Twirling the Wheel of Fortune for Business Growth

Introduction

Picture this: Technology and payments are like two horses yoked together, galloping toward the future. They’re a dynamic duo, moving forward not only in developed markets but also in emerging ones, where it’s crucial to have payment solutions that can reach the currently underbanked. This wild ride has led to the rise of PayTechs, a new player in the payments game that’s disrupting the traditional payments ecosystem with lightning speed. FinTechs have hopped on this bandwagon, leveraging their tech capabilities and customer-centric approach to expand into payments.

The result?

Users are now spoiled with fast, easy payment solutions catering to their needs. PayTechs are a sub-group of FinTechs that are hyper-focused on the payment value chain, including payment facilitators, PSPs, networks creating new payment propositions, and payment technology suppliers.

However, that’s just the tip of the iceberg. PayTechs offer integrated payment solutions seamlessly embedded into the digital economy, catering to the growing appetite for hassle-free payments. Think contactless payments, mobile payments, e-wallets, and cryptocurrencies – all at your fingertips. PayTechs were quick to recognize that fast and frictionless payments offer a distinct competitive advantage in the digital world, and they’re taking full advantage of it.

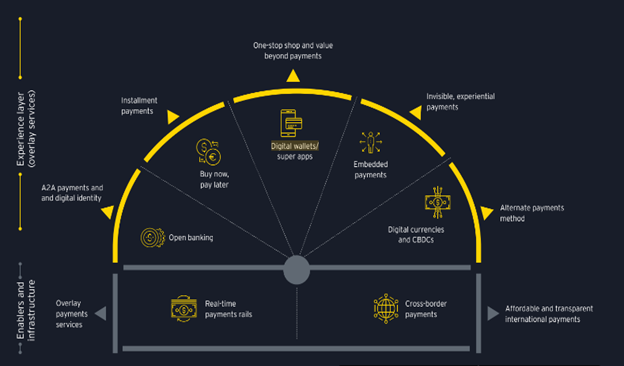

With payment security, blockchain, artificial intelligence, biometric authentication, IoT, open banking, real-time payments, cross-border payments, subscription billing, and payment gateway at their disposal, PayTechs are creating a dynamic and fast-moving payment landscape. So, hop on this payment rodeo, and let’s explore the latest payment innovations and trends shaping the next generation of PayTech services. This blog will discuss how you can leverage the latest payment innovation trends and technologies to drive business growth.

Breaking the Mold: How PayTechs are Disrupting the Payments Industry

The payments industry is undergoing a radical metamorphosis, with PayTechs leading the charge in shaking up the traditional payments landscape. They’re like the caterpillars of the payments world, turning into beautiful butterflies that offer fast, frictionless, and integrated payment solutions that cater to the needs of both consumers and merchants.

Using cutting-edge technologies like blockchain, artificial intelligence, and biometric authentication, PayTechs are like mad scientists in their laboratories, concocting potions that make payments faster, more secure, and more convenient than ever before. They’re turning digital payments into the new gold standard.

With the rise of digital payments, PayTechs are the architects of a new world where cash is obsolete. They’re like the builders of a new world, paving the way for a cashless future and transforming how we pay for goods and services. From mobile payments to e-wallets and contactless payments, PayTechs are alchemizing the payments industry, revolutionizing the status quo and driving it towards a new era of innovation and growth.

A survey conducted by CB Insights and EY revealed that as of June 2022, PayTechs have proliferated to over 2400 globally, making up a quarter of all FinTechs. These high-tech payment facilitators have nestled themselves at the heart of the business world, driving the digital economy forward with a colossal market size of USD 240 tn.

Elucidated in the words of Jeremy Balkin, Global Head of Innovation and Corporate Development, Payments at J.P. Morgan, “When you exchange data, you exchange value. When you exchange value, you’re making a payment. That’s why payments are eating the world.”

Indeed, with the rise of the digital economy, customers’ hunger for seamless and swift payments is surging, and PayTechs is the key to satisfying this craving. Instead, they offer integrated solutions that cater to the needs of both customers and merchants.

PayTechs know that fast, frictionless, and embedded payments are the future, and they have been quick to seize the opportunity to stay ahead in the game. By providing innovative and convenient payment solutions, PayTechs are driving the evolution of the payments industry, and their impact on the growth and transformation of this realm is enduring.

Revolutionary Trends Innovating Payments: What’s Next for PayTech Services?

The payments industry is undergoing a revolution of all sorts, with PayTechs and other new entrants leading the charge of innovation and disruption. These dynamic and game-changing trends push banks and traditional payment providers to transform their approach and offer more than just payments. We’re excited about the future of PayTech services but recognize the challenges that lie ahead for banks and payment providers.

Payment Services Providers (PSPs) are at the forefront of a revolution that’s changing the very landscape of commerce. As technology continues to evolve, so do consumers’ demands; and PSPs are constantly innovating to meet those demands. From contactless payments to mobile wallets, PSPs are redefining the way we pay for goods and services.

PSPs are paving the way for a future where payment processing is seamless, secure, and instantaneous. They’re developing new payment channels, such as voice-activated payments, and new payment models, like pay-as-you-go plans.

As the world becomes more digitized, PSPs find new ways to leverage technology to improve the payments experience. They’re using artificial intelligence and machine learning to enhance fraud detection and streamline payment processing.

PSPs continue to push the boundaries of what’s possible in the payments industry. By collaborating with other stakeholders in the financial ecosystem, such as banks and FinTech startups, PSPs are driving innovation and shaping the next generation of payment services.

As we navigate this ever-evolving landscape, we continue to ask better questions and challenge conventional wisdom to build a better working world for financial institutions and industry stakeholders alike.

Riding high on the waves of innovation, let’s unravel an in-depth analysis of the trends shaping up and disrupting the PayTech landscape:

-

1.PayTech’s Connection Revolution: Shaping the Future of Digital Commerce

As the digital economy grows, payment methods are becoming astoundingly faster, cheaper, and safer. Connected commerce is driving the transformation of the payments industry, and PayTechs are at the forefront of this change. Their innovative payment propositions are like digital bridges that connect merchants and consumers directly, creating a seamless payment experience. The future of PayTechs lies in their ability to create more efficient connections between businesses and their customers, leading to increased sales, improved customer satisfaction, and enhanced security.

-

2.The Evolution of PayTechs Beyond Transactions

PayTechs are stepping up their game and going beyond transactions to offer customers a complete and seamless experience. By providing value-added services before and after payments, they’re becoming the go-to destination for all financial needs.

With the rise of digital commerce, PayTechs are leveraging this trend to create personalized services catering to individual customer needs. For instance, some PayTechs now offer financial management tools, credit scoring, and loyalty programs to enhance the overall customer experience.

Here are some examples of PayTechs that are offering value beyond payments:

- PayPal: PayPal has introduced a suite of financial wellness tools, including a budgeting tool and bill pay service, to help customers manage their money beyond just sending and receiving payments.

- Square: Square’s Cash App allows users to send and receive money and offers investment options, a cash card for everyday spending, and even a Boost program that discounts popular retailers.

- Klarna: Klarna, a Buy Now Pay Later (BNPL) service, has expanded its offerings to include shopping features like price-drop alerts and a loyalty program and payment services.

These examples illustrate how PayTechs are moving beyond traditional payment processing and offering customers a wider range of services that can help improve their overall financial well-being.

This approach has proved to be a game-changer, as PayTechs are shifting from just being transactional to providing a comprehensive suite of services to their customers.

-

3.API Channels and Financial Super Apps: Open Banking is Revolutionizing PayTech Services

The rise of open banking has become a hot topic in the payments industry as it promises to be a real game-changer. Allowing customers to access banking capabilities and granting authorized third parties to connect merchants and customers directly creates new possibilities for faster, more secure, and cheaper payments that are convenient for customers.

Open banking provides a compelling “pay by bank” option that makes transactions seamless and convenient for customers, thereby firmly putting control of data, identity, and payments in their hands. This trend has been accelerated by technology and public policy, making it a global phenomenon that is here to stay.

According to Tom Pope, Head of Payments and Platforms at Tink, “Open banking adoption has really taken off this year. We should not lose sight of the enormous potential already within our grasp on the existing payment initiation service (PIS) and account information service (AIS) rails, from payments to onboarding to risk services. We are seeing huge improvements in connectivity performance in Southern and Eastern Europe and expect this to drive a new wave of consumer adoption in the short term. This is before, of course, the big leap forward in recurring payments enabled by VRP and SEPA Payment Account Access (SPAA), which are fast becoming reality.”

Indeed, as the quote affirms, the increasing adoption of open banking and the potential of utilizing payment initiation services (PIS) and account information services (AIS) rails. The improved connectivity performance in Southern and Eastern Europe is expected to boost consumer adoption in the short term. Additionally, introducing variable recurring payments (VRP) and SEPA Payment Account Access (SPAA) will drive a significant leap forward in recurring payments. The quote suggests that open banking presents vast opportunities for the payments industry, and those who are quick to embrace the new technology will benefit immensely.

In Europe, there are regulatory minimums on granting customer access to accounts, while in other regions like the US and Canada, banks are commercializing API channels. Meanwhile, financial super apps in parts of Asia offer deep integrations between financial and lifestyle brands, building extensively on APIs to drive seamless integration. Despite the regional differences, the overall direction of the industry is towards an opening up access and infrastructure, which supports customer choice.

As PayTech services continue to evolve, open banking will undoubtedly become a vital component of the payments landscape, driving innovation and providing new possibilities for payment methods like variable recurring payments (VRP) that will benefit customers and merchants alike.

-

4.The Synergy of RTR and Overlay Services: Powering the Future of Payments

Real-Time Retail Payments (RTR) have become a buzzword in the world of PayTech, and for a good reason. RTR has the potential to revolutionize payment transactions, unlocking a plethora of innovative payment solutions and services. RTR allows transactions to be processed instantly, allowing customers to send and receive payments in real-time.

One of the most significant advantages of RTR is that it allows all Payment Service Providers (PSPs) to provide better customer services through account-to-account (A2A) transactions. With RTR, all PSPs can offer their customers faster, cheaper, and more secure payment options, which is increasingly important in today’s fast-paced world.

RTR is also significantly reinforced and accelerated by open banking. The combination of RTR and open banking has the potential to create a more connected and seamless payment experience for customers. Open banking enables PSPs to offer more personalized services and tailored payment options by providing access to customer data.

With the adoption of RTR, the possibilities for innovation in PayTech are endless. It opens up new opportunities for payment solutions such as digital wallets, P2P payments, recurring payments, and more. For example, adopting RTR has led to the development of “Request-to-Pay” services. Customers can easily initiate payment requests from their mobile devices, making it easier to pay bills or split costs with friends and family.

Here are some more examples to illustrate how RTR and overlay services are powering the future of payments:

- Faster and more convenient payments: With the adoption of RTR and overlay services, PSPs can offer customers faster and more convenient payment options. For example, payment providers can leverage RTR to facilitate real-time transactions between bank accounts, while overlay services can provide additional features like payment reminders, customizable payment options, and more.

- Increased competition and innovation: The combination of RTR and overlay services drives increased competition and innovation in the payments industry. New entrants are leveraging these technologies to offer innovative payment services that challenge traditional players in the market. This competition is driving down costs and improving the quality of payment services for consumers.

- Improved security and fraud prevention: RTR and overlay services are helping to improve security and prevent fraud in the payments industry. Real-time payment processing and additional security measures offered by overlay services are helping to prevent fraudulent transactions and protect consumer data.

- Greater financial inclusion: RTR and overlay services are also helping to promote greater financial inclusion by providing consumers with more options for accessing financial services. For example, low-cost overlay services can help underbanked and unbanked consumers gain access to financial services that they may not have been able to access otherwise.

Brace yourselves for the future of payments! The journey of RTR and overlay services has been a rollercoaster of innovation that will keep the payments industry on the edge for years to come.

-

5.From E-Commerce to Everywhere: How Embedded Payments are Revolutionizing Customer Journeys

The rise of e-commerce, platforms, and marketplaces has paved the way for a new player in the payments space: non-financial service providers. These providers are integrating payments into customer journeys, creating a seamless and frictionless experience for consumers. With embedded payments, payments become more invisible, allowing customers to pay without even realizing they are doing so.

As embedded payments continue to scale, the opportunities for innovation are endless. For example, social media platforms like Instagram and Facebook are already testing embedded payment features that allow users to purchase products without leaving the app. Similarly, smart speakers like Amazon Echo and Google Home are expected to become key channels for voice-enabled payments, creating new opportunities for integrating payments into the home environment.

Furthermore, as embedded payments become more mainstream, payment providers must focus on creating APIs and SDKs that are easy to integrate with third-party applications. This will allow non-financial service providers to easily integrate payments into their existing customer journeys without developing their own payment infrastructure.

From shopping to booking a ride, embedded payments are taking over our daily routines and revolutionizing the payments industry. This opens up an entirely new world of opportunities for both financial and non-financial service providers to disrupt the payment landscape and create innovative customer experiences. As embedded payments continue to become more seamless and integrated, payment providers must keep up with the pace and adapt their strategies to stay ahead of the game. The future of payments lies in the hands of those who can innovate and meet the demands of the ever-evolving market.

-

6.The Rise of PayFacs: Disrupting the Payment Ecosystem

The emergence of PayFacs is like a bolt of lightning that has struck the payments industry, fundamentally changing the way businesses, acquiring banks, and card networks work together. With PayFacs, businesses can easily set up a merchant account and start accepting payments without the need for complicated processes and long waiting times. The rise of innovative PayFacs is set to revolutionize the payments landscape, making it more accessible and seamless for businesses and consumers alike.

PayFacs have been gaining momentum in recent years, with the likes of Square, Stripe, and PayPal leading the charge. By providing a single platform for merchants to accept payments, manage their transactions and access valuable data insights, PayFacs are streamlining the payments process and lowering the barrier to entry for businesses of all sizes.

New PayFac ecosystems are emerging and revolutionizing the PayTech industry by acquiring banks and collaborating with card networks. Along with this transformation, radical data monetization opportunities and unique customer offerings will be explored. These innovative PayFacs are providing secure storage, management, and utilization of consumer and merchant data generated through payment transactions, making it possible to extract valuable insights and drive growth.

The rise of PayFacs is also putting pressure on traditional acquiring banks and card networks to adapt to the changing payments ecosystem. With the ease and convenience offered by PayFacs, businesses are increasingly opting for these innovative solutions over traditional merchant accounts. As a result, acquired banks and card networks are being forced to reevaluate their business models and find new ways to stay relevant in a rapidly evolving industry.

-

7.The Cryptocurrency Overhaul: Paving the Way for Instant Settlement and Programmable Payments

The rise of digital currencies is set to shake up the payments industry as we know it. Cryptocurrencies are no longer just an alternative payment method; they offer a whole new infrastructure for instant settlement and programmable payments.

With the advent of distributed ledger technology (DLT), transactions can be processed in real time without intermediaries such as banks or payment processors. The programmable nature of cryptocurrencies allows for the creation of smart contracts, enabling automated payments based on predefined conditions.

Tokenization, which represents digital assets as tokens, also opens up new possibilities for asset ownership and transfer. With all these innovations, the future of payments looks more decentralized, transparent, and efficient.

-

8.The Guardians of Payment Security: Blockchain, AI, Biometrics, and IoT Shaping the Chessboard

As the payment industry evolves, security remains a top priority. With the rise of FinTech and digital payments, new technologies such as blockchain and artificial intelligence (AI) are being used to secure transactions. Blockchain technology, for instance, provides a decentralized ledger that enables secure and transparent transactions, while AI can help detect and prevent fraud.

In addition to these emerging technologies, biometric authentication and the Internet of Things (IoT) are also transforming payment processing. Biometric authentication, such as facial recognition and fingerprint scanning, is increasingly being used to verify a customer’s identity, providing an added layer of security. Meanwhile, the IoT allows for seamless payment processing through connected devices such as wearables and smart speakers, making payments quick and convenient.

Here are some real business use cases:

-

a)Payment security and blockchain

- Ripple: The blockchain-based payment platform Ripple uses its proprietary XRP cryptocurrency to facilitate cross-border payments, which are faster and more secure than traditional methods. The platform partners with over 300 financial institutions worldwide, including Santander and American Express.

- BitPay: BitPay is a payment service provider that enables merchants to accept bitcoin and other cryptocurrencies as payment. Its platform uses blockchain technology to ensure secure and fast transactions.

-

b)Biometric authentication and IoT in payment processing

- Amazon Go: Amazon Go is a chain of convenience stores that uses a combination of sensors, cameras, and machine learning algorithms to enable “just walk out” shopping. Customers can simply scan their Amazon Go app at the entrance, pick up the items they want, and walk out without paying at a traditional checkout. The payment is automatically deducted from their Amazon account.

- Mastercard: Mastercard has introduced biometric payment cards that use fingerprint authentication to authorize transactions. The cards have an embedded fingerprint sensor, eliminating customers needing to enter a PIN or sign a receipt. Mastercard is working with several banks, including Absa Bank in South Africa and Eurobank in Greece, to roll out the technology.

As payment fraud becomes more sophisticated, the industry will need to keep pace with new and emerging security technologies. The guardians of payment security must remain vigilant and adapt to new threats to ensure the safety and security of payment transactions for consumers and businesses alike.

How FinTech and Digital Payments Steer the Course

The payment landscape has rapidly evolved with the introduction of FinTech and digital payments. Traditional payment methods have become a thing of the past, and a new era of innovative payment services has emerged. The need for secure, fast, and convenient payment options has driven this change.

FinTech and digital payments have revolutionized the payment process and transformed the entire financial industry. With the introduction of mobile payment apps, payment gateways, and digital wallets, customers can now make payments on the go, from anywhere, anytime. This has brought convenience to customers and streamlined the payment process for businesses.

Furthermore, digital payments have also opened new doors for financial inclusion. The rise of mobile payments has made it possible for people in remote areas to have access to financial services. This has increased financial literacy and created new opportunities for businesses to tap into new markets.

Here are a few examples illustrating how payment services are evolving with the advent of FinTech and digital payments:

- Mobile payment apps: FinTech companies like PayPal, Venmo, and Cash App have introduced mobile payment apps that allow users to send and receive money quickly and easily. These apps have become increasingly popular among younger generations, who prefer the convenience of digital payments over traditional payment methods.

- Mobile payment apps: FinTech companies like PayPal, Venmo, and Cash App have introduced mobile payment apps that allow users to send and receive money quickly and easily. These apps have become increasingly popular among younger generations, who prefer the convenience of digital payments over traditional payment methods.

- Contactless payments: With the COVID-19 pandemic accelerating the shift away from cash, contactless payments have become more popular. Payment service providers like Visa and Mastercard have introduced contactless payment options, such as tap-to-pay cards and mobile wallets, which allow users to make purchases without physically touching a payment terminal.

- Blockchain and cryptocurrency: Blockchain technology and cryptocurrencies like Bitcoin and Ethereum are disrupting the traditional payment landscape by offering a decentralized, secure, and transparent payment system. Companies like Ripple are leveraging blockchain technology to enable faster, cheaper, and more secure cross-border payments.

- Open banking: As discussed above, the rise of open banking has created new opportunities for payment service providers to offer innovative payment solutions. By sharing customer data securely and efficiently, open banking has enabled the development of new payment models, such as account-to-account payments and peer-to-peer transfers.

The introduction of FinTech and digital payments has also spurred the growth of payment infrastructure and systems. New payment platforms are being developed, and existing ones are being upgraded to meet the market’s growing demands. As a result, the payment systems have become more secure, fast, and efficient, ensuring that transactions are processed seamlessly.

In Conclusion

As we draw the curtains on this payment innovation extravaganza, we can see that the path ahead is paved with new opportunities for businesses looking to ride the waves of change. The next generation of PayTech services is rapidly shaping the future of the payments industry, with a focus on improving customer experiences, increasing security, and unlocking new monetization opportunities.

Just as a skilled surfer catches the perfect wave, leveraging the latest PayTech services can help businesses ride the waves of payment innovation and achieve their goals of growth and success.

At MSys Technologies, we understand the importance of staying ahead of the curve in the constantly evolving payments landscape. Whether you’re an ISV looking to optimize your payment services or a large enterprise seeking to leverage the latest payment innovations, MSys Technologies is here to add value to your journey toward payment transformation.

With our cutting-edge, end-to-end full-stack FinTech services, we offer businesses a unique value proposition that is tailor-made for their specific needs. Our subscription billing and payment gateway solutions are like the sails on a ship, providing the necessary wind to propel businesses forward in their payment journey.

Our 2500+ FinTech experts guide businesses toward the best solutions for their payment needs, spearheading innovation, technological ingenuity, security, and customer intimacy & satisfaction with skill and assurance.

Join forces with MSys Technologies to blaze a trail toward payment success and get the wheel of fortune twirling in your favor! We are your seasoned, trusty beacons to navigate the brighter horizons of the ever-evolving PayTech landscape with ease and confidence.