to each investment with care. With $50 million sown into this vibrant ecosystem, they exemplify the growing interest in responsible financial practices and ESG investing.

- Clarity AI – Unleashing a $15 Million Symphony of Sustainable Finance: Clarity AI, the Spanish FinTech company specializing in sustainable finance and ESG investing, conducts a symphony of impact with its $15 million funding round. Each note resonates with the harmony of responsible financial practices, promoting sustainable development through their innovative approach.

- Arabesque Partners – Choreographing a $20 Million Ballet of Sustainable Investment: Arabesque Partners, the UK-based sustainable investment firm, takes the stage and choreographs a graceful ballet of sustainable investment with their $20 million funding round. Their elegant movements reflect a commitment to responsible financial practices and ESG investing, creating a harmonious balance between profitability and positive impact.

- Aspiration Partners, Inc. – Guiding a $300 Million Expedition into Sustainable Finance: Aspiration Partners, Inc., the US-based FinTech company, sets sail on a daring expedition into the realm of sustainable finance. With a substantial $300 million raised in their funding round, they navigate the waters of responsible financial practices and ESG investing, guiding investors towards a future where financial growth aligns with environmental and social sustainability.

- Refinitiv – Unveiling a $1 Billion Tapestry of Sustainable Finance: Refinitiv, the UK-based financial data provider, unveils a breathtaking tapestry of sustainable finance intricately woven with their $1 billion commitment. Every thread in this masterpiece represents a dedication to responsible financial practices and ESG investing, creating a vibrant tableau of impact and innovation.

- Acuity Knowledge Partners – Illuminating a $100 Million Path to Sustainable Finance: Acuity Knowledge Partners, the US-based financial services company, illuminates a $100 million path towards sustainable finance. Their guiding light leads investors towards responsible financial practices and ESG investing, illuminating a future where profitability and positive impact go hand in hand.

These groundbreaking investments showcase the convergence of financial acumen and environmental stewardship, highlighting the growing interest and commitment towards sustainable finance. By prioritizing responsible investments and considering the long-term impacts of their financial decisions, these companies are fueling a future rooted in ecological resilience and social progress.

Revolutionizing the Finverse: Open Banking, Embedded Finance, and BaaS Take Center Stage

“In the cosmic credence of finance, Open Banking, Embedded Finance, and BaaS emerge as interstellar phenomena, drawing investors into their gravitational pull and captivating the industry with their boundless possibilities.”

In the celestial theater of Q3 2023, the financial services industry witnessed the rise of Open Banking, Embedded Finance, and Banking-as-a-Service (BaaS), captivating investors and offering a constellation of reasons to explore these transformative sectors. BaaS, akin to banks sharing their infrastructure and services with third-party companies, dances in harmony with Embedded Finance, where financial services seamlessly integrate into non-financial platforms like e-commerce, social media, or mobile apps. Meanwhile, Open Banking illuminates the universe of financial data, fostering innovation and competition and safeguarding consumer protection.

As the Axway Blog aptly notes, Open Banking serves as the cosmic catalyst, fueling all three models and accelerating the proliferation of real-time payments and cutting-edge Open Banking technology. This cosmic symphony echoes the resounding demand for instantaneous services and the celestial preference for advanced technology, as consumers seek seamless payment experiences and avant-garde payment solutions.

The Paypers Global Partnerships Analysis Q3 2023 reveals the astronomical size of the digital payments market, valued at a staggering USD 2,476.8 trillion in 2023. The exponential growth trajectory of 14.3% CAGR signals the universe’s inclination towards digitalization and supports governments’ advocacy for digital payments. This celestial endorsement seeks to enhance financial inclusion, reduce cash dependence, promote transparency, and accelerate economic progress.

Within this galactic landscape, emerging stars like Czech Republic-based Lemonero and India-based OneStack illuminate the heavens, raising significant funds for their development and expansion efforts. Their remarkable journeys align with the cosmic evolution of Embedded Finance and Open Banking, empowering their presence in the European region and accelerating product development and international expansion.

In an ever-changing celestial tapestry, Nigeria-based Anchor and the omnipresent Swan radiate their brilliance, raising millions to fortify their enterprise-focused approach. These investments fuel their cosmic orbit, supporting international expansion, introducing new product lines, and solidifying their positions as celestial pioneers in the BaaS and Embedded Finance sectors.

September witnessed celestial challenges within the financial markets as these solemn global enterprises danced to their own rhythms. The intricacies of celestial events unfolded, shaping the financial landscape and presenting both opportunities and trials. As the cosmos continues to evolve, the industry must navigate these celestial fluctuations, harnessing their energies to propel forward on the cosmic journey of financial progress.

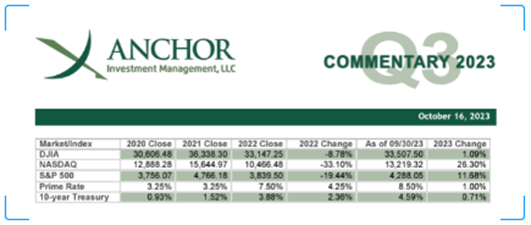

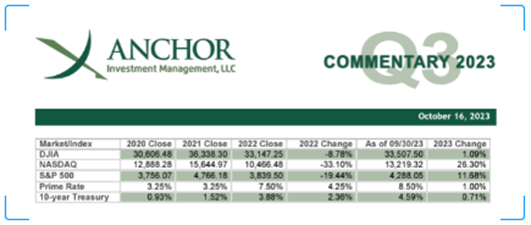

Source: Anchor Investment Management LLC

Source: Edenred

Digital Banking: Stepping Into the New Cosmos of Financial Transformation

“In the vast expanse of the financial cosmos, digital banking emerges as the radiant constellation, illuminating a celestial path towards boundless possibilities.”

During Q3, as also unraveled so far in our analytical blog – “Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience,” the financial landscape witnessed a profound shift towards digital development as banks and financial institutions endeavored to meet the evolving demands of customers in a digital era. This transformative trend propelled several notable initiatives, shaping the future of banking and redefining the customer experience.

In a celestial alignment of innovation, Italy-based illimity Bank and Engineering Group joined forces, securing a significant USD 59.3 million funding round to introduce cutting-edge digital banking products to small businesses and retail banking segments. Simultaneously, Bank Asia embarked on a mission to introduce a digital bank, aiming to enhance digital services and facilitate cashless transactions with a USD 1.1 million funding endeavor.

Afreximbank and CDB directed their energies towards supporting small and medium-sized enterprises (SMEs), unveiling a game-changing USD 400 million loan facility. This cosmic collaboration bolstered African businesses engaged in extra and intra-African trade, fostering growth and prosperity within the Afreximbank Member States’ productive sectors.

Boldly charting their course, banks and financial institutions harnessed their funding to accelerate development processes, propelling the industry forward. The Bank of India, utilizing a USD 61 million loan, launched three startup centers with a grand vision to establish a total of 12 centers. Meanwhile, the Bank of London announced its formal application for an EU banking license, backed by a USD 213 million investment, aiming to expand its presence in Luxembourg and hire 300 additional employees by 2023.

September unveiled cosmic milestones, as Zopa secured USD 92 million in Tier 2 capital, fueling its growth mission and commitment to innovation. In parallel, Mexico-based neobank albo triumphantly raised USD 40 million in a Series C funding round, positioning itself as a catalyst for accelerated development and delivering an enhanced FinTech platform to its clientele.

With a celestial gaze set upon international expansion, several banks and financial institutions steered their funding rounds towards serving customers on a global scale. The Netherlands-based neobank, bunq, ignited their interstellar ambitions with an additional USD 47.5 million in growth capital, propelling their international expansion. Likewise, J.P. Morgan augmented its stake in Brazil-based digital bank C6 to 46%, establishing a viable partnership and solidifying their presence in the digital banking realm.

Throughout Q3 2023, investments played a pivotal role in developing and launching innovative services and digital solutions that catered to the evolving needs and expectations of the industry. HSBC, in an epic collaboration, invested USD 35 million into Tradeshift, facilitating the launch of a joint-owned business focused on Embedded Finance solutions and financial services applications. Germany-based Ivy secured USD 20 million in a Series A funding round, aiming to propel the development of a network for instant bank payments.

Embracing the cosmic spirit of transformation, UK-based Cynergy Bank leveraged a USD 24.5 million Tier 2 capital facility to spearhead the development of Cynergy Bank and Cynergy Business Finance. Meanwhile, the strategic partnership between EY and Microsoft ushered in a new era of assurance technology with the infusion of a USD 1 billion investment program, empowering clients with advanced solutions. In the same realm of innovation, US-based Flex raised USD 120 million in equity and debt funding rounds, setting the stage for the launch of a groundbreaking finance super app tailored to business owners.

The Lending and LendTech Odyssey: Charting a Stellar Path to Financial Growth

“In the transcendent tapestry of finance, lending takes flight as a celestial voyage, empowering businesses and investors to reach new frontiers and unlock unparalleled growth.”

During the eventful voyage of Q3 2023, the lending industry witnessed a cosmic surge in development and optimization. Companies and firms sought investment to enhance their suite of solutions, digitize their processes, and accelerate their overall growth trajectory while introducing innovative products to their customers.

In a celestial alignment of investments, US-based CoinFund soared to new heights with the closure of their USD 158 million Seed IV Fund LP. This esteemed venture aimed to support pre-seed and seed stage investments across the Web3 ecosystem, nurturing the growth of projects within the crypto asset-focused investment landscape.

Petal, the US-based credit card and financial technology company, also embarked on a glorious journey, securing a USD 200 million debt facility. With this infusion of funds, Petal aimed to expand its credit card program, embracing digital innovations to better serve its customers in the realm of financial solutions.

Similarly, Mexico-based digital financial services platform Klar embraced cosmic growth opportunities by raising a USD 100 million debt facility. This cosmic investment acted as fuel for expanding Klar’s credit products, empowering consumers across North America with enhanced financial solutions.

In September 2023, Vero Technologies harnessed celestial momentum by utilizing its USD 8.5 million Series A funding to propel the growth of its innovative Lending-as-a-Service (LaaS) offering. This cosmic infusion enabled Vero Technologies to scale its transformative lending services, ushering in a new era of financial possibilities.

Celebrating cosmic collaboration, Vista Equity Partners secured a USD 5.3 billion private loan to facilitate the refinancing of Finastra, a move designed to optimize debt management and foster financial stability while unlocking growth potential within the lending landscape.

The celestial alignment of investments continued with the European Investment Fund (EIF) bestowing more than USD 42 million to SME Finance, empowering micro-businesses in the Baltics, Finland, and the Netherlands to flourish. Meanwhile, Singapore-based Funding Societies raised USD 27 million in debt funding, bridging the credit gap for small and medium-sized enterprises (SMEs) in the Southeast Asian region.

Guided by an ethereal ambition, Coinbase, the renowned cryptocurrency exchange, set its sights on launching a cutting-edge lending platform for institutional investors. With a global investment totaling USD 57 million, Coinbase embarked on an interstellar mission to introduce a digital asset lending platform, opening up new avenues of financial opportunity for large institutional investors.

Cryptographic Horizons: Navigating the Metaverse of Digital Assets

“In the uncharted realm of cryptography, the Metaverse emerges as a celestial landscape, igniting a cosmic fusion of technology and finance.”

Amidst the turbulence faced by the cryptocurrency industry in 2023, innovative companies embraced the transformative power of blockchain technology, propelling expansion efforts and attracting significant investments.

France-based Treasury Management FinTech Fipto charted a cosmic course by raising a USD 16 million seed funding round. This infusion of funds enabled Fipto to optimize its platform, extending beyond the realm of cryptocurrencies to encompass diverse sectors such as retail, supply chain management, and financial services.

In parallel, companies focused on streamlining operations and extending their global reach. US-based crypto custodian BitGo secured a monumental USD 100 million in a Series C funding round to facilitate strategic acquisitions and expand the reach of its comprehensive solutions worldwide.

September unveiled cosmic milestones as US-based financial operating system Mesh raised USD 22 million in a Series A funding round. This celestial infusion fueled the development of new tools for payouts, payments, and deposits, propelling the financial landscape into a new era of efficiency and innovation.

Directing their cosmic gaze towards the Metaverse, Italy-based Stella group venture incubator Dpixel selected four startup companies for the Metaverse 4 Finance incubator program. This noteworthy program, backed by a USD 3.2 million investment allocation, aimed to optimize the growth of startups and foster the development of inclusive and secure services within the Metaverse, specifically applicable to the realm of finance.

Defending Against Evolving Cyber Threats: FinTech’s Response to AI-Generated Fraud

“FinTech, techno-sorcerers, harness the lightning of artificial intelligence to summon an impenetrable shield, warding off the dark forces of AI-generated fraud and safeguarding the realm of finance with an enchanting digital defense.”

With the rising trend of artificial intelligence and digitalization, fraudulent actors are leveraging AI and stolen personally identifiable information to create realistic digital identities. In response, investors have directed their funding efforts towards fighting fraud and addressing online threats.

In September 2023, Deduce, a US-based fraud prevention company, announced a successful funding round of $9 million, aiming to combat AI-generated identity fraud. The company’s innovative solutions align with the industry’s growing need for advanced protection against evolving threats. Similarly, Legit Security, a cybersecurity firm, secured a substantial $40 million investment to address the challenges posed by AI and Large Language Models (LLMs).

Recognizing the power of artificial intelligence in protecting businesses, UK-based Quantexa received a significant investment of $155 million in the AI industry. The funding aims to accelerate the development of AI tools that optimize growth and security for the next three years.

Several companies utilized their newfound capital to expand their suite of solutions globally. For instance, UK-based cybercrime detection service provider Netcraft raised $100 million in July 2023 to support its worldwide expansion, strengthening the fight against online threats.

Cleafy, another cybersecurity company, secured $10.6 million in funding in September 2023. This capital injection enables Cleafy to expand its platform’s reach to new markets and institutions worldwide, strengthening its ability to safeguard against emerging threats. Additionally, ThetaRay raised $57 million to provide financial institutions and banks with new business opportunities while accelerating its international expansion.

Prioritizing fraud prevention, Norway-based Strise received $10.6 million to reduce financial crime through automated Anti-Money Laundering (AML) processes. By further developing its end-to-end AML product and expanding internationally, Strise solidifies its position in reducing fraud and enhancing transparency in the business sector.

In the face of evolving cyber threats, the FinTech industry is proactively investing in innovative solutions to defend against AI-generated fraud. These investments pave the way for enhanced security measures and ensure a more secure and trustworthy financial ecosystem.

Identity Services: Protecting the Digital Fortress

“Fashioning a Citadel of Trust in the Digital Realm: Safeguarding Identities and Fortifying Transactions.”

In the intricate web of global business networks, concerns surrounding identity fraud, data security, and privacy have become paramount. As organizations navigate today’s challenging economic landscape, investments in identity services have emerged as a crucial safeguard.

In August 2023, UK-based Suade committed $20 million to extend its footprint in the US and Canada, fortifying its presence and addressing the reverberations caused by past banking failures. Meanwhile, US-based SpyCloud closed a growth round of $110 million, fortifying its global expansion efforts and thwarting authentication bypass to protect digital identities. Similarly, Certa announced a Series B funding round of $35 million, reinforcing its go-to-market strategies and accelerating its market reach across multiple regions.

Amidst this landscape, UK-based identity services provider OneID secured $1.2 million in a funding round, optimizing the digital experience of UK citizens by empowering banks to offer robust identity verification services.

These investments underscore the growing importance of fortifying identities and securing digital transactions. Just like building a fortress of trust, identity services serve as the primary defense against the looming threat of fraud and data breaches. By investing in cutting-edge solutions, organizations can build an impenetrable fortress to ensure the integrity, security, and privacy of digital identities.

Drawing the Curtains: The FinTech Q3 2023 Encore

“Q3 2023 witnessed the FinTech whirlwind spinning innovation. Investments soared high like a rocket’s flight, resilience standing tall in the face of every fright. Fueling growth and disruption with a mighty roar, FinTech’s spirit shone bright, igniting a FinTech revolution galore.”

In the complex landscape of the global FinTech industry, the third quarter of 2023, as highlighted in this blog, “Global FinTech Investments Analysis Q3 2023: The US FinTech Funding Highlights Robust FinTech Resilience,” showcased a dynamic and evolving landscape. Despite economic challenges and uncertainties, the industry continued to attract significant investments in various sectors, including digital banking, lending, fraud prevention, and financial inclusion. Cautious investor sentiment prompted a thorough scrutiny of companies’ plans for development and profitability, leading to prudent capital allocation. However, the overall global FinTech funding only declined by 3% in Q3 2023 compared to the previous quarter, demonstrating the industry’s resilience.

US-based FinTechs remained at the forefront, accounting for nearly half of all quarterly FinTech funding in Q3’23. These companies leveraged their newly acquired funds to fuel global expansion and enhance their product offerings, reflecting a commitment to meeting customer expectations in an ever-evolving financial landscape. The cybersecurity and fraud prevention sector also saw significant investments targeting AI-generated fraud and challenges posed by Large Language Models (LLMs). This area has become increasingly critical to safeguarding the integrity of online transactions.

Furthermore, the financial industry explored opportunities in Open Banking, Embedded Finance, and Banking-as-a-Service (BaaS), offering convenience and accessibility beyond traditional banking. This led to investments in innovative companies like Lemonero, OneStack, and Anchor, contributing to the growing FinTech ecosystem.

Overall, the FinTech landscape in Q3 2023 exhibited adaptability and resilience, with investments ranging from traditional financial services to cutting-edge technologies. Investors and companies alike demonstrated a commitment to innovation, customer-centric solutions, and the pursuit of growth and development in the ever-evolving world of finance.

As MSys Technologies, we understand the challenges and opportunities in the FinTech industry. Our value add lies in our technological ingenuity, customer intimacy, and complete testing services. We aim to be your partner in conquering financial services hick-ups with our state-of-the-art solutions. Together, we can build a fort of trust in the digital realm and transform your business processes for the better. Like a mystical unicorn, we harness the power of untamed technology, weaving digital solutions that defy gravity and push boundaries. With the agility of a nimble acrobat, we navigate the tightrope of complex challenges, balancing the delicate dance between security and convenience.

Let us be your steadfast ally, ready to unlock the gates of FinTech engineering possibilities, guiding you towards a future where visions blossom into tangible realities.