Juggling the Maze to Discover the Best FinTech Software Development Services in the Bay Area? You’ve Arrived!

Audio : Listen to This Blog.

Let’s Spark Collaboration and Ignite Innovation to Roll Out State-of-the-Art Solutions from Use Cases of Your Choice at MSys FinTech CoEs

Introduction:

In the bustling ecosystem of FinTech, selecting the right software development services can feel like navigating a labyrinth. Amidst a sea of options, it’s crucial to pinpoint a partner that not only shares your vision but also possesses the technical prowess to bring it to fruition. In this blog, we’ll delve into the myriad use cases of FinTech software development and illuminate how MSys Technologies emerges as your beacon, guiding you towards unparalleled success in the Bay Area’s competitive FinTech arena.

Why Do We Need FinTech Software Development Services And What Problems Can They Help C-Suite Executives Solve?

Fintech software development services are crucial for C-suite executives in the financial industry as they help address various challenges and provide innovative solutions.

Streamlining Operations: Fintech software development services revolutionize operations by automating processes, minimizing manual errors, and boosting operational efficiency in financial institutions. This optimization translates into accelerated transaction processing, enhanced data management, and significant cost savings.

Enhancing Security: These services play a pivotal role in fortifying cybersecurity measures through the implementation of cutting-edge encryption techniques, multi-factor authentication, and real-time monitoring systems. By bolstering security protocols, fintech solutions safeguard sensitive financial data and thwart cyber threats effectively.

Improving Customer Experiences: Fintech software development services prioritize the creation of user-friendly interfaces, tailored services, and seamless digital experiences for customers. Innovative solutions such as mobile banking apps, online payment platforms, and robo-advisors elevate customer satisfaction and foster long-term loyalty.

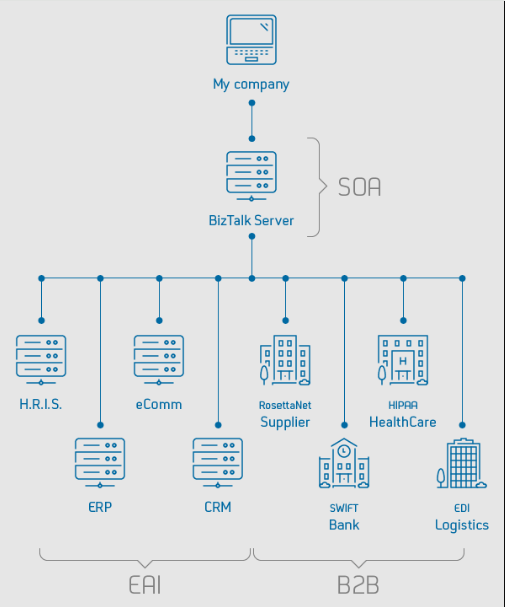

Ecosystem Integration: Fintech services facilitate the seamless integration of diverse financial systems and third-party applications using APIs (Application Programming Interfaces). This integration promotes data sharing, interoperability across platforms, and the development of comprehensive financial ecosystems offering a myriad of services to customers.

API-Based Services: Leveraging APIs, fintech software development fosters connectivity between disparate systems and applications. By providing API-based services, companies can effortlessly incorporate new functionalities, collaborate with external partners, and swiftly adapt to evolving market demands.

In essence, fintech software development services are indispensable for C-suite executives as they address critical challenges in the financial sector while nurturing innovation and competitiveness in an increasingly digital landscape.

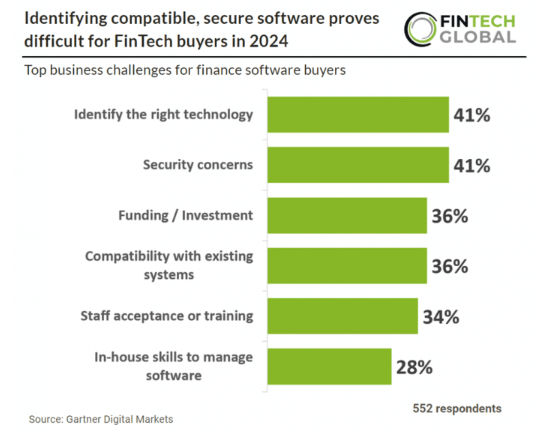

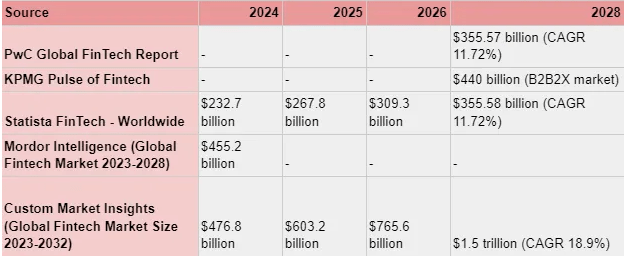

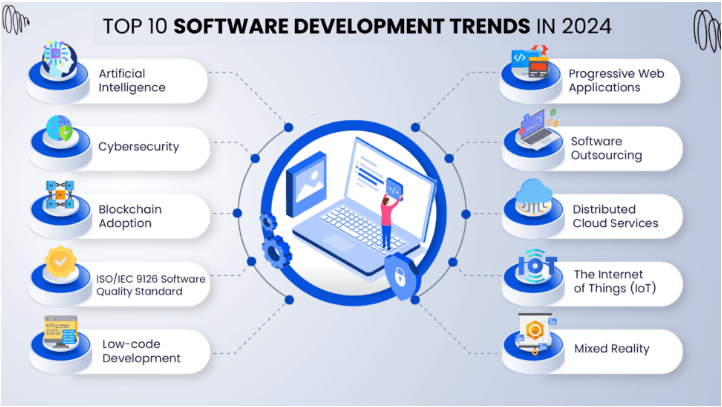

Source: FinTech Global

Unveiling the Diversity of FinTech Software Development & How MSys Helps Customers Elevate their FinTech Game

At the helm of FinTech innovation stands MSys Technologies, a distinguished provider of FinTech software development services in the Bay Area.

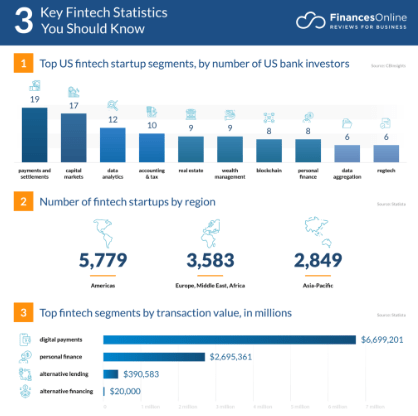

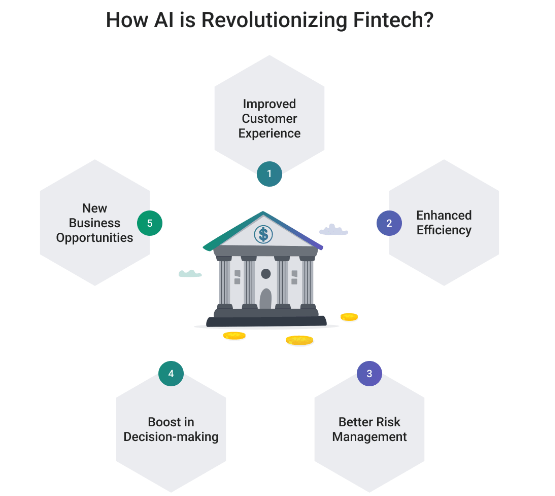

Source: FinancesOnline

With a keen understanding of industry dynamics and a track record of excellence, MSys Technologies offers bespoke solutions across a spectrum of FinTech domains:

Download Our Case Studies Here.

FinTech COEs Help Clients Elevate their Game

| FinTech Use Cases | Description | MSys Technologies Approach | Deployment of MSys’s Engineering Stack |

|---|---|---|---|

| Personal Finance Management | Streamlining the management of finances, empowering individuals to track income, expenses, and savings effortlessly while strategizing for future financial endeavors. | Empowers individuals with user-friendly software solutions that streamline financial tracking and offer tailored advice, ensuring effortless management and fostering financial empowerment. | Utilizes MSys’s “MoneyMaster” framework, incorporating customizable modules and AI-driven algorithms, to d personalized finance management software with “WealthNavigator” solution accelerators for easy tracking and advice provision. |

| Investment Management | Equipping investors with robust software tools for portfolio management, facilitating informed decision-making, and enabling real-time tracking of market trends. | Provides intuitive software tools for portfolio management and market analysis, offering real-time insights to investors for informed decision-making and optimized investment strategies. | Leverages MSys’s “InvestPro” framework, integrating advanced analytics and visualization tools, to create portfolio management solutions with “MarketSense” solution accelerators for real-time insights and decision support. |

| Trading Platforms | Crafting secure and intuitive platforms that cater to traders’ diverse needs, facilitating seamless transactions of financial instruments with utmost efficiency. | Creates secure and efficient trading platforms, catering to traders of all levels and ensuring optimal user experience, thereby bolstering confidence in trading endeavors. | Deploys MSys’s “TradeTech” framework, fortified with blockchain integration and real-time monitoring features, to deploy trading platforms with “SecureTrade” solution accelerators ensuring secure transactions and intuitive user experience. |

| Payment Processing | Ensuring the seamless flow of transactions through the development of resilient payment processing software, adhering to the highest standards of security and reliability. | Guarantees secure and efficient payment transactions through robust payment processing software, maintaining the highest industry standards and fostering trust and reliability in financial transactions. | Utilizes MSys’s “PayGenius” framework, incorporating encryption protocols and fraud detection algorithms, to build payment processing solutions with “SecurePay” solution accelerators ensuring seamless transactions and adherence to security standards. |

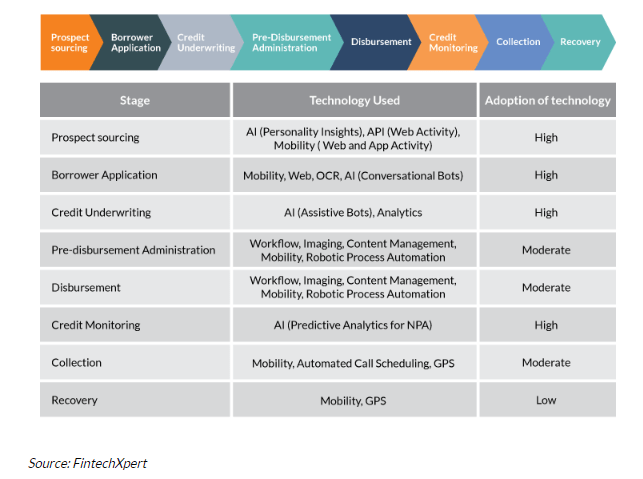

| Credit Risk Management | Mitigating risks for financial institutions with comprehensive credit risk management software, enabling accurate assessment of borrower creditworthiness. | Provides financial institutions with comprehensive credit risk management software, facilitating accurate assessment of borrower creditworthiness and enabling informed decision-making to mitigate risks effectively. | Leverages MSys’s “CreditGuard” framework, utilizing machine learning models and data analytics, to deploy credit risk management software integrated with “RiskAssess” solution accelerators for accurate assessment and informed decision-making. |

| Fraud Detection | Leveraging cutting-edge machine learning algorithms to detect and prevent fraudulent activities, safeguarding businesses against potential financial losses. | Utilizes advanced machine learning algorithms to detect and prevent fraudulent activities, fortifying businesses against financial losses and ensuring proactive mitigation of fraudulent threats. | Deploys MSys’s “FraudShield” framework, powered by neural networks and anomaly detection algorithms, to implement fraud detection systems with “SafeGuard” solution accelerators for proactive threat mitigation. |

| Compliance Management | Simplifying regulatory compliance processes through automation, minimizing the risk of non-compliance penalties while ensuring adherence to industry standards. | Automates compliance processes to ensure regulatory adherence and minimize the risk of non-compliance penalties, upholding industry standards and fostering trust and credibility for businesses. | Implements compliance management solutions using MSys’s “CompliTech” framework, with robotic process automation and audit trail features, integrated with “ReguSure” solution accelerators for automated processes ensuring regulatory adherence and risk mitigation. |

| Wealth Management | Tailoring personalized wealth management solutions to cater to the unique needs of high-net-worth individuals, providing them with invaluable investment insights. | Offers personalized wealth management solutions tailored to the unique needs of high-net-worth individuals, providing invaluable investment insights and strategies for wealth optimization. | Develops wealth management software leveraging MSys’s “WealthPro” framework and predictive analytics, with “InvestEdge” solution accelerators for customized solutions catering to high-net-worth individuals’ needs. |

| Insurance Management | Optimizing policy administration, claims processing, and risk assessment for insurance companies through streamlined software solutions. | Streamlines insurance operations with software solutions for policy administration, claims processing, and risk assessment, enhancing operational efficiency and customer satisfaction for insurance companies. | Utilizes MSys’s “InsureTech” framework, featuring claims automation and predictive modeling, to build insurance management software with “ClaimEase” solution accelerators for streamlined policy administration, claims processing, and risk assessment, ensuring operational efficiency and customer satisfaction. |

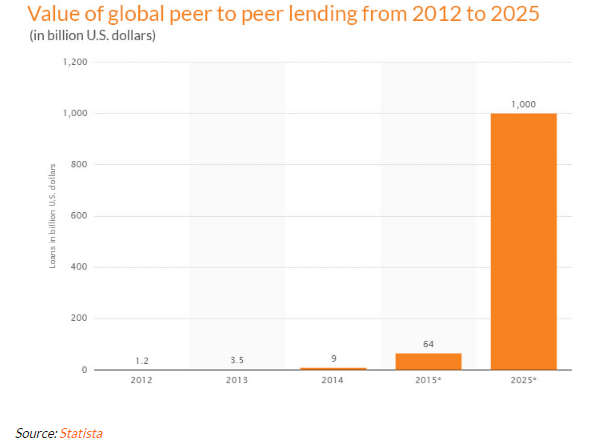

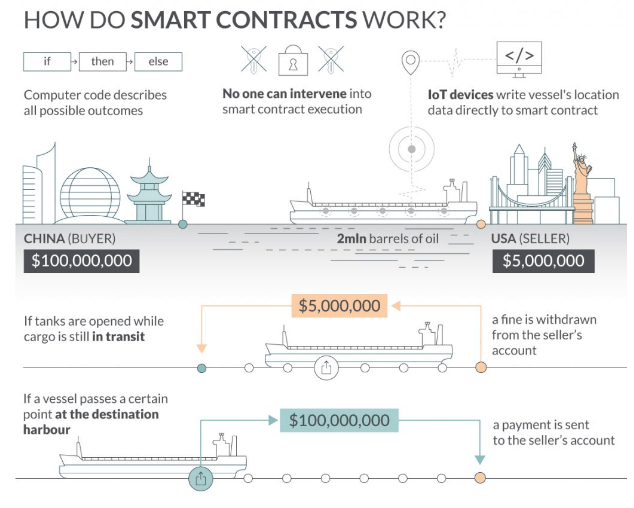

| Lending Platforms | Revolutionizing the lending landscape by connecting borrowers with lenders seamlessly, automating loan processes to enhance accessibility and efficiency. | Innovates lending platforms, facilitating seamless borrower-lender interactions and automating loan processes to enhance accessibility and efficiency, thereby mitigating risks and fostering a conducive lending environment. | Deploys MSys’s “LendTech” framework, integrating smart contracts and digital identity verification, to deploy lending platforms with “LoanEase” solution accelerators ensuring seamless interactions, automated loan processes, and risk mitigation, thereby fostering a conducive lending environment. |

MSys Value Add:

| Value Add | Description |

|---|---|

| User-Centric Approach | MSys Technologies prioritizes user experience by incorporating usability testing, intuitive design, feedback mechanisms, and customization options into their solutions. This ensures that end-users can navigate financial tools seamlessly. |

| Strategic Partnership Benefits | Partnering with MSys Technologies offers a multitude of benefits including industry expertise, innovative solutions, tailored services, cost-effectiveness, scalability, and a steadfast commitment to excellence. |

| Distinctive Offerings | MSys stands out in the FinTech landscape due to its deep understanding of the industry, proven track record of excellence, and ability to deliver bespoke solutions tailored to diverse FinTech domains. |

| Tailored Software Development Approaches |

|

| Technological Expertise |

|

Conclusion

In the ever-evolving landscape of FinTech, partnering with the right software development services provider is paramount to success. With MSys Technologies as your trusted ally, you can navigate the intricacies of FinTech innovation with confidence and clarity. From personal finance management to lending platforms and beyond, MSys Technologies offers tailored solutions that empower businesses to thrive in the dynamic Bay Area FinTech ecosystem. Embrace collaboration, ignite innovation, and embark on a journey towards unparalleled FinTech excellence with MSys Technologies by your side.

FAQs: A Homing Beacon for FinTech Software Development Service Seekers in the Bay Area

1. What is FinTech software development, and how does it impact the financial industry?

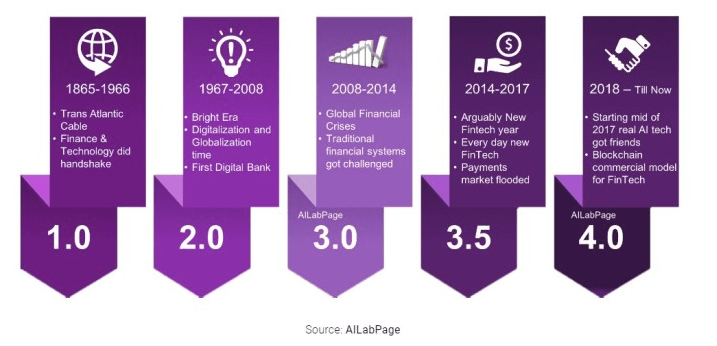

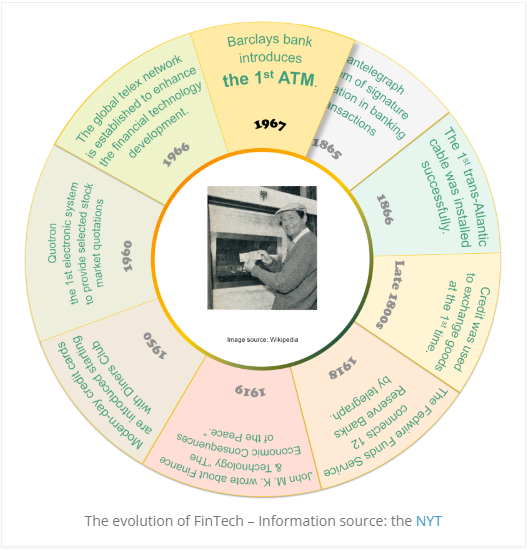

FinTech software development refers to the creation of financial technologies that aim to improve and innovate various aspects of the financial industry, such as payments, investments, and lending. It impacts the financial industry by enhancing efficiency, reducing costs, and providing better services to customers.

2. What are the key use cases of FinTech software development?

Some key use cases of FinTech software development include personal finance management, investment management, trading platforms, payment processing, credit risk management, fraud detection, compliance management, wealth management, insurance management, and lending platforms.

3. What are some of the top FinTech Software Development Services Companies?

Here’s the list of some of the top FinTech Software Development Services Companies in the USA, and beyond:

- MSys Technologies: Leading the digital revolution in the financial sector, MSys Technologies is at the forefront of transforming traditional banking and finance operations with cutting-edge technology. With 15+ Fortune 500 clients and 250+ FinTech engineers we are breaking barriers and forging excellence. We bring to you a FinTech odyssey like no other. Join us as we decode the language of innovation, elevate financial services, and set sail toward a limitless horizon.

- 100+ Projects

- 250+ Full-Stack FinTech Engineers Deployed

- MSys Lab-as-a-Service Integrating cutting-edge Ecosystems

- Unifying Global Engineering Symphony Across Multiple GCCs

- Seamlessly Accelerate From Prototype to Profitability in Record Time

- Adaptive Development Services (ADS) & Product Sustenance

- A3logics: A leading provider of fintech solutions, A3logics specializes in digital payments, banking accounts, investments, and insurance products. Their expertise lies in producing cost-efficient, innovative services with enhanced security features.

- DianApps: DianApps excels in providing customized fintech solutions, committed to swift, reliable, and technical debt-free practices. They facilitate seamless technology for scalable business growth.

- Kony (now Temenos): Kony, now part of Temenos, powers a world of banking for various players in the industry, including banks, non-banks, and fintechs. Their ambition is to be everyone’s banking platform.

- Multishoring: Multishoring specializes in offshore and nearshore IT development in Poland, making them a significant player in the fintech software development landscape.

- Andersen Inc.: An international custom medical software development company, Andersen focuses on technology-intensive industries. They’ve completed over 1000 projects and received positive reviews from customers worldwide.

Unleash the Financial Future: #1 Fintech Services that Wow!

4. How does MSys Technologies approach FinTech software development?

MSys Technologies focuses on understanding industry dynamics and providing bespoke solutions across a spectrum of FinTech domains. They deploy their engineering stack and leverage advanced technologies like AI, machine learning, and blockchain to develop innovative solutions for clients.

5. What are the benefits of partnering with MSys Technologies for FinTech software development?

Partnering with MSys Technologies offers benefits such as industry expertise, innovative solutions, tailored services, cost-effectiveness, scalability, and a commitment to excellence in every project.

6. How does MSys Technologies ensure data security in their FinTech software solutions?

MSys Technologies prioritizes data security by implementing encryption protocols, robust authentication mechanisms, and continuous monitoring to safeguard sensitive financial information.

7. What role does AI play in MSys Technologies’ approach to FinTech software development?

AI is integrated into MSys Technologies’ solutions for predictive analytics, fraud detection, personalized recommendations, and process automation, enhancing efficiency and accuracy.

8. Can MSys Technologies’ FinTech software solutions be customized to suit specific business requirements?

Yes, MSys Technologies offers customizable solutions tailored to meet the unique needs and objectives of each client, ensuring optimal functionality and alignment with business goals.

9. How does MSys Technologies stay abreast of the latest trends and technologies in the FinTech industry?

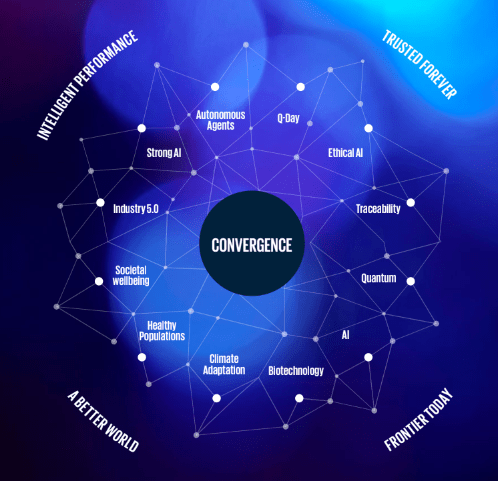

MSys Technologies invests in continuous research, training programs, and partnerships to stay updated on emerging trends like blockchain, AI, and Web3, ensuring cutting-edge solutions for clients.

10. What support and maintenance services does MSys Technologies provide post-implementation of FinTech software solutions?

MSys Technologies offers comprehensive support and maintenance services post-implementation, including troubleshooting, updates, security patches, and performance optimization to ensure seamless operation.

11. How does MSys Technologies ensure regulatory compliance in their FinTech software development projects?

MSys Technologies adheres to strict regulatory standards by incorporating compliance features, audit trails, and automated processes in their software solutions to help clients meet regulatory requirements.

12. What measures does MSys Technologies take to ensure user-friendly interfaces in their FinTech software solutions?

MSys Technologies prioritizes user experience by conducting usability testing, incorporating intuitive design principles, feedback mechanisms, and customization options to enhance user satisfaction and engagement.

13. What are the key benefits of partnering with MSys Technologies for FinTech software development services?

Partnering with MSys Technologies offers benefits such as industry expertise, innovative solutions, tailored services, cost-effectiveness, scalability, and a commitment to excellence in every project.

14. What sets MSys Technologies apart in the FinTech software development landscape?

MSys Technologies stands out for its deep industry understanding, track record of excellence, and bespoke solutions tailored to diverse FinTech domains.

15. How does MSys Technologies approach Personal Finance Management software development?

MSys empowers individuals with user-friendly solutions like “MoneyMaster” and “WealthNavigator” to streamline financial tracking and offer personalized advice for effortless management.

16. In what way does MSys Technologies assist in Investment Management software development?

MSys provides intuitive tools like “InvestPro” and “MarketSense” for portfolio management, real-time market insights, and informed decision-making for investors.

17. What expertise does MSys Technologies bring to Trading Platforms development?

MSys crafts secure platforms using “TradeTech” and “SecureTrade” frameworks, integrating blockchain for secure transactions and real-time monitoring.

18. How does MSys Technologies ensure secure Payment Processing software development?

MSys guarantees secure transactions with the “PayGenius” framework, incorporating encryption protocols and fraud detection algorithms through “SecurePay” accelerators.

19. What approach does MSys Technologies take in Credit Risk Management software development?

MSys mitigates risks with the “CreditGuard” framework, utilizing machine learning models and data analytics integrated with “RiskAssess” accelerators for accurate risk assessment.

20. How does MSys Technologies tackle Fraud Detection in financial transactions?

Leveraging advanced algorithms like “FraudShield,” MSys detects and prevents fraudulent activities using neural networks and anomaly detection for proactive threat mitigation.

21. What solutions does MSys Technologies offer for Compliance Management in FinTech?

MSys automates compliance processes with the “CompliTech” framework, ensuring regulatory adherence through robotic process automation and audit trail features with “ReguSure” accelerators.

22. How does MSys Technologies cater to Wealth Management needs for high-net-worth individuals?

MSys tailors personalized wealth management solutions using the “WealthPro” framework, predictive analytics, and “InvestEdge” accelerators for customized investment strategies.

23. In what ways does MSys Technologies optimize Insurance Management operations for insurance companies?

Streamlining policy administration, claims processing, and risk assessment with the “InsureTech” framework and “ClaimEase” accelerators to enhance operational efficiency and customer satisfaction.

24. How is Lending Platforms revolutionized by MSys Technologies’ solutions?

By connecting borrowers with lenders seamlessly through the “LendTech” framework, smart contracts, and digital identity verification, automating loan processes for enhanced accessibility and efficiency.

25. What benefits can businesses expect from collaborating with MSys Technologies in the FinTech sector?

Businesses partnering with MSys can expect tailored solutions, innovative technologies, industry expertise, and a track record of excellence to thrive in the dynamic Bay Area FinTech ecosystem.

26. How does collaboration with MSys Technologies drive innovation in FinTech software development services?

Collaborating with MSys sparks innovation by leveraging cutting-edge technologies, personalized solutions, and a commitment to excellence to achieve unparalleled success in the competitive FinTech arena.

27. What role does collaboration play in achieving FinTech excellence with MSys Technologies as a partner?

Collaboration with MSys fosters a culture of innovation, knowledge sharing, and strategic alignment to drive businesses towards achieving FinTech excellence in the Bay Area’s competitive landscape.

28. How can businesses leverage the expertise of MSys Technologies to navigate the complexities of the FinTech industry successfully?

By partnering with MSys Technologies, businesses gain access to tailored solutions, industry insights, technical prowess, and collaborative partnerships that empower them to navigate the intricate FinTech landscape effectively.

29. How does Msys Technologies approach personal finance management software development?

MSys Technologies approaches personal finance management software development by focusing on new financial tools, application programming interfaces (APIs), and transactional data to create revenue-sharing ecosystems. They also emphasize the integration of financial services into non-financial applications and platforms, known as embedded finance. This integration requires the development of secure and efficient systems that can handle complex financial transactions and data.

The company’s services in digital asset management further demonstrate their commitment to secure and efficient technology solutions. By merging AI-driven tech with secure cloud services, they help businesses transform their digital asset management processes, ensuring the safety and accessibility of financial data.

In summary, MSys Technologies’ approach to personal finance management software development involves creating innovative financial tools and integrating financial services into various applications, while maintaining a strong focus on security and efficiency.

30. What is the difference between digital solutions and traditional financial management tools?

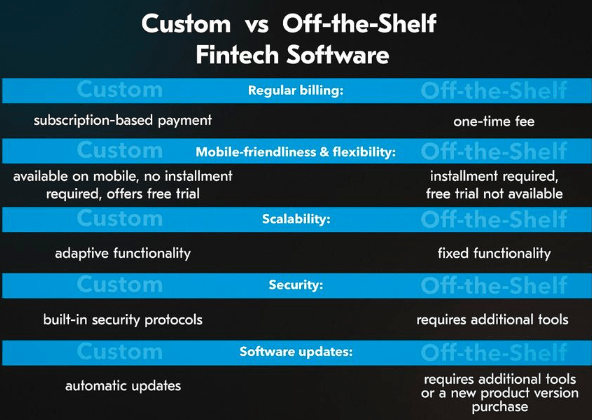

Digital solutions refer to the use of technology-based tools and platforms for managing personal finances. These tools can include mobile apps, online banking, and other digital platforms that allow users to manage their money from anywhere at any time. Traditional financial management tools, on the other hand, are paper-based or manual methods of managing finances, such as using a checkbook or a spreadsheet.

31. How can digital solutions help with cash flow management?

Digital solutions can help with cash flow management by providing real-time insights into income and expenses. Users can track their spending and income using mobile apps or online platforms, allowing them to identify areas where they may be overspending or under-earning. This information can be used to make more informed decisions about how to manage their money and improve their cash flow.

32. What role does retirement planning play in digital solutions for personal finance management?

Retirement planning is an essential aspect of personal finance management, and digital solutions can help users plan for their future. These tools can help users estimate their retirement income, calculate how much they need to save, and set up automatic savings plans. By using digital solutions for retirement planning, users can ensure that they are on track to achieve their financial goals and have a comfortable retirement.

33. How can digital solutions help users achieve their financial goals?

Digital solutions can help users achieve their financial goals by providing them with the tools and resources they need to manage their money effectively. These tools can include budgeting apps, investment platforms, and other financial management tools that allow users to track their progress and make informed decisions about their money. By using digital solutions, users can take control of their finances and work towards achieving their financial goals.

Related Image Gallery

Source: N-iX

Source: Cision

Source: N-iX

Source: Medium

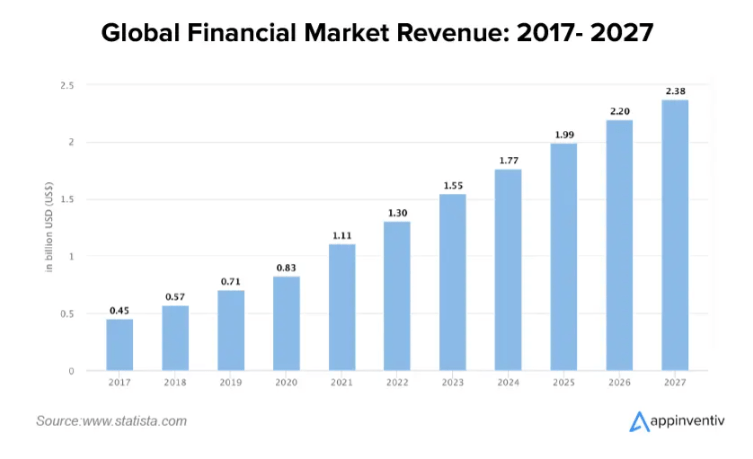

Source: Appinventiv

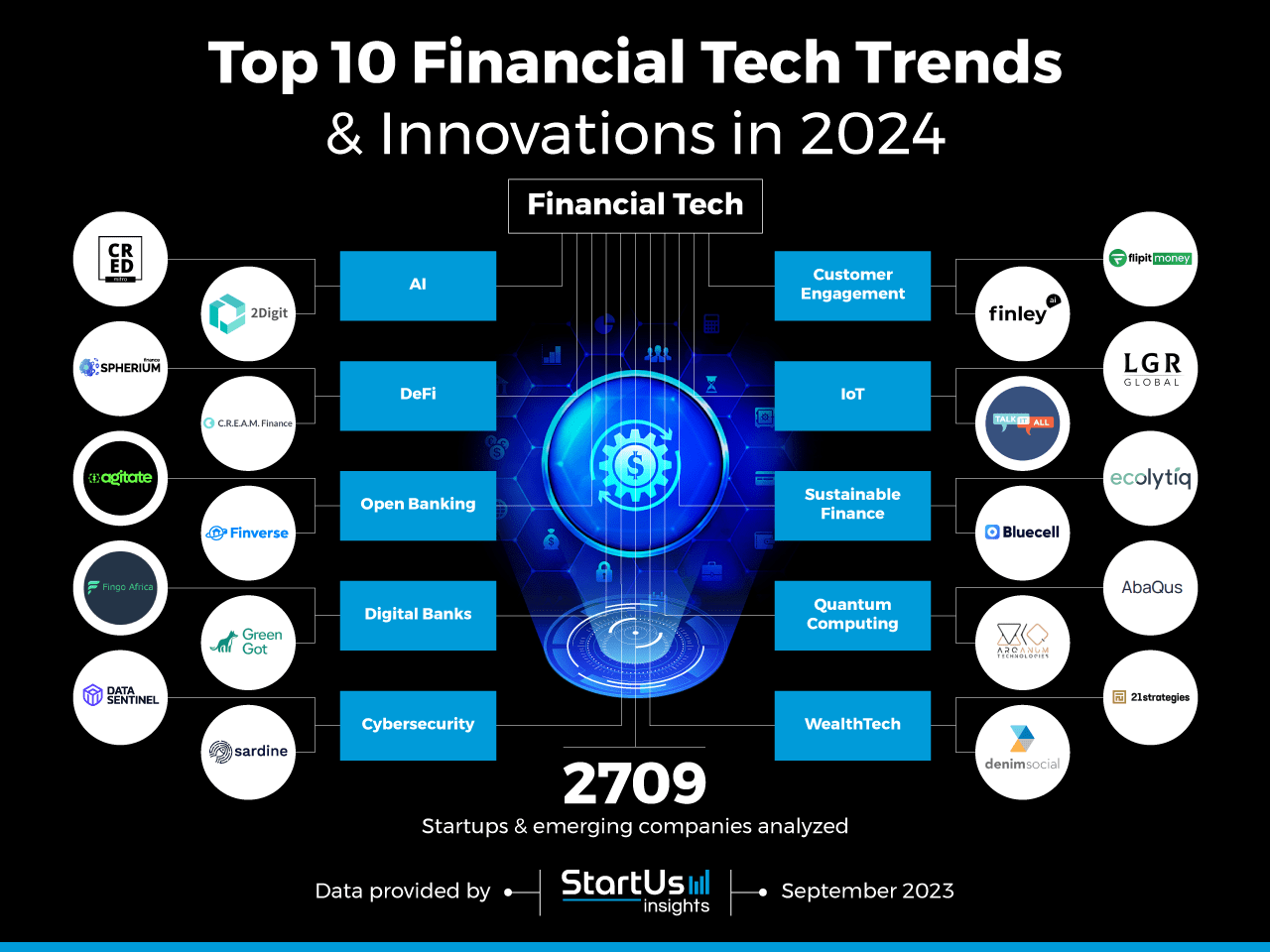

Source: StartUs insights

Source: Ailoitte

Source: Acropolium

Different IT Integration Models: Source: Multishoring

Modern-Day FinTech Powered by Digital Transformation: Source: KPMG

Source: NYT

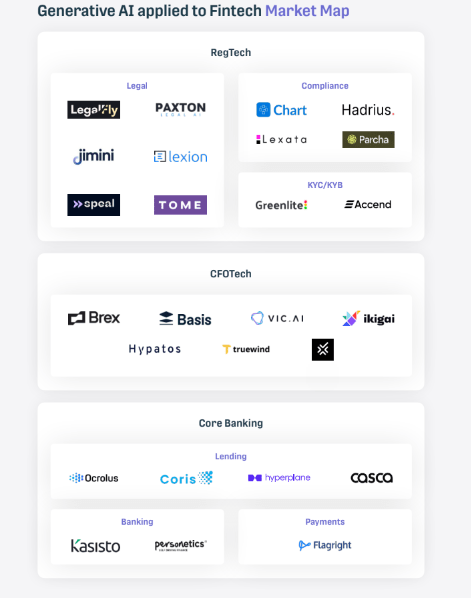

GenAI’s ‘Imaginotive’ FinTech Realm

Ready to bring the future of FinTech to life? Contact MSys Technologies today and let’s transform your vision into reality. Reach out to us now to explore how our innovative solutions can propel your business into the digital frontier.