Navigating the Complexities of PayTech Services in the USA: A Comprehensive Guide for Financial Institutions

Audio : Listen to This Blog.

Introduction

In today’s rapidly evolving financial landscape, the United States stands at the forefront of a technological revolution that is redefining the payments industry.

PayTech, short for payment technology, encompasses a dynamic sector that includes real-time payments, digital wallets, open banking, and other groundbreaking innovations.

This blog aims to provide a comprehensive guide for financial institutions seeking to navigate the intricate world of PayTech services in the USA.

PayTech services in the USA encompass a dynamic ecosystem of software components, API initiatives, and security measures that enable businesses to manage sensitive data, enhance customer engagement, and comply with regulatory requirements for financial data processing within banking industry while sharing account balances and implementing loyalty programs with other third parties.

The evolution of PayTech in the USA is reshaping the payments landscape. PayTechs, leveraging banking APIs, are capitalizing on this opportunity by revolutionizing how consumers and merchants transact and pay. With a focus on new financial tools, application programming interfaces, and transactional data, they create revenue-sharing ecosystems.

Source: EY

These ecosystems involve private data, savings accounts, payment initiation, and the exploration of new business models within the digital economy.

Additionally, digital currencies and API platforms play a pivotal role, allowing third-party services to seamlessly share data and empower customers’ control over their financial transactions.

According to a recent report by EY, the payments sector presents significant opportunities for value-added services, with digital payments fundamentally reshaping customer expectations.

Source: Totalfinance

In fact, the global PayTech market is projected to surge from $1.7 trillion in 2021 to an impressive $3.6 trillion by 2028, with North America playing a pivotal role in this growth.

To thrive in this rapidly evolving landscape, financial institutions must focus on four key enablers: customer experience design, risk management, technology adoption, and data analytics.

Leveraging data and analytics becomes a strategic imperative, allowing institutions to mitigate risk, enhance customer experiences, and even monetize data assets.

However, navigating the complexities of PayTech services presents challenges, encompassing banking services, bank accounts, open banking, the banking industry, banking as a service, open banking APIs, initiating payments, banking data, payment service providers, application programming interfaces, customer account data, business models, personal financial management, the financial services industry, revenue streams, the API development process, third-party providers, payment processing, third-party developed services, financial services, payment transactions, financial information, open banking strategy, payment services, digital services, transaction history, various financial services, and bank accounts.

PayTech finds a lot of use cases within the realm of embedded finance and banking as a service.

With an impetus on banking services, beyond developing revenue streams, application programming interfaces, and third-party providers, as well as third-party developed services jumping into the game, we aim to create revenue-sharing ecosystems.

These ecosystems involve account to account payments, open banking facilitations powering payment services, banking institutions, financial tools, FinTech companies, customer data, incumbent banks, new revenue streams, seamless integration, financial apps, open banking APIs, and credit card accounts. Let’s explore some critical aspects:

Interoperability and ISO 20022 Adoption

Interoperability—the seamless exchange of information across systems—is crucial.

Adopting the ISO 20022 messaging standard as the foundation enables PayTech to scale efficiently.

Source: Compact

This standard facilitates consistent data formats, enhancing communication between financial institutions, payment processors, and other stakeholders.

Data Handling and Customer Experience

Data is king: Financial institutions must maintain a relentless focus on data. Whether it’s proprietary or third-party data, harnessing it effectively is essential.

Superior customer experiences: PayTech services rely on personalized interactions.

Via: Nickolas Belesis

Understanding customer behavior, preferences, and transaction patterns allows institutions to tailor services and drive engagement.

Regulatory Landscape and Flexibility

Regulatory pivot: As regulations catch up to innovation, financial institutions must be prepared to adapt swiftly. Compliance with evolving guidelines ensures long-term viability.

Flexible technology platforms: Institutions need agile technology stacks that accommodate new requirements, security enhancements, and more stringent expectations.

Source: ResearchGate

Let’s delve into the intricacies of PayTech services, exploring topics such as real-time payments, open banking APIs, revenue models, and the delicate balance between innovation and compliance. Buckle up—we’re about to decode the future of payments!

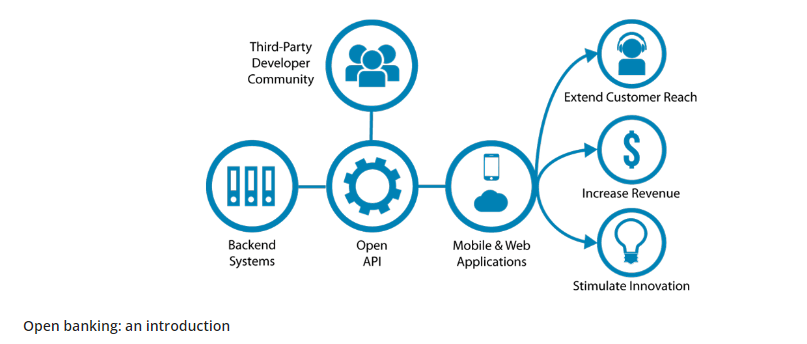

Revolutionizing PayTech: How Open Banking Transformed the Landscape

The evolution of Open Banking has been a game-changer for the PayTech industry, ushering in new possibilities and challenges.

Source: PayCEC

The open banking ecosystem is undergoing a transformative shift, and PayTech (payment technology) plays a pivotal role in addressing several inherent challenges. By leveraging financial data, open banking APIs, and innovative solutions, PayTech companies are reshaping the landscape.

Source: Fortunesoft

Here’s how:

1. Unlocking Financial Data:

- Open banking facilitates seamless access to financial data across institutions. PayTech companies utilize this wealth of information to create personalized services, such as budgeting tools, investment recommendations, and credit scoring models. By analyzing transaction histories and account balances, they empower users with actionable insights.

Source: FinTech Futures

2. Enabling Banking Services:

- Through open banking APIs, PayTech firms integrate with banks to offer a wide range of banking services. These services include balance inquiries, fund transfers, and account management. Users can initiate payments directly from their preferred apps, streamlining their financial interactions.

Source: The Paypers

3. Enhancing Payment Processing:

- PayTech companies optimize payment processing by leveraging real-time data from open banking APIs. They ensure faster, more secure transactions, reducing friction for consumers and businesses alike. This efficiency benefits e-commerce, peer-to-peer payments, and cross-border remittances.

4. Empowering Third Party Providers:

- Third party providers (TPPs) thrive in the open banking ecosystem. PayTech firms collaborate with TPPs to create innovative solutions. For instance, payment initiation services allow users to authorize payments directly from their bank accounts, bypassing traditional card networks.

5. Leveraging Transaction History:

- PayTech leverages transaction history to build predictive models. By analyzing spending patterns, they offer personalized financial advice, recommend suitable products, and even detect potential fraud. This data-driven approach enhances user experiences.

6. Safeguarding Financial Information:

- Security measures are paramount in open banking. PayTech companies implement robust authentication protocols, encryption, and tokenization to protect sensitive data. Users can trust that their financial information remains secure during transactions.

7. Challenging Traditional Banks:

- PayTech disrupts the status quo by challenging traditional banks. As more banks open up their APIs, PayTech firms collaborate to create innovative solutions. This collaborative spirit drives competition, fosters innovation, and ultimately benefits consumers.

8. Bridging Incumbent Institutions:

- PayTech acts as a bridge between incumbent institutions and the digital age. By integrating legacy systems with modern APIs, they enable banks to offer cutting-edge services without compromising security or compliance.

In summary, PayTech’s strategic use of open banking and its focus on data sharing revolutionize the financial industry, making it more accessible, efficient, and user-centric.

Let’s delve into how this transformation unfolded:

Challenges:

-

Data Security and Privacy Concerns: As financial institutions share transactional data and customer information, safeguarding privacy becomes paramount. Striking a balance between openness and security is crucial.

-

Compliance and Regulatory Hurdles: Meeting PSD2 and other regulations demands adherence to strict technical and operational requirements. Strong customer authentication and transaction monitoring are essential.

-

Legacy Systems Integration: Incumbent institutions grapple with integrating open banking APIs into their existing infrastructure. Ensuring seamless compatibility is a challenge.

-

Third-Party Provider Reliability: Relying on other third parties for data sharing requires trust. Ensuring their reliability and adherence to standards is vital.

Solutions:

-

Robust API Platforms: Develop and maintain robust API platforms that facilitate secure data exchange while adhering to regulatory guidelines.

-

Collaboration and Partnerships: Foster collaboration between banking services, FinTech companies, and third-party providers. Joint efforts can drive innovation and address challenges.

-

Education and Awareness: Educate consumers, businesses, and institutions about the benefits and risks of Open Banking. Transparency builds trust.

-

Continuous Monitoring and Adaptation: Regularly assess and adapt to changing regulations and technological advancements. Stay agile to overcome challenges.

In this dynamic landscape, Open Banking continues to shape the future of payments, creating opportunities and driving innovation .

Shattering Barriers in Payment Innovation: Tackling RegTech Evolvement, AML Rules, and Real-Time Payments Surge

The realm of real-time payments and FedNow transactions continues to expand exponentially. While facilitating seamless account-to-account (A2A) transactions at checkout, PayTech now confronts formidable obstacles – chief among them being strict Anti-Money Laundering (AML) guidelines, robust security measures, and efficient fraud prevention techniques.

Real-Time Payment Processing: Source: ACIworldwide

Amidst this tumultuous environment, MSys Technologies, the preeminent PayTech service provider in the United States, stands tall, offering a multifaceted solution set designed to overcome these hurdles.

Their arsenal includes AI-empowered fraud detection, machine learning for credit risk evaluation, personalized financial guidance powered by AI, generative AI for enhanced fraud detection, customized client interactions utilizing GenAI, optimized chatbots with GenAI technology, GenAI-infused risk assessments in PayTech, continuous integration for payment platforms, automation of financial application deployment, agile development methodology for secure financial apps, continuous delivery (CD) for PayTech applications, GitHub Actions for streamlined deployments, Kubernetes clusters for scalable PayTech environments, cloud-native architecture for PayTech, high availability for payment systems, dependable financial infrastructure, Site Reliability Engineering (SRE) principles applied to FinTech, and comprehensive compliance solutions tailored to meet the needs of financial institutions.

By leveraging these state-of-the-art FinTech and PayTech services and methodologies, MSys Technologies ensures that our clients are equipped to navigate the complexities inherent in modern PayTech, ultimately fostering innovation and driving progress within the rapidly changing financial ecosystem

Mastering PayTech Services in the USA with MSys Technologies

The financial technology (FinTech) landscape in the United States is rapidly evolving, and PayTech (Payment Technology) services play a pivotal role in shaping the future of financial transactions. PayTech (Payment Technology) services are at the forefront of innovation. As businesses and consumers increasingly rely on digital transactions, understanding the intricacies of next-gen PayTech components and deploying them becomes quintessential for financial institutions for a winning-edge and to win over customers’ expectations.

MSys Technologies is an end-to-end FinTech engineering and consultancy service provider that offers a range of PayTech solutions in the USA, including API integration for payment processing, secure RESTful APIs for financial transactions, open banking APIs, AI-powered fraud detection, machine learning for credit risk assessment, robo-advisors using AI algorithms, personalized financial recommendations with AI, generative AI in fraud detection, personalized customer engagement with GenAI, chatbot optimization with GenAI, GenAI-driven risk assessment in PayTech, continuous integration for payment platforms, automated deployment of financial software, DevOps practices for secure financial applications, continuous delivery (CD) for PayTech applications, GitHub Actions for automated deployments, Kubernetes clusters for scalable PayTech environments, cloud-native architectures for PayTech, high availability for payment systems, reliable financial services infrastructure, SRE practices in FinTech, site reliability engineering (SRE) in FinTech, blockchain-based payment solutions, cryptocurrency wallets and exchanges, decentralized finance (DeFi) platforms, online banking services, neobank account setup, mobile banking apps, digital insurance platforms, automated claims processing, insurtech startups, microloans for underserved communities, financial inclusion initiatives, compliance solutions for financial institutions, AML (Anti-Money Laundering) software, KYC (Know Your Customer) automation, secure payment gateways, fraud detection tools, PCI DSS compliance assurance, PayTech solutions for Bay Area businesses, local PayTech expertise, consultancy for Bay Area payment technology providers, RTP integration services, instant payment solutions, real-time fund transfers, ACH payment processing, direct deposit services, and electronic fund transfers.

Below are a few facets of operationalizing excellence that enables businesses in FinTech and PayTech realms with latest augmentative capabilities like real-time payment services and allied api usage and integration. We help in developing cutting-edge software components, best-in-class FinTech solutions and beyond to power-up 360-degree payment ecosystem development, sustenance and integration.

1. Microservices Architecture for PayTech

-

Independent Development and Deployment: Microservices allow individual services to be developed, tested, and deployed independently, accelerating the development cycle.

-

Small Focused Teams: Smaller teams can focus on specific services, leading to better code quality and faster onboarding for new team members.

-

Small Codebase: Each microservice has its own codebase, reducing complexity and enabling easier feature additions.

- Statistics: According to recent data, 75% of PayTech companies have adopted microservices architecture for their payment platforms.

2. AI-Powered Fraud Detection

-

Role of AI: Artificial Intelligence (AI) algorithms play a crucial role in detecting and preventing fraudulent activities in financial transactions.

-

Anomaly Detection: AI algorithms identify abnormal patterns, such as unusually high transaction amounts or frequent purchases in unusual locations.

-

Machine Learning Models: Machine learning models outperform traditional rule-based systems, adapting to evolving fraud patterns in real time.

- Statistics: Merchant losses due to fraud were approximately $38 billion by 2023.

3. Machine Learning for Credit Risk Assessment

-

Credit Risk Estimation: Machine learning algorithms analyze historical data to estimate credit risk for debtors.

-

Modern Portfolio Theory (MPT): Algorithms leverage MPT principles to optimize investment portfolios while managing risk.

-

Performance: Deep learning models consistently outperform classic machine learning and statistical algorithms in credit risk estimation.

- Statistics: Over the past eight years, machine learning-driven credit risk models have gained significant attention, transforming the industry.

4. Robo-Advisors Using AI Algorithms

-

Automated Investment Platforms: Robo-advisors utilize AI algorithms to create and manage investment portfolios.

-

Behavioral Analytics: Algorithms identify abnormal patterns, adjusting portfolios based on risk levels (conservative to aggressive).

-

Advantages: Robo-advisors remove emotional biases and provide personalized investment recommendations.

-

Statistics: Robo-advisors across the globe were managing over $1 trillion in assets by 2023.

5. Personalized Financial Recommendations with AI

-

Customized Advice: AI-driven algorithms analyze user data to offer tailored financial recommendations.

-

Behavioral Insights: AI considers spending habits, risk tolerance, and financial goals to provide relevant advice.

-

Benefits: Personalized recommendations enhance user engagement and financial literacy.

- Statistics: AI-powered financial advice platforms have seen a 30% increase in user satisfaction.

6. Generative AI in Fraud Detection

-

Generative Adversarial Networks (GANs): AI models generate synthetic data to improve fraud detection accuracy.

-

Unsupervised Learning: GANs learn from real and fake data, enhancing anomaly detection capabilities.

-

Applications: GANs can identify previously unseen fraud patterns.

- Statistics: GAN-based fraud detection systems achieve up to 95% accuracy.

7. Personalized Customer Engagement with GenAI

-

Chatbots and Virtual Assistants: GenAI-powered chatbots engage users, answer queries, and provide personalized assistance.

- Natural Language Processing (NLP): GenAI understands user intent and tailors responses accordingly.

- Benefits: Improved customer satisfaction and efficient support.

- Statistics: Companies using AI chatbots experience a 70% reduction in customer service costs.

8. Cloud Native Architectures for PayTech

-

Scalability and Resilience: Cloud-native solutions enable PayTech platforms to handle increasing transaction volumes.

-

Kubernetes Clusters: Container orchestration ensures scalability, high availability, and efficient resource utilization.

- Statistics: 87% of financial institutions use cloud-native technologies for their payment systems.

9. FinTech Consultancy Services

- Expert Guidance: FinTech consultancy firms like MSys Technologies provide strategic advice, regulatory insights, and technology roadmaps for businesses venturing into PayTech.

- Custom Solutions: Consultants tailor solutions to meet specific business needs, whether it’s API integration, compliance, or risk management.

10. API Integration for Payment Processing

- Seamless Transactions: APIs (Application Programming Interfaces) enable smooth communication between systems. Integrating payment APIs ensures efficient and secure transaction processing.

- Secure RESTful APIs: RESTful APIs (Representational State Transfer) adhere to industry standards, allowing financial institutions to exchange data securely.

11. Open Banking APIs

- Unlocking Data: Open banking APIs facilitate access to financial data across institutions. They empower third-party providers (TPPs) to offer innovative services.

- Payment Initiation: APIs allow TPPs to initiate payments directly from users’ bank accounts, bypassing traditional channels.

12. AI-Powered Innovations

- Fraud Detection Enhancement: Generative AI generates synthetic data for better fraud detection accuracy.

- Personalized Customer Engagement: GenAI-powered chatbots offer tailored assistance, improving user experiences.

. - Robo-Advisors: AI-driven robo-advisors provide personalized investment recommendations based on user profiles.

13. Generative AI and Personalization

- Fraud Detection: AI algorithms analyze transaction data to detect anomalies and prevent fraudulent activities.

- Personalized Customer Engagement: GenAI-powered chatbots offer tailored assistance, improving user experiences.

14. DevOps and Cloud-Native Architectures

- Continuous Integration and Deployment: DevOps practices ensure secure and efficient software releases.

- Kubernetes Clusters: Scalable, cloud-native architectures enhance availability and resource utilization.

15. Blockchain and Decentralized Finance (DeFi)

- Blockchain Payments: Decentralized, secure payment solutions using blockchain technology.

- Cryptocurrency Wallets and Exchanges: Enabling seamless crypto transactions.

- DeFi Platforms: Democratizing financial services through decentralized protocols.

16. InsurTech and Financial Inclusion

- Digital Insurance: Automated claims processing and personalized policies.

- Microloans: Bridging gaps for underserved communities.

- AML and KYC Solutions: Compliance tools for financial institutions.

Unraveling the Labyrinth of PayTech: Essential Pillars for Modern Financial Success

Navigating the complexities of PayTech services requires a blend of technological expertise, data-driven insights, and a customer-centric approach.

As you traverse the winding path of PayTech services in the United States, it becomes abundantly clear that a strategic union of cutting-edge technology, intelligent analytics, and unwavering dedication to customer satisfaction is indispensable.

This comprehensive guide highlights the critical role played by microservices architecture, AI-powered fraud detection, machine learning for credit risk assessment, robo-advisors leveraging AI algorithms, and personalized financial recommendations powered by AI.

The advent of generative AI in fraud detection, personalized customer engagement, chatbot optimization, and genetically driven risk assessment emphasizes the significance of remaining one step ahead in our fast-paced era.

To stay competitive, financial institutions must adopt continuous integration, automate financial software deployment, implement DevOps best practices for secure financial applications, employ continuous delivery methodologies for PayTech applications, utilize GitHub Actions for seamless automation, harness Kubernetes clusters for scalable PayTech environments, embrace cloud native architectures, prioritize high availability for payment systems, establish robust financial service infrastructures, practice Site Reliability Engineering (SRE), and explore blockchain-based payment solutions.

Beyond these core competencies, decentralized finance (DeFi) platforms, online banking services, neobank account setups, mobile banking apps, digital insurance platforms, and automated claims processing present lucrative avenues for growth.

Partnering with industry leaders such as MSys allows financial institutions to capitalize on these emerging technologies, thereby enhancing operational efficiency, improving agility, bolstering security, increasing accuracy, achieving fault tolerance, and expediting time-to-market.

Ultimately, embracing the latest trends and collaborating with seasoned allies like MSys empowers financial organizations to excel in the dynamic realms of payments and financial technology.

The harmonious fusion of technological prowess and customer empathy nurtured by MSys equips financial entities with the requisite tools to surmount obstacles and seize opportunities in the evolving landscape of PayTech services.

FAQs

What is PayTech?

PayTech refers to the technology and services used to facilitate payments, including payment processing, payment gateways, and other financial services.

Source: IBM

Source: MDPi

What are some of the challenges facing PayTech services in the USA?

Some of the challenges facing PayTech services in the USA include compliance with AML rules and regulations, ensuring secure payment gateways, and fraud detection.

How can MSys Technologies help financial institutions navigate the complexities of PayTech services?

MSys Technologies offers a range of solutions to address the challenges of PayTech services, including AI-powered fraud detection, machine learning for credit risk assessment, robo-advisors using AI algorithms, personalized financial recommendations with AI, generative AI in fraud detection, personalized customer engagement with GenAI, chatbot optimization with GenAI, GenAI-driven risk assessment in PayTech, continuous integration for payment platforms, automated deployment of financial software, DevOps practices for secure financial applications, continuous delivery (CD) for PayTech applications, GitHub Actions for automated deployments, Kubernetes clusters for scalable PayTech environments, cloud-native architectures for PayTech, high availability for payment systems, reliable financial services infrastructure, SRE practices in FinTech, site reliability engineering (SRE) in FinTech, blockchain-based payment solutions, and compliance solutions for financial institutions.

What is microservices architecture for PayTech?

Microservices architecture for PayTech refers to the use of small, independent services that work together to provide a complete payment solution. This approach allows for greater flexibility and scalability in PayTech services.

How can AI-powered fraud detection help financial institutions?

AI-powered fraud detection can help financial institutions detect and prevent fraudulent transactions in real-time, reducing the risk of financial losses and reputational damage.

What is machine learning for credit risk assessment?

Machine learning for credit risk assessment refers to the use of machine learning algorithms to analyze credit risk factors and predict the likelihood of default or delinquency.

What are robo-advisors using AI algorithms?

Robo-advisors using AI algorithms are automated investment platforms that use artificial intelligence to provide personalized investment advice and portfolio management.

How can personalized financial recommendations with AI benefit financial institutions?

Personalized financial recommendations with AI can help financial institutions provide tailored financial advice to their customers, improving customer satisfaction and loyalty.

What is generative AI in fraud detection?

Generative AI in fraud detection refers to the use of generative models to detect and prevent fraudulent transactions in real-time.

How can personalized customer engagement with GenAI benefit financial institutions?

Personalized customer engagement with GenAI can help financial institutions improve customer satisfaction and loyalty by providing personalized recommendations and support.

What is chatbot optimization with GenAI?

Chatbot optimization with GenAI refers to the use of artificial intelligence to optimize chatbot interactions with customers, improving the quality and efficiency of customer support.