Navigating Down Rounds in US Venture Capital

Audio : Listen to This Blog.

Venture capital (VC) financing is a common way for startups to get funding. However, not all startups are successful in securing funding through VC financing. Some startups face what is known as a down round, which is when the valuation of the company in a financing round is lower than in the previous round. This could potentially harm startups by eroding investor confidence and reducing the overall value of the company.

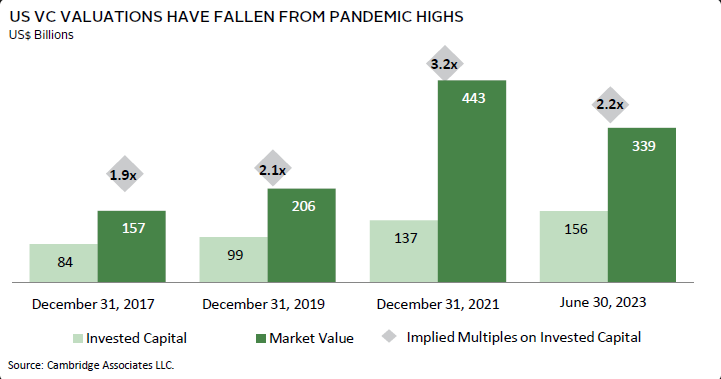

The US venture capital market for 2024 is experiencing a rise in down rounds despite the continued prevalence of artificial intelligence. Key statistics show that 20% of VC deals in 2023 were down rounds, up from 8% in 2022. In Q2 2023, 15% of VC rounds were down rounds, which is the highest it has been since Q4 2017. The decline in valuations is more pronounced for late-stage companies than early-stage ones. The median change in valuation for early-stage follow-on financing rounds was 1.7x in 2023, which is the lowest since 2016.

Prepare to set sail on a venture capitalist odyssey in our blog,”Navigating Down Rounds in US Venture Capital!” Uncover the mysteries of down rounds, ride the waves of DeFi, and navigate the uncharted territories of AI with MSys Technologies as your ingenious crew. Anchors aweigh, it’s time to chart a course for venture success like never before!

Learning Outcomes:

Understanding Down Rounds: Gain insights into the challenges faced by startups, particularly in late-stage companies, and comprehend the concept of down rounds in US venture capital financing.

Navigational Strategies: Explore effective strategies to navigate down rounds, including emphasis on core business, revenue generation, and providing a clear path to profitability. Learn from successful companies like PharmEasy and Titan Global Capital Management.

Trends in the Venture Capital Landscape: Stay informed about key trends in the 2024 US venture capital landscape, such as the rise of down rounds, the influence of AI, and the increasing focus on sustainability and social responsibility.

Strategic Prioritization: Understand the importance of prioritizing sustainability, exploring DeFi, embracing AI advancements, promoting diversity in investment portfolios, and supporting emerging VC managers globally for long-term success in the evolving venture capital ecosystem.

Image Credits: Cambridge Associates

The US VC market is expected to be a mixed bag in 2024, with a rise in down rounds despite the continuing influence of artificial intelligence. Late-stage companies are under pressure for liquidity, leading to down rounds, recaps, and tough choices. The number of unicorn companies and their valuations are expected to decline, indicating that down rounds will be a significant trend. To avoid down rounds, investors should prioritize companies with strong potential for growth and a clear path to profitability. Providing additional support, such as strategic guidance and network access, becomes crucial to navigating these challenges. Successful examples like health tech startup PharmEasy highlight the importance of staying focused on core business, revenue generation, and proactive steps to address issues.

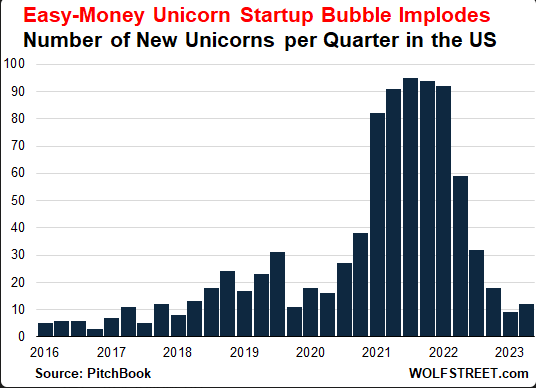

Image Credits: WOLFSTREET

The startup ecosystem in Silicon Valley has been facing significant challenges lately, with many unicorn companies experiencing downturns in their valuations. A recent report by Startup Grind highlights this trend, which has made it increasingly difficult for these startups to pursue their long-term goals.

Despite the ongoing slowdown in unicorn companies, a report by CB Insights suggests that billion-dollar valuations are still achievable. However, in the current venture capital landscape, investors are prioritizing startups that are profitable and can use capital efficiently. As a result, it will be a matter of which companies can reach that milestone under increased investor scrutiny.

According to a report by PYMNTS.com, nearly 90% of the 128 companies that achieved valuations of $1 billion or more in 2021 are now estimated to be valued lower. This decline in valuations is more pronounced for late-stage companies than early-stage ones, though both still exceed pre-2021 levels. The fintech sector is the most affected by this trend, while digital health has remained resilient.

Investors should prioritize companies with clear paths to profitability and strong growth potential. Providing additional support, such as strategic guidance and network access, will be essential for navigating these challenges. These strategies are particularly important in the current venture capital landscape, as the examples and statistics from various reports illustrate.

The Future of Venture Capital: Key Takeaways for Enterprises

As we move into 2024, the venture capital landscape in the US is expected to undergo significant changes, with an emphasis on sustainability, DeFi, and AI. In order to remain competitive, businesses should prioritize the following:

- Prioritize Sustainability and Social Responsibility Ventures

Investors are increasingly interested in eco-friendly and socially responsible companies, with a focus on sustainability expected to drive funding in the coming years. As a result, enterprises should consider investing in startups that prioritize sustainability and social responsibility. - Explore Decentralized Finance (DeFi) for Substantial Capital Investment

DeFi is emerging as a revolutionary concept within the blockchain, offering a decentralized alternative to traditional financial systems. As such, investing in startups working on DeFi solutions is expected to attract substantial capital in the years to come. - Embrace Artificial Intelligence and Machine Learning Advancements

Artificial intelligence and machine learning startups are expected to continue attracting substantial capital in 2024. Enterprises should keep up with the latest developments. In the world of AI and machine learning, the development and investment will be driven by these technologies. - Promote Diversity and Inclusion in Investment Portfolios

Investment portfolios are increasingly prioritizing diversity and inclusion, reflecting a broader commitment to creating a more representative and equitable startup ecosystem. Enterprises should ensure that their investment portfolio reflects a commitment to diversity and inclusion. - Support Emerging VC Managers Globally for New Opportunities

Smaller Limited Partners are increasingly supporting emerging VC managers on a global scale, signaling a shift towards diversification and a willingness to explore new and promising investment opportunities. Enterprises should consider partnering with smaller Limited Partners to support emerging VC managers on a global scale. - Identify Favorable Entry Points in Early-Stage Startup Valuations

Investors are finding favorable entry points in the valuations of early-stage startups, emphasizing a focus on identifying ventures with strong growth potential at an opportune stage. Enterprises should also consider identifying these favorable entry points for early-stage startup valuations. - Be Prepared for Down Rounds and Strategies to Mitigate Decreased Valuations

Down rounds are expected to increase in 2024, prompting companies to explore options to mitigate the adverse consequences. Enterprises should be aware of the potential for down rounds in US venture capital financings and consider strategies to mitigate the impact of decreased valuations. - Monitor Secondary Transaction Volume for Investment or Consolidation Indications

Investors should keep an eye on the secondary transaction volume, as this can indicate opportunities for investment or consolidation in the venture capital market.

In conclusion, enterprises that prioritize sustainability, DeFi, and AI while promoting diversity and inclusion in their investment portfolios will succeed in the rapidly evolving venture capital landscape in 2024.

Unveiling the Future of DeFi and 2024 Venture Capital Landscape

nvestors are now placing a greater emphasis on sustainability and social responsibility. Investors are willing to accept lower returns for investments in sustainable companies.

A recent paper titled “Sustainable Investing in Equilibrium” by finance professors Lubos Pastor, Robert F. Stambaugh, and Luke Taylor, indicates that investors are willing to sacrifice returns for sustainable investments. The paper suggests that green assets typically have lower expected returns due to the satisfaction investors derive from holding them and their ability to hedge against climate risk. However, these assets tend to outperform the market during unexpected shifts in customers’ preferences for green products and investors’ preferences for green holdings.

Additionally, a report by PWL Capital notes that investors inclined towards sustainable investments would demand higher expected returns for unsustainable companies, thereby increasing their expected returns. Conversely, these investors are willing to accept lower expected returns for investments in sustainable companies, thereby driving down their expected returns.

This shift in focus is expected to drive funding towards blockchain and cryptocurrency-related ventures, which are gaining prominence due to the growing influence of decentralized finance (DeFi). While DeFi has primarily facilitated the financing and trading of crypto-assets, it is expected to expand its scope in the future.

The number of insider-led deals by US VCs is expected to rise in 2024, as they look to capitalize on their privileged information. However, late-stage companies nearing initial public offerings, as well as their early- and mid-stage counterparts, are feeling the impact of a surge in down rounds, which has been fueled by the uncertainty in equity markets. With the negative impact on valuations, venture-backed companies planning to raise capital in 2024 are already considering alternatives to issuing stock at a lower valuation, commonly known as a “down round.” To avoid this outcome, companies may offer enhanced rights to investors or extend the exercise period for stock options.

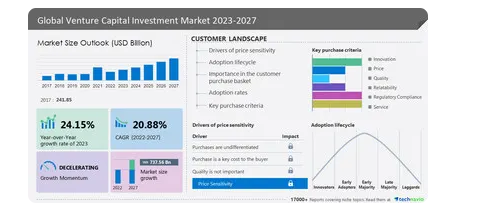

Venture Capital Landscape in 2024: Trends and Statistics

The 2024 venture capital landscape in the US is characterized by a focus on sustainability, DeFi, and AI, as well as a notable emphasis on diversity and inclusion within investment portfolios.

Here are some key trends and statistics to keep in mind:

- Sustainability and Social Responsibility

Investors these days are increasingly interested in businesses that prioritize sustainability and social responsibility. The following points highlight this trend and explain how investors can make socially responsible investments to generate financial returns while also contributing positively to society and the environment:

– Socially responsible investing aims to invest in companies that make a positive, sustainable, or social impact while excluding those that make a negative impact. This approach can be called values-based investing, sustainable investing, or ethical investing.

– According to a 2019 Morgan Stanley survey, 85% of individual investors are interested in sustainable investing. Additionally, a report by NerdWallet highlights that socially responsible investing can go by many names and is gaining popularity.

– ESG (Environmental, Social, and Governance) investing provides a broader framework for looking at social impact beyond simply excluding companies. Socially responsible investing, on the other hand, involves conducting positive and negative screens for investing in companies that are deemed socially responsible.

– A report by S&P Global notes that ESG investing is considered the contemporary and exemplary choice, while socially responsible investors engage in decision-making primarily on principle.

– Socially responsible investing aims to foster positive social and environmental outcomes while generating financial returns. Investors who prioritize social responsibility are less concerned with minimizing the financial risks of immoral investments and prioritize doing good.

– Combining ESG research with traditional financial considerations can give a more holistic view of ESG/sustainability, as highlighted by a report by Forbes. Integrating ESG factors into the investment process does not guarantee positive ESG outcomes, but it does bring additional considerations into the security selection process.

– Investors can invest in socially responsible funds that prioritize sustainability and social responsibility. Some of the best socially responsible funds available in the market include the iShares ESG Aware MSCI USA ETF (ESGU), Vanguard ESG U.S. Stock ETF (ESGV), and Nuveen ESG Large-Cap Growth ETF.

Examples of companies that prioritize sustainability and social responsibility in their business models include Patagonia, Tesla, and Beyond Meat.

- Decentralized Finance (DeFi)

– Decentralized finance (DeFi) is an emerging financial technology that uses cryptocurrency and blockchain technology to manage financial transactions.

– DeFi aims to democratize finance by replacing legacy, centralized institutions with peer-to-peer relationships that can provide a full spectrum of financial services.

– The total value locked in DeFi protocols reached an all-time high of $157.8 billion in May 2022, up from $1 billion in June 2020, according to a report by CoinMarketCap.

– The growth of DeFi protocols has been driven by the increasing demand for decentralized financial services, which offer greater transparency, security, and accessibility.

– DeFi protocols have enabled the creation of new financial products and services, such as decentralized exchanges, lending platforms, and stablecoins.

– Uniswap and Aave are examples of popular DeFi protocols that have attracted significant amounts of capital.

– DeFi has enabled the creation of new investment opportunities, such as yield farming and liquidity mining.

– Yield farming involves staking cryptocurrencies in DeFi protocols to earn rewards, while liquidity mining involves providing liquidity to DeFi protocols in exchange for rewards.

DeFi is expected to drive funding towards blockchain and cryptocurrency-related ventures.

Thus, the growth of DeFi has become a significant trend in the US venture capital market for 2024. - Artificial Intelligence (AI)

Venture capitalists are focusing on AI as a significant trend in the US market for 2024.

– A report by VentureBeat predicts that 2024 will be a defining year for AI, with the rise of multimodal models and the fall of generative AI startups.

– According to a report by Business Insider, VCs predict that 2024 will continue to be a major investing year for AI startups.

– The global AI funding reached $45 billion in 2022, and the global AI market size is expected to grow 37% every year from 2023 to 2030, according to a report by Hostinger.

– The Q1 2024 Venture Trends report by VC Lab highlights that AI and machine learning startups continue to attract substantial capital.

Successful AI-powered companies include OpenAI, Character.AI, Instagram, and Paige, which highlight the importance of AI in various industries. Investors are scrutinizing companies’ commitment to responsible practices in the dynamic landscape, as AI companies navigate market volatility amid ethical scrutiny.

- Down Rounds

– Down rounds accounted for 20% of VC deals in 2023, up from 8% in 2022. Late-stage valuations have fallen more sharply than those of early-stage companies, though both still exceed pre-2021 levels.

– Approximately 15% of VC rounds in the second quarter of 2023 were downrounded, the highest level since the fourth quarter of 2017.

- Navigating Down Rounds

Companies can navigate down rounds by emphasizing their core business, demonstrating their ability to generate revenue, and providing a clear path to profitability. Offering enhanced rights to investors to justify propped-up share prices or extending the exercise period for stock options also helps.

- Successful Companies

PharmEasy and Titan Global Capital Management are companies that successfully navigated down rounds. These companies focused on their core business, demonstrated their ability to generate revenue, and provided a clear path to profitability.

- Investor Advice

– Investors should support emerging VC managers globally, identify favorable entry points in early-stage startup valuations, and be prepared for down rounds.

– They should also monitor secondary transaction volume for investment or consolidation indications.

By focusing on these fundamental aspects, both investors and startups can position themselves for long-term success despite the prevalence of down rounds.

The Bottom Line

To sum up, even though down rounds can present significant difficulties for startups, it is essential to concentrate on the core principles of the business and look for assistance to reduce the impact. Doing so makes it possible to cultivate sustainable long-term growth and generate value, even in the face of prevailing market trends.

Ahoy there! If you find yourself adrift in the choppy waters of venture capitalism, fear not! MSys Technologies is here to steer you towards calmer seas with our expert guidance and extensive network connections. As the industry sails through changes, we can help you chart a course that prioritizes:

Decentralized Finance (DeFi): Dip your toes into the deep end of financial innovation and ride the waves of opportunity.

Artificial Intelligence (AI): Upgrade your ship’s engine with cutting-edge tech and sail past the competition.

Diversity & Inclusion: Cultivate a diverse crew and ensure everyone has a seat at the table.

Emerging Venture Capital Managers: Lend a helping hand to budding captains and build a stronger maritime community.

Startup Valuation: Spot the perfect moment to invest in promising ventures and claim your share of treasure.

Down Rounds Preparation: Brace yourself for rough weather and keep your business buoyant amidst the storm.

Ready to set sail on a journey of growth and success? Drop anchor at MSys Technologies and let’s navigate the evolving venture capital landscape together!

FAQs

What is a down round in venture capital?

A down round in venture capital refers to a financing round where a company raises funds at a valuation lower than the valuation of the previous round. This can lead to dilution of existing shareholders and is often a sign of financial difficulty for the company.

How common are down rounds in the US?

Down rounds are not uncommon in the US. According to statista, in 2022, the venture capital investment in the US software sector alone was valued at approximately 90.2 billion USD.

What factors can lead to a down round?

A down round can be triggered by various factors such as a company’s inability to meet performance expectations, changes in market conditions, or a reassessment of the company’s valuation based on its current financial situation.

How do down rounds impact existing investors?

Down rounds can significantly dilute the ownership stakes of existing investors, including founders, employees, and earlier investors, which can lead to a decrease in the overall value of their holdings.

What are the implications of a down round on company morale and culture?

Down rounds can negatively impact company morale and culture as they are often perceived as a sign of financial distress. This can lead to demotivation among employees and make it challenging to retain top talent.

Are there any alternatives to down rounds for struggling companies?

Companies facing financial challenges may explore alternatives to down rounds, such as restructuring, cost-cutting measures, or seeking bridge financing to improve their financial position before pursuing another round of funding.

How have down rounds been affected by market trends?

According to ey.com, in 2022, the venture capital investment in the US declined by 34% quarter over quarter. Despite this, VC-backed companies still raised more than $200 billion in a volatile market in the same year.

What should companies consider before pursuing a down round?

Before pursuing a down round, companies should carefully evaluate the long-term implications and consider seeking professional advice to assess the best course of action for their specific situation.

How can companies mitigate the impact of a down round?

Companies can mitigate the impact of a down round by maintaining transparent communication with stakeholders, focusing on operational efficiency, and demonstrating a clear path to achieving financial stability and growth.

What are the long-term effects of a down round on a company’s valuation?

Down rounds can have lasting effects on a company’s valuation, making it more challenging to attract future investment at higher valuations and potentially impacting its ability to go public or pursue acquisition opportunities.

How does the current market outlook affect the prevalence of down rounds?

The current market outlook, characterized by fluctuating investment trends, declining VC activity, and significant amounts of dry powder available for investment, has contributed to the prevalence of down rounds in the US venture capital landscape.

What are the key considerations for investors in the event of a down round?

Investors should carefully assess the reasons behind the down round, the company’s strategy for overcoming its challenges, and the potential for future growth and profitability before making any decisions regarding their investment.

What are the legal and regulatory implications of a down round?

Down rounds can have legal and regulatory implications, particularly related to the treatment of existing shareholders, disclosure requirements, and compliance with securities laws. Companies should seek legal counsel to navigate these complexities.

How do down rounds impact the fundraising prospects of a company in the future?

Down rounds can impact a company’s fundraising prospects in the future, as they may signal a lack of confidence in the company’s performance and make it more difficult to attract new investors at favorable terms.

What are the best practices for communicating a down round to stakeholders?

Transparent and proactive communication is essential when navigating a down round. Companies should provide clear explanations, realistic action plans, and reassurance to stakeholders, including employees, investors, and partners, to maintain trust and confidence in the company’s long-term prospects.

What is MSys Technologies and how can it help startups navigate the venture capital landscape?

MSys Technologies is a technology consulting firm that provides expert guidance and extensive network connections to help startups navigate the evolving venture capital landscape. MSys can help startups chart a course that prioritizes decentralized finance, artificial intelligence, diversity and inclusion, emerging venture capital managers, startup valuation, and down rounds preparation.

How can MSys Technologies help startups prepare for down rounds in venture capital financing?

MSys Technologies can help startups prepare for down rounds by providing strategic guidance and network access. By focusing on core business principles, generating revenue, and providing a clear path to profitability, startups can mitigate the impact of decreased valuations and cultivate sustainable long-term growth.

What is the role of MSys Technologies in promoting diversity and inclusion in investment portfolios?

MSys Technologies can help promote diversity and inclusion in investment portfolios by encouraging enterprises to invest in startups that prioritize diversity and inclusion. By cultivating a diverse crew and ensuring everyone has a seat at the table, startups can create a more representative and equitable ecosystem.

How can MSys Technologies help startups leverage artificial intelligence to gain a competitive edge?

MSys Technologies can help startups upgrade their ship’s engine with cutting-edge AI technology and sail past the competition. By keeping up with the latest developments in AI and machine learning, startups can enhance their online presence, attract relevant prospects, and improve their ROI.

What is the significance of decentralized finance (DeFi) in the venture capital landscape, and how can MSys Technologies help startups leverage it?

Decentralized finance (DeFi) is an emerging financial technology that uses cryptocurrency and blockchain technology to manage financial transactions. MSys Technologies can help startups dip their toes into the deep end of financial innovation and ride the waves of opportunity by investing in startups working on DeFi solutions.

How can MSys Technologies help startups identify favorable entry points in early-stage startup valuations?

MSys Technologies can help startups identify favorable entry points in early-stage startup valuations by providing expert guidance and network access. By focusing on identifying ventures with strong growth potential at an opportune stage, startups can position themselves for long-term success.

What is the future of venture capital, and how can MSys Technologies help enterprises stay competitive?

The future of venture capital is characterized by a focus on sustainability, DeFi, and AI, as well as a notable emphasis on diversity and inclusion within investment portfolios. MSys Technologies can help enterprises prioritize these areas and navigate the evolving venture capital landscape with expert guidance and extensive network connections.

What is the significance of sustainability and social responsibility in the venture capital landscape, and how can MSys Technologies help enterprises invest in socially responsible companies?

Sustainability and social responsibility are increasingly important in the venture capital landscape, with investors prioritizing eco-friendly and socially responsible companies. MSys Technologies can help enterprises invest in socially responsible companies by providing expert guidance and network access to startups that prioritize sustainability and social responsibility.

What is the role of MSys Technologies in supporting emerging venture capital managers globally for new opportunities?

MSys Technologies can support emerging venture capital managers globally for new opportunities by partnering with smaller Limited Partners to explore new and promising investment opportunities. By building a stronger maritime community, MSys can help enterprises stay competitive in the rapidly evolving venture capital landscape.

How can MSys Technologies help startups navigate the challenges of down rounds and emerge stronger?

MSys Technologies can help startups navigate the challenges of down rounds by providing strategic guidance and network access. By emphasizing core business principles, generating revenue, and providing a clear path to profitability, startups can mitigate the impact of decreased valuations and emerge stronger in the long run.