Best FinTech Engineering Services in USA: How to Choose a Reliable Partner for Your FinTech Software Solutions

Audio : Listen to This Blog.

Introduction

The FinTech landscape is rapidly evolving, driven by technological advancements and changing consumer preferences.

As financial institutions and companies seek to enhance their services, fintech engineering services play a pivotal role in transforming traditional financial processes.

Whether it’s optimizing financial transactions, automating banking services, or creating innovative financial products, finding the right partner is crucial.

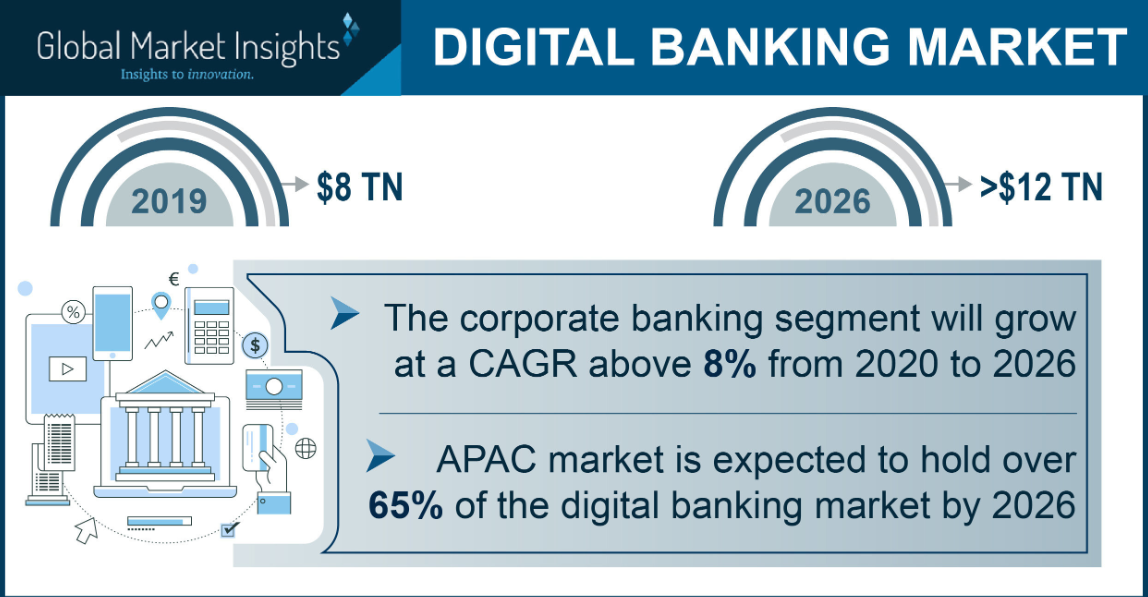

Img.: The Current State of the USA FinTech Market

If you’re looking for nothing but the best Fintech Engineering Services in USA and are looking to onboard a reliable partner for your FinTech software solutions then this blog is for you.

Learning Outcomes

A) Understanding the FinTech landscape: Familiarize with the key areas of FinTech, such as loyalty programs, payment processing, digital wallets, asset management, and risk analysis.

B) Navigating multisided partnerships: Gain insights into the collaborative alliances in outsourcing and their role in reshaping traditional financial processes.

C) MSys Technologies’ value proposition: Learn about MSys Technologies’ expertise in fostering collaboration, innovation, and client success in the FaaS market in the USA.

D) Agility and adaptability: Understand the importance of agility and adaptability in adapting to changing business processes and ensuring acceptable cost and speed.

E) Robust risk management: Learn about MSys Technologies’ risk management solutions and their ability to mitigate risks associated with market fluctuations or unforeseen events.

F) Technological ingenuity: Discover MSys Technologies’ relentless pursuit of technological innovation and how it enables revolutionary changes at the organizational level.

G) Customer-centric approach: Understand MSys Technologies’ ‘Customer Intimacy’ model and how it places customers’ needs at the forefront of business goals.

H) Full-stack FinTech expertise: Learn about MSys Technologies’ unwavering commitment to collaboration, innovation, and customer success in navigating the complexities of multisided partnerships within the USA FaaS market.

Img.: MSys Full-Stack FinTech Spectrum

Img: MSys Optimizing FinTech for a winning Edge

Img: MSys FinTech CoE’s a Commitment to Excellence: Let’s Start Co- Building a PoC Now!

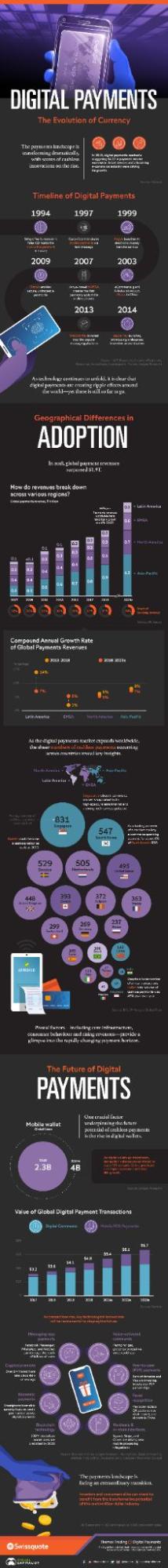

Navigating the Dynamic Landscape of US FinTech: Trends, Insights, and Future Prospects

The United States’ financial technology (FinTech) arena is experiencing a rapid metamorphosis, propelled by technological innovations and shifting consumer preferences, positioning the nation as a pivotal hub for financial transformation.

Embracing diverse solutions spanning from cryptocurrencies to digital payments, robo-advisors to neobanks, FinTech is revolutionizing financial dynamics, shaping the trajectory of global finance.

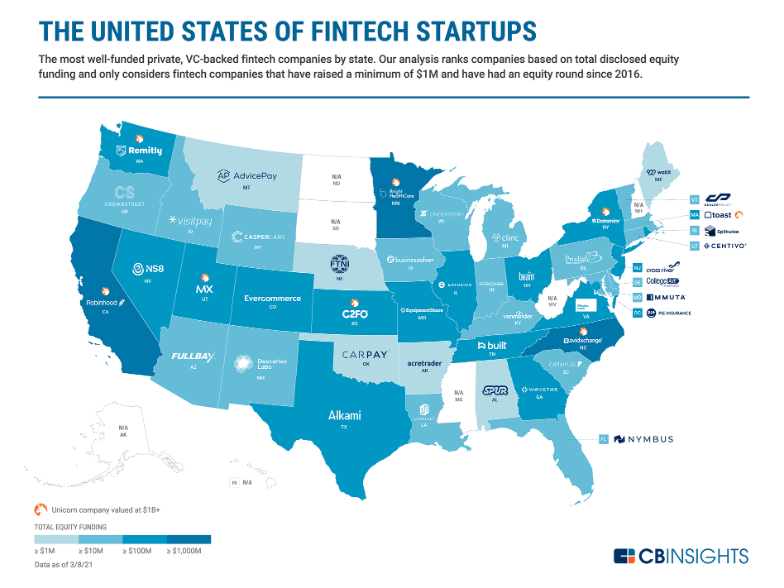

Img.: Source: CB Insights

Unveiling the Latest Trends

Here are a few burgeoning trends from –

Img.: Burgeoning FinTech Trends

These can further be classified into:

A) General Trends: Notable advancements like microservices, Fintech-as-a-Service (FaaS), embedded finance, and cryptocurrencies are driving industry growth.

B) Customer Trends: The forefront sees digital payments and fintech disrupting traditional banking models.

C) Technology Trends: Artificial intelligence, machine learning, and biometrics are pivotal in reshaping the fintech landscape.

Key Market Insights

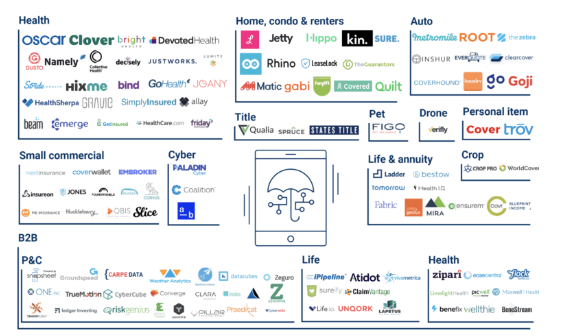

A) The US FinTech market boasts a robust CAGR of 11%, with digital payments reigning supreme.

B) Venture capital influx into digital banking drives significant growth annually.

C) Diverse services like digital payments, investments, neo-banking, and online insurance are reshaping the financial landscape.

Img.: FinTech Unicorns in the USA

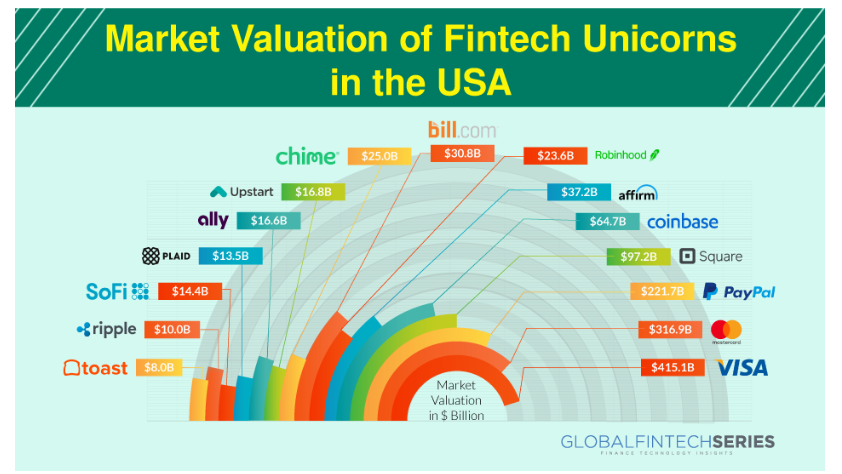

Img.: Market Valuation of FinTech Unicorns in USA

Img. Source: F’prime

Envisioning the Future

The future of US FinTech promises sustained growth, underpinned by mobile adoption, digital banking proliferation, and substantial investments.

Img. Source: PRNewswire

Specializations span payment processing, digital banking, investment management, and insurtech, ensuring innovative solutions tailored to evolving consumer needs.

In essence, the US FinTech landscape is dynamic, poised for continual evolution through innovation and disruption across various financial domains.

Staying abreast of emerging trends and technologies will be paramount for navigating this ever-changing terrain successfully.

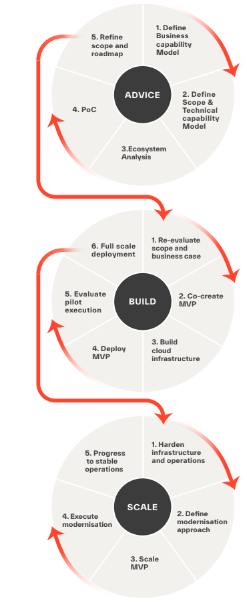

Img.: Continuous Deployment, Scaling, Delivery and Sustenance at MSys’s FinTech CoEs

Unveiling the Flourishing Landscape of FinTech as a Service (FaaS) Market in the USA

The current landscape of the FinTech as a Service (FaaS) market in the United States is undergoing a remarkable evolution, brimming with growth prospects and boundless potential.

As illuminated by a comprehensive report from Markets and Markets, projections suggest an impressive surge, with the market poised to ascend from USD 310.5 billion in 2023 to a staggering USD 676.9 billion by 2028, propelled by a compelling compound annual growth rate (CAGR) of 16.9% throughout the forecasted period.

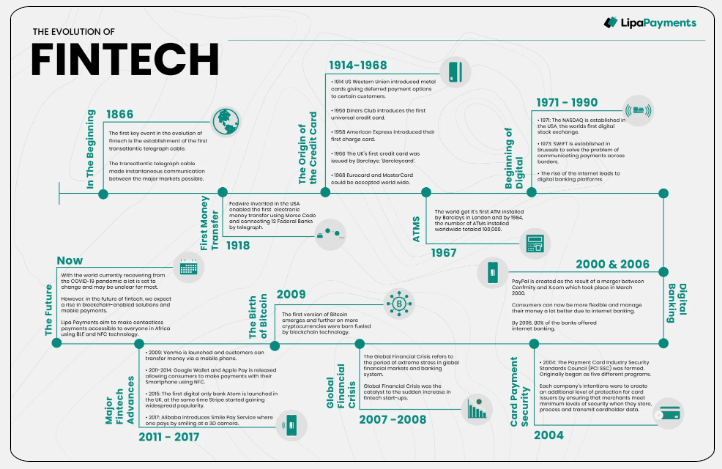

Img. Source: LipaPayments

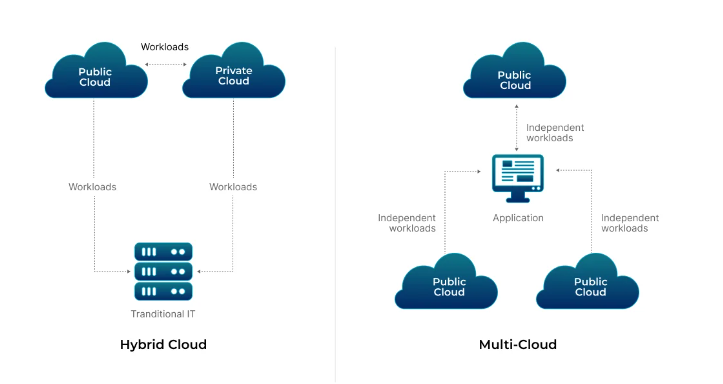

This remarkable trajectory owes its momentum to several pivotal factors, notably the advent of cloud computing technology, heralding a new era of operational flexibility and scalability.

Img: Cloud-Computing Powering FinTech

Furthermore, relentless innovation in artificial intelligence (AI) and blockchain technologies stands as a cornerstone, actively shaping the expansive horizons of the FaaS landscape.

Img.: Blockchain Powering FinTech

At the forefront of this burgeoning sector, prominent entities such as PayPal, Mastercard, and Fiserv, among a constellation of others, assert their dominance.

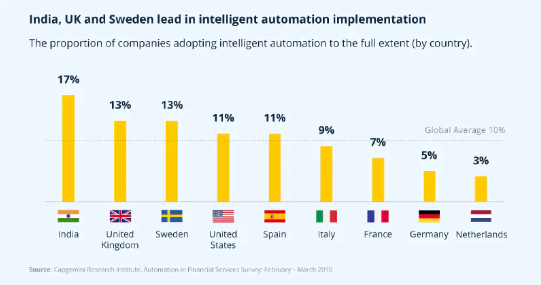

This market sphere is intricately segmented by type, encompassing banking, payment, insurance, and investment services, as well as by technological innovations, spanning AI, blockchain, robotic process automation (RPA), and application programming interfaces (APIs).

Img.: RPA powering FinTech

Img.: RPA for FinTechs – Let’s Co-Deploy Your Use Case

Moreover, the diverse array of applications, including fraud monitoring, KYC verification, and regulatory compliance, underscore the multifaceted nature of FaaS offerings, tailored to meet diverse end-user requirements across different regions.

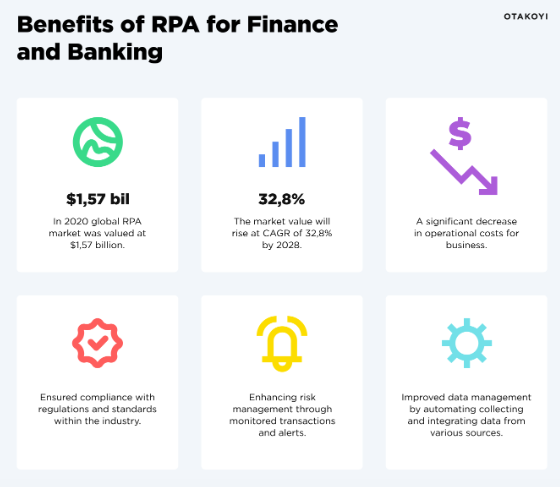

Central to the thriving FaaS milieu in the USA is the symbiotic relationship with robust regulatory frameworks and a sophisticated financial services ecosystem.

Build Your FinTech Products While Complying with Regulatory Requirements with MSys

North America’s preeminence in this realm is further bolstered by the paradigm shift within financial institutions towards customer-centric models, amplifying the demand for FaaS solutions.

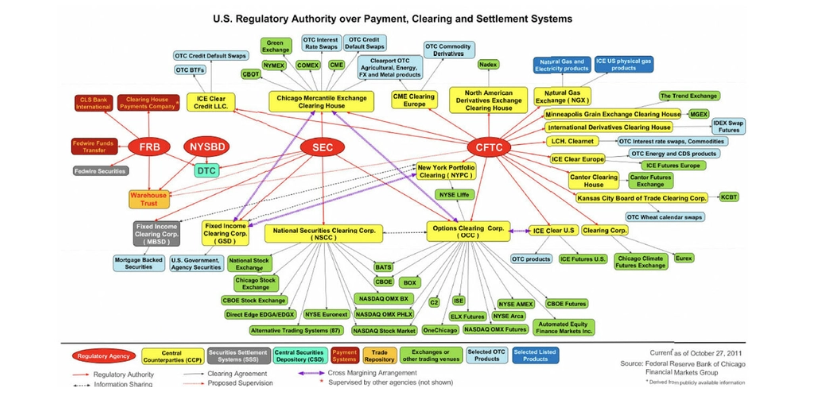

For example, Insurtech is the use of technology designed to maximize savings and gain efficiency from the insurance industry models.

InsurTechs are redefining the insurance customer experience by innovating lengthy processes including underwriting, claims processing and immediate activation.

Img.: Tap into USA InsurTech Market Map with MSys

FinTech companies are starting to partner with traditional insurance companies to automate processes and enable the insurance companies to expand coverage.

Trading and investing has improved with the adoption of FinTech.

Information from big data is often unstructured and unreadable without the help of AI.

In essence, the flourishing FaaS market in the USA is a testament to the harmonious convergence of technological innovation, regulatory stewardship, and the imperative for seamless compliance and regulatory adherence.

Amidst intensifying competition, industry leaders continue to unveil innovative solutions, catering to the evolving needs of both financial institutions and discerning consumers, thus charting an exciting trajectory of growth and innovation.

Why Fintech Engineering Services Matter

Innovation: Fintech companies leverage cutting-edge technology, including artificial intelligence, machine learning, and blockchain, to revolutionize financial services.

They offer solutions that improve efficiency, enhance security, and provide personalized experiences.

Mobile Banking: With the rise of mobile devices, mobile banking has become a preferred way for customers to manage their finances.

Fintech solutions enable seamless mobile payments, account management, and access to financial data.

Financial Inclusion: Fintech bridges gaps by reaching underserved populations, providing access to banking services, and promoting financial literacy.

It empowers small business owners, facilitates peer-to-peer payments, and supports emerging markets.

Digital Wallets: Fintech companies develop user-friendly digital wallets, allowing users to store digital assets, make payments, and transfer money securely.

Exploring Some Popular FinTech Software Solutions in the USA and Their Real-Time Use Cases

The dynamic landscape of FinTech (Financial Technology) is reshaping the way we manage money, conduct transactions, and interact with financial services.

Let’s delve into some real-world examples where FinTech solutions are making a significant impact:

Mobile Banking and Payment Apps:

Img.: Digital Payment Ecosystem in the USA

a) Chime: A digital bank that offers no-fee banking services, early direct deposit, and a user-friendly mobile app.

b) Venmo: A peer-to-peer payment platform that simplifies splitting bills, paying friends, and managing expenses.

c) Cash App: Allows users to send money, invest in stocks, and even buy Bitcoin via their mobile devices.

Automated Financial Advisors:

a) Betterment: An automated investment platform that uses algorithms to create personalized portfolios for users.

b) Wealthfront: Offers automated investment management, tax-loss harvesting, and financial planning tools.

Blockchain and Cryptocurrency:

a) Coinbase: A popular cryptocurrency exchange that allows users to buy, sell, and store digital assets like Bitcoin and Ethereum.

b) Gemini: A regulated crypto exchange that emphasizes security and compliance.

Lending and Borrowing Platforms:

a) LendingClub: A peer-to-peer lending platform connecting borrowers with investors.

b) SoFi: Provides student loan refinancing, personal loans, and mortgage services.

Financial Data Aggregators:

Plaid: Enables secure access to financial data from various banks and institutions, powering apps like Venmo and Robinhood.

Yodlee: Yodlee provides secure access to financial data from various sources, enabling apps and services to offer personalized financial insights and solutions based on user data.

Quovo: Quovo is another financial data aggregator that allows secure access to financial information, empowering applications to offer tailored financial services and products to users based on their financial data.

Robo-Advisors:

Acorns: Rounds up everyday purchases and invests the spare change in diversified portfolios.

Stash: Helps users invest in fractional shares of stocks and ETFs based on their interests.

AI-Driven Financial Insights:

Personal Capital: Combines financial tracking, investment management, and retirement planning.

Mint: Aggregates accounts, tracks spending, and provides budgeting insights.

Digital Wallets and Payment Solutions:

Apple Pay: Allows contactless payments using iPhones and Apple Watches.

Google Pay: Offers seamless in-store and online payments.

Small Business Financial Tools:

Square: Provides point-of-sale systems, invoicing, and business loans.

QuickBooks: Streamlines accounting, payroll, and financial management for small businesses.

Fraud Detection and Prevention:

Forter: Uses machine learning to identify and prevent fraudulent transactions.

Feedzai: Offers real-time fraud detection for financial institutions.

Remember, these examples represent just a fraction of the diverse FinTech landscape.

As technology continues to evolve, FinTech solutions will play an increasingly vital role in shaping our financial lives and improving financial outcomes for individuals, businesses, and institutions

Key Considerations When Choosing a Fintech Partner

Expertise: Look for a partner with a strong track record in fintech software development.

Consider their experience in building solutions for financial institutions, fintech companies, and other players in the industry.

Many FinTech companies might just be looking for legacy modernization while venture capital firms might want to opt for API integrations like cash app, for example.

Digital lending platform integrations might be ideally suited for a payment processing company that offers financial services, and optimizing traditional banking services.

Traditional banks must improve financial services provided by them and opt for mobile device based POS services, facilitate online banking, portfolio management and electronic bank transfers.

Today, with the rise of the FinTech industry, global financial markets require dynamic players.

Regulatory Compliance: Fintech operates within a complex regulatory environment. Ensure your partner understands and complies with relevant laws, such as Anti-Money Laundering (AML) regulations.

Risk and Fraud Management: A reliable partner should have a robust risk and fraud management plan. This includes forecasting and preventing risks related to financial operations.

User-Centric Design: An intuitive and contemporary design is essential for fintech solutions.

It attracts users and sets your app apart from competitors.

Scalability: As your business grows, scalability becomes critical.

Choose a partner capable of handling increased demand and adapting to changing requirements.

Financial Goals: Align with a partner who shares your financial goals.

Whether it’s improving financial outcomes or expanding services, mutual objectives are essential.

Remember, the right fintech partner can propel your business forward, enhance financial services, and contribute to your success in the dynamic world of finance.

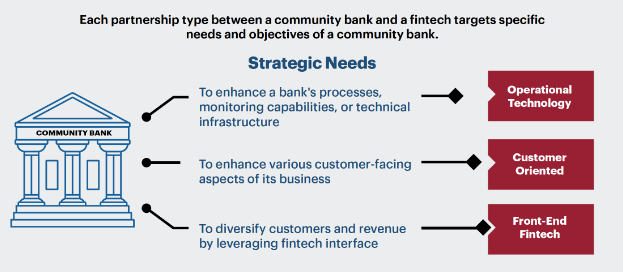

Navigating Multisided Partnerships in FaaS: Insights and MSys Technologies’ Value Proposition

In the ever-evolving landscape of FinTech as a Service (FaaS) within the USA, the collaborative alliances in outsourcing play a pivotal role in reshaping traditional financial processes and fostering enduring cooperation.

Delving into key aspects, including flexibility, trust-building, governance, risk management, peace of mind, and innovation, reveals the quintessence of successful partnerships in this dynamic domain.

Img.: Strategic Partnerships to Elevate Innovation

Understanding Multisided Partnerships for FinTech Companies

Multisided partnerships thrive on collaboration, flexibility, and innovation, vital for navigating the complexities of the FaaS market.

Effective communication, robust governance models, and shared objectives underpin mutual success, making such partnerships instrumental in driving industry transformation.

MSys Technologies’ Value Add:

As an industry leader in FinTech software solutions, MSys Technologies stands poised to address the nuanced challenges within the FaaS market, emerging as an ideal partner for navigating multisided partnerships in outsourcing.

Here’s how MSys Technologies adds value to such collaborations:

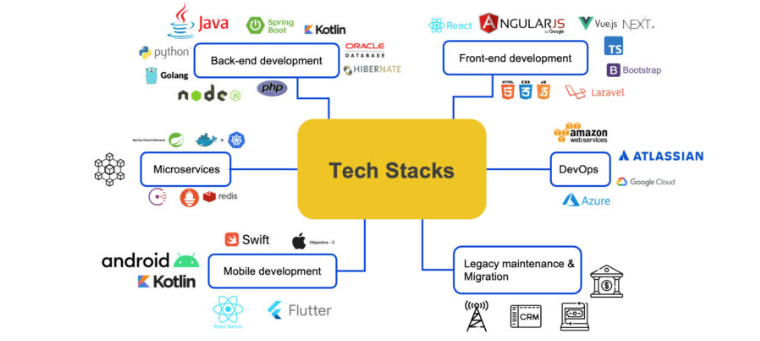

Flexibility: MSys Technologies excels in maintaining a delicate balance between contractual clarity and adaptability, fostering an environment conducive to innovation and seamless adjustment to evolving needs.

Trust Building: With a commitment to trust and reliability, MSys Technologies empowers outsourcing partners to exceed expectations, fostering stable and enduring collaborations through clear task assignments and freedom in execution.

Governance Model: Implementing agile governance models, MSys ensures swift decision-making and alignment of priorities, fostering effective communication and collaboration across strategic, tactical, and operational levels.

Risk Management: Offering proactive risk management solutions, MSys provides access to scalable resources, mitigating risks associated with market fluctuations or unforeseen events, instilling confidence and peace of mind in clients.

Innovation: At the forefront of innovation, MSys integrates emerging technologies like RPA, AI, and analytics, driving continuous improvement and ensuring clients stay ahead of the curve in the ever-evolving FaaS landscape.

These can be used for automating financial services, lending process automation, accessing financial health for the clients of any financial institution.

Img. 4: A Peek Into Tech Stack at MSys Technologies

In essence, MSys Technologies’ expertise in fostering collaboration, innovation, and client success positions them as a leading provider of FinTech software solutions tailored to meet the evolving needs of the FaaS market in the USA.

Their commitment to flexibility, trust-building, governance, risk management, peace of mind, integrating ecosystems and platforms for digital wallets, DLT-based solution accelerators and exchange traded funds.

Our innovation makes us an invaluable partner for any financial technology company or the financial services industry at large, navigating multisided partnerships and driving industry transformation.

Elevating FinTech Partnerships: MSys Technologies’ Value Proposition

In the dynamic realm of FinTech as a Service (FaaS), where collaborative alliances drive innovation and transformation, MSys Technologies emerges as an indispensable partner, steering clients towards success with a blend of technological prowess and customer-centric strategies.

Here’s how MSys Technologies adds substantial value to multisided partnerships in the evolving USA FaaS market:

Leveraging FinTech Expertise:

MSys Technologies boasts a deep understanding of the FinTech landscape, encompassing a spectrum of critical areas such as loyalty programs, payment processing, digital wallets, asset management, and risk analysis.

With a team of 250+ skilled engineers, MSys offers a comprehensive suite of FinTech solutions tailored to optimize business endeavors and drive cost efficiencies, reducing total cost of ownership (TCO) by up to 45%.

Agility and Adaptability:

Embracing the ethos of agility, MSys excels in swiftly adapting to changing business processes, ensuring acceptable cost and speed.

Through flexible deployment models and rapid team deployment within 15 days (scaling up in 90 days), MSys empowers clients to scale rapidly and introduce new products and services without compromising performance or availability.

Robust Risk Management:

In an era fraught with uncertainties, MSys Technologies offers invaluable risk management solutions, providing access to scalable resources to mitigate risks associated with market fluctuations or unforeseen events.

With fault tolerance mechanisms and round-the-clock support from dedicated teams, MSys ensures business continuity, prevents costly downtime, and maintains customer trust and loyalty.

Technological Ingenuity:

At the core of MSys’ ethos lies a relentless pursuit of technological innovation.

Aggressively investing in technical proficiencies and leveraging cutting-edge solutions, MSys doesn’t merely facilitate business objectives but enables revolutionary changes at the organizational level.

With complete testing services, CI/CD powered QA automation, and a robust QA automation framework, MSys ensures faster time-to-market with uncompromising quality.

Customer-Centric Approach:

MSys Technologies embraces a ‘Customer Intimacy’ model, placing customers’ needs at the forefront of business goals. By forging deeper, sentiment-based relationships, MSys delivers personalized experiences, reinforcing trust and loyalty.

With a 360-degree, end-to-end full-stack FinTech expertise, MSys transforms business processes, acting as knights in shining armor to conquer financial services hiccups.

Amongst numerous FinTech services companies clouding the USA market, MSys Technologies’ unwavering commitment to collaboration, innovation, and customer success makes us an unparalleled partner in navigating the complexities of multisided partnerships within the USA FaaS market.

Join forces with MSys and embark on a journey towards transformative FinTech solutions, underpinned by state-of-the-art technology and unwavering support.

In the fast-paced world of FinTech, selecting the right partner is akin to navigating a labyrinth of opportunities and challenges.

The search results underscore the significance of this decision, as the right partner can make or break a business’s success in the dynamic landscape of FinTech as a Service (FaaS) in the USA.

Closing the Drapes: Finding the Needle in the Haystack of FinTech Partnerships

A reliable partner should possess a robust risk and fraud management plan, a user-centric design, scalability, and financial goals that align with the client’s objectives.

This is where MSys Technologies comes into play.

our value proposition emphasizes flexibility, trust-building, governance, risk management, peace of mind, and innovation, making them an ideal partner for navigating multisided partnerships in outsourcing.

By leveraging their expertise in FinTech, MSys Technologies helps clients optimize their business endeavors and drive cost efficiencies, ultimately contributing to their success in the dynamic world of finance.

In essence, choosing MSys Technologies as a fintech partner is like striking gold in a sea of options, ensuring a smoother journey through the ever-evolving FinTech landscape.

FAQs

A) What is Financial Technology (FinTech)?

FinTech refers to the innovative use of technology in financial services.

It encompasses interesting ecosystem integrations elevating a bank account holder’s facilitations, enabling capabilities such as digital lending, blockchain, and more.

Img. 5: How Technology Impacts the Financial Services Industry

B) How do FinTech Companies Enhance Financial Services?

FinTech companies introduce efficiency and innovation.

Contrary to financial services companies that offer traditional financial products with established methods, FinTech companies use technology for innovative, efficient financial solutions.

In today’s financial industry, fintech companies pioneer technological advancements to transform traditional financial practices.

A fintech company revolutionizes the way clients accept payments, automate financial services, open a bank account, and revolutionize the financial industry at large.

Examples include mobile banking apps, robo-advisors, and blockchain-based solutions.

C) What Real-Life Examples Illustrate the Impact of FinTech?

Cryptocurrency Exchanges: Platforms like Coinbase and Binance enable secure trading.

Decentralized Finance (DeFi): DeFi protocols run on blockchain, offering lending and yield farming.

Supply Chain Management: Blockchain ensures transparency in supply chains.

D) Why Should You Choose MSys Technologies as Your FinTech Engineering Partner?

MSys combines fintech expertise with emerging technologies.

We empower financial companies to innovate, enhance security, and improve customer experiences.

E) How Does Blockchain Benefit Fintech Companies?

Blockchain enhances security, reduces fraud, and streamlines processes.

Fintech companies can leverage it for faster cross-border payments, smart contracts, and identity verification.

F) What Are Some Real-Life Examples of Blockchain in FinTech?

Cryptocurrency Exchanges: Platforms like Coinbase and Binance use blockchain for secure trading.

Decentralized Finance (DeFi): DeFi protocols run on blockchain, enabling lending, borrowing, and yield farming without intermediaries.

Supply Chain Management: Blockchain ensures transparency and traceability in supply chains.

G) Why Should MSys Technologies Be Your Fintech Engineering Partner?

MSys Technologies combines expertise in fintech software development with a deep understanding of blockchain.

Our solutions empower financial companies to innovate, improve security, and enhance customer experiences.

H) What services do FinTech engineering companies offer?

FinTech engineering companies provide a wide range of services, including developing bank account management systems, enabling businesses to accept payments, and creating innovative solutions for managing financial accounts and paying bills.

I) How can FinTech engineering services benefit my business?

By leveraging FinTech engineering services, businesses can streamline their operations, enhance customer experience through user-friendly bank accounts and payment acceptance systems, and gain access to cutting-edge financial products tailored to their needs.

J) What distinguishes a reliable FinTech company in the USA?

A reliable FinTech company should have a proven track record of delivering high-quality solutions for managing savings accounts, providing financial advisory services, and offering employee benefits solutions.

Look for a company with expertise in private equity and a strong reputation in the financial industry.

K) What should I consider when choosing a FinTech engineering partner?

When selecting a FinTech engineering partner, consider factors such as their experience in developing financial products, their ability to integrate seamlessly with existing systems of many financial institutions, and their parent company’s reputation and financial stability.

L) Can FinTech engineering services help my business scale?

Yes, engaging with a reputable FinTech engineering company can facilitate scalability for your business by providing scalable solutions such as those to pay bills, integrating with a variety of bank accounts with your parent company, and enabling efficient management of financial transactions for employee benefit.

M) Are there any notable examples of successful FinTech projects?

Yes, several big FinTech companies have executed successful projects, such as developing innovative solutions for managing bank accounts, providing financial advisory services, and facilitating private equity transactions.

These companies have made significant contributions to the financial industry.

N) Who are the biggest fintech companies of 2024?

The most prominent fintech companies of 2024, according to reputable sources, include:

Visa: Leading the PayTech sector with a market capitalization of $559.6 billion.

Mastercard: Close behind Visa, with a market capitalization of $436.7 billion, solidifying its presence in PayTech.

Ant Group: A significant player valued at $78.5 billion, showcasing its influence in the fintech industry.

Stripe, Inc.: Valued at $50 billion, particularly known for its payment solutions expertise.

Revolut: Holding a valuation of $33 billion, showcasing its impact in the fintech landscape.

Chime Financial, Inc.: Valued at $25 billion, positioning itself as a major player in fintech.

Rapyd: With a valuation of $15 billion, offering innovative financial solutions.

Plaid: Valued at $13.4 billion, crucial in enabling financial technology services.

Brex, Inc.: Valued at $12.3 billion, demonstrating significant influence and growth.

GoodLeap: Holding a valuation of $12 billion, cementing its place among the top fintech companies.

These are some of the largest FinTech companies and are key players, shaping the fintech industry and customer behavior in 2024, evident from their market capitalizations and contributions to financial technology innovation and services.

These technology companies also support many sustainability endeavors supporting small private companies and MSMEs along with small businesses globally, promoting financial inclusion, alleviating financial stress.

O) Name some of the biggest FinTech startups in USA and some of their unique online platforms?

Some of the biggest FinTech startups in the USA and their unique online platforms include:

Stripe, Inc.: Stripe is a payment processing company that provides secure and user-friendly payment processing tools for businesses.

Their online platform enables finance teams to delight customers easily through an array of payment services.

Chime Financial, Inc.: Chime is a digital banking platform that offers checking and savings accounts, debit cards, and investment opportunities to its users.

Their online platform provides a comprehensive suite of financial services for individuals.

Brex, Inc.: Brex is a financial technology company that offers corporate cards and cash management solutions for businesses.

Their online platform streamlines the process of managing business expenses and cash flow.

Rapyd: Rapyd is a global payments platform that facilitates businesses to accept and make payments in over 100 countries.

Their online platform offers a seamless and efficient way for companies to manage their international payments and financial systems.

Plaid: Plaid is a financial technology company that provides APIs for banks and financial institutions to connect with other financial applications.

Their online platform enables developers to build financial applications that integrate with various financial institutions.

GoodLeap: GoodLeap is a platform that allows individuals to invest in sustainable projects and properties.

Their online platform provides a way for investors to support environmentally friendly projects while earning returns.

Wealthfront: Wealthfront is a robo-advisor that offers automated investment management services.

Their online platform utilizes algorithms to construct and manage investment portfolios for users.

Betterment: Betterment is another robo-advisor that provides automated investment management services.

Their online platform employs algorithms to construct and manage investment portfolios for users benefiting from their financial system.

Lemonade: Lemonade is an insurance technology and a financial advisor genre company that offers home and renters insurance through a mobile app.

Their online platform provides a simple and user-friendly way for customers to manage their insurance policies and financial systems.

Root: Root is an insurance technology company and another financial advisor genre company that provides car insurance through a mobile app.

Their online platform utilizes data and technology to offer personalized insurance quotes and manage policies for customers and the company’s platform.