What is RegTech & How Is It Revolutionizing the Financial Industry in the USA by Democratizing Compliance?

Audio : Listen to This Blog.

Introduction

In today’s rapidly evolving world, technology holds the reins of transformation, directing its might towards an industry that constitutes the backbone of a nation’s economy – the financial landscape. Amidst this diversity, a potential game-changer that vows to redefine industry standards is RegTech, a revolutionary symbiosis of ‘Regulatory’ and ‘Technology.’ This developing wave of innovative synergy revolutionizes the course by which financial institutions fall in line with dynamic and multifaceted regulations. In this blog, we’ll understand: “What is RegTech, and how is it revolutionizing the financial industry in the USA by democratizing compliance.”

Steering the regulatory helium balloon ever so confidently, RegTech stands tall as a testament to democratization in the financial compliance sphere. As one of the best RegTech service providers in the USA, MSys Technologies adds value by offering cutting-edge FinTech engineering and consultative services that streamline compliance processes, enhance efficiency, and ensure regulatory compliance and happy to unravel the role of the RegTech realm in leveling the financial industry’s chessboard in the USA amidst ruffles brought up by technologies such unregulated blockchain and DLT technologies, digital currencies and more, by democratizing compliance.

With finesse and sophistication, RegTech democratizes compliance by providing accuracy, and cost efficiency, arguably enhanced compared to traditional methodology. By spearheading an automated route to compliance, encapsulating real-time monitoring and apt reporting, it furnishes many wonderful financial organizations an avenue by which to herald their instigation towards fore-handed risk management.

Tucked under the vast umbrella of RegTech are its highly functional offerings that are reengineering multiple facets of the Financial industry, from operative methods in KYC and AML compliance practices to risk management and regulation mapping and from vigilance-inducing fraud detection systems to the vehement virtual shield of cybersecurity.

Standing at the helm of affairs, throwing light on a consolidated document readied to embolden the framework for the future, RegTech’s undeniable commitment projects a silhouette greatly promising to redefine compliance doctrines and champion innovation measures in the financial sector.

RegTech is reshaping the financial landscape in the USA, achieving this through the democratization of compliance fueled by cutting-edge technologies such as AI, big data, and machine learning. RegTech is booming, and the global RegTech market size reached $5.46 billion in 2019 and is projected to reach $28.33 billion by 2027, growing at a CAGR of 22.3% from 2020 to 2027. In this blog article, “What is RegTech and How is It Revolutionizing the Financial Industry in the USA by Democratizing Compliance,” we’ll also explore several instances showcasing RegTech’s transformative influence on the industry, viz.:

- Regulatory monitoring: Utilizing AI and machine learning, RegTech solutions ensure real-time monitoring of regulatory changes, allowing financial institutions to remain in sync with the latest compliance prerequisites.

- Automated Reporting: RegTech streamlines the laborious regulatory reporting process by collecting data from diverse sources and generating reports that align seamlessly with regulatory demands.

- Real-time Risk Management: With AI and machine learning algorithms, RegTech provides continuous transaction monitoring, effectively identifying potential risks before they escalate.

- Fraud Detection & Safeguarding: RegTech scrutinizes extensive datasets, pinpointing patterns indicative of fraudulent activities. This aids financial institutions in promptly detecting and thwarting instances of fraud.

- Simplified Compliance: Through automation, RegTech simplifies compliance procedures, diminishing the need for manual intervention and heightening precision.

- Economical Solutions: The cost-effectiveness of RegTech solutions significantly curbs the compliance expenses borne by financial institutions.

- Heightened Efficiency: By automating compliance protocols, RegTech cuts down the time and effort invested in adhering to regulatory standards.

- Precision Refinement: The infusion of AI and machine learning into RegTech amplifies compliance accuracy, mitigating the likelihood of errors and non-compliance.

The essence of RegTech lies in its capability to automate, streamline, and simplify compliance tasks, thereby enabling organizations to navigate the ever-evolving regulatory framework with ease. Through its implementation, financial institutions can enhance their regulatory compliance management, concurrently lowering expenses and elevating accuracy.

Let’s stand prepared to walk you through the labyrinth of RegTech’s carefully gathered constructs that highlight and explain its enchantment that has played impressive cards on the deck of the USA’s financial industry. It swears to mention much larger definitions governed by ‘Regulatory Technology’; therefore diminishing unforeseen issues puncturing holes to upswing financial compliance measures. Also discussed will be the avant-garde benefits offered by RegTech, namely, evolved efficiency, slashed costs, and augmented precision resonating promising possibilities. Be ready as we venture on this journey to explain the compelling, transformative force that the upcoming RegTech paradigm holds over the current industry practices.

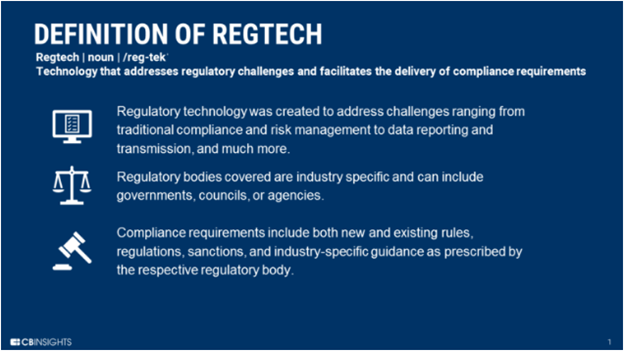

Demystifying RegTech: What is RegTech

RegTech, a contraction of “regulatory technology,” refers to the strategic implementation of innovative technologies to streamline and automate the intricate processes of regulatory compliance. It encompasses an array of advancements, such as artificial intelligence (AI), machine learning, blockchain, data analytics, and cloud computing.

(Image 1: What Does the Term RegTech Signify?)

Through the utilization of these cutting-edge tools, RegTech solutions furnish financial institutions with more streamlined, precise, and cost-efficient avenues to fulfill regulatory requisites.

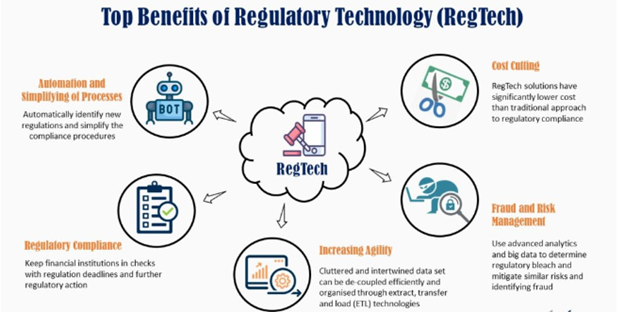

(Image 2: Top Benefits of RegTech)

The worldwide RegTech market burgeoned to $5.46 billion in 2019 and is anticipated to swell further to $28.33 billion by 2027. This remarkable growth represents a compounded annual growth rate (CAGR) of 22.3% spanning from 2020 to 2027.

At its core, RegTech holds the imperative of democratizing compliance, effectively breaking down barriers for organizations of all dimensions. In days gone by, compliance was an exhaustive and manual endeavor, often monopolized by larger establishments fortified with substantial budgets. Smaller entities found it strenuous to keep pace with the burgeoning demands of compliance. Yet, RegTech emerges as the great equalizer, empowering entities of every magnitude to adeptly navigate the intricate labyrinth of regulations.

In this landscape, RegTech solutions offer valuable support to financial institutions, heightening their capacity to oversee regulatory compliance with enhanced efficiency and efficacy. Concurrently, these solutions effectively curb costs and amplify the precision of compliance processes.

Notably, MSys Technologies stands as a vanguard among the best RegTech service providers in the USA. Their expertise acts as a guiding light for companies, facilitating seamless assimilation and utilization of RegTech. This translates to optimized compliance strategies, improved processes, and, ultimately, fortified confidence in navigating the regulatory landscape.

The Evolution of RegTech in the USA

The genesis of RegTech can be traced back to the aftermath of the 2008 financial crisis, during which global regulators endeavored to fortify oversight and forestall future crises. In the United States, this impelled the adoption of substantial regulatory reforms, most notably the Dodd-Frank Financial Reform Act. While the Act aimed to bolster oversight and safeguard consumers, it simultaneously ushered in a wave of novel compliance mandates for financial institutions. As the regulatory terrain grew intricate and onerous, the call for inventive solutions to navigate compliance surged. This gave birth to the emergence of RegTech enterprises, concentrated on fabricating technologies to surmount the challenges encountered by financial institutions. Harnessing advancements in AI, machine learning, and data analytics, these companies automated compliance procedures, truncated errors, and augmented efficiency.

The seismic impact of RegTech on the American financial landscape is encapsulated in its ability to democratize compliance through the adroit utilization of avant-garde technologies like AI, big data, and machine learning.

A notable player in this transformative tide is MSys Technologies, nestled among the best RegTech service providers in the USA. We offer best-in-class, end-to-end, full-stack FinTech software engineering services, allowing you to ride the crest of this evolution and navigate the ever-shifting regulatory horizons with confidence.

Benefits of RegTech in the Financial Industry

RegTech offers numerous benefits to financial institutions, regulators, and consumers alike. Let’s explore some of the key advantages:

1. Enhanced Efficiency and Accuracy

By automating compliance processes, RegTech solutions significantly improve efficiency while reducing the margin for error. Manual tasks, such as data entry and verification, can be replaced by intelligent algorithms, freeing up valuable time for compliance professionals to focus on more strategic and value-added activities.

2. Real-Time Monitoring and Reporting

RegTech solutions provide real-time monitoring and reporting capabilities, enabling financial institutions to stay on top of their compliance obligations. Through advanced analytics and data processing, these solutions can quickly identify patterns, anomalies, and potential risks, allowing institutions to take proactive measures to mitigate compliance issues.

3. Cost Reduction

The adoption of RegTech can lead to significant cost savings for financial institutions. Organizations can reduce their reliance on manual resources by automating labor-intensive compliance processes, ultimately lowering operational costs. Furthermore, RegTech solutions enable better resource allocation, ensuring compliance efforts are focused where needed.

4. Improved Risk Management

RegTech solutions offer enhanced risk management capabilities by providing better insights into potential risks and vulnerabilities. By leveraging AI and machine learning algorithms, these solutions can analyze vast amounts of data to identify emerging risks and patterns that may be indicative of non-compliance. This allows institutions to proactively address issues before they escalate.

5. Simplified Regulatory Reporting

Regulatory reporting is a critical aspect of compliance, but it can be a complex and time-consuming process. RegTech solutions simplify this process by automating data collection, validation, and submission. This not only reduces the burden on compliance teams but also improves the accuracy and timeliness of reporting, ensuring that financial institutions meet their regulatory obligations.

RegTech is transforming the financial industry in the USA by democratizing compliance and offering enhanced efficiency, accuracy, and cost reduction for financial institutions. MSys Technologies, being amongst the best RegTech service providers in the USA, is equipped with end-to-end full-stack FinTech software engineering services such as loyalty, payment processing, digital wallets, digital asset management, enterprise mobility, risk and fraud analysis, payment gateways, AI/ML, digital engineering and SRE to name a few pivotal ones helps you stay ahead of the regulatory curve and navigate the complex regulatory landscape effectively.

RegTech Applications in the USA

RegTech solutions have found applications across various areas within the financial industry in the USA. Let’s explore some of the key use cases:

1. Know Your Customer (KYC) and Anti-Money Laundering (AML) Compliance

KYC and AML compliance are essential in preventing financial crimes, such as money laundering and terrorist financing. RegTech solutions leverage advanced data analytics and AI to automate customer due diligence processes, enabling financial institutions to efficiently identify and verify customer identities, assess risks, and monitor transactions for suspicious activities.

2. Risk Assessment and Management

Regulatory reporting is a critical obligation for financial institutions. RegTech solutions automate the collection, validation, and submission of data required for reporting, ensuring compliance with regulatory requirements. These solutions can integrate with internal systems, extract relevant data, and generate reports in the specified format, saving time and reducing the likelihood of errors.

3. Regulatory Reporting and Compliance

The adoption of RegTech can lead to significant cost savings for financial institutions. Organizations can reduce their reliance on manual resources by automating labor-intensive compliance processes, ultimately lowering operational costs. Furthermore, RegTech solutions enable better resource allocation, ensuring compliance efforts are focused where needed.

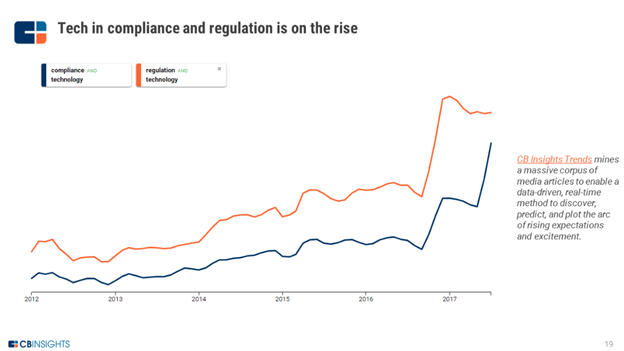

(Image 3: The Proliferation of RegTech)

4. Fraud Detection and Prevention

RegTech solutions play a vital role in fraud detection and prevention by utilizing advanced analytics and AI algorithms to identify suspicious patterns and anomalies. These solutions can analyze transactional data in real time, flagging potentially fraudulent activities and triggering alerts for further investigation. By detecting fraud early, financial institutions can minimize losses and protect their customers.

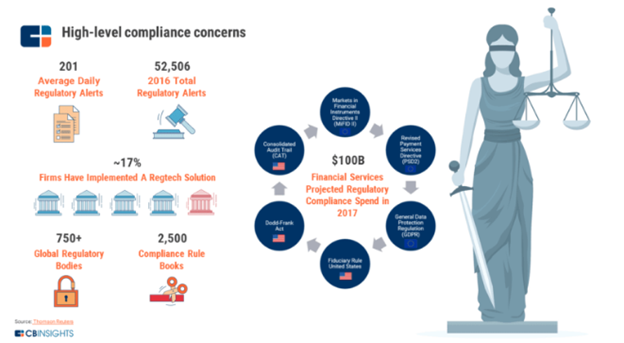

(Image 4: The Ever-Evolving Vicious Surface Area of Compliance Concerns Necessitates RegTech)

5. Cybersecurity and Data Privacy

In an era of increased cybersecurity threats and data breaches, RegTech solutions provide financial institutions with tools to strengthen their cybersecurity and data privacy measures. These solutions can monitor network activity, detect potential vulnerabilities, and ensure compliance with data protection regulations. By proactively addressing security risks, financial institutions can safeguard sensitive information and maintain customer trust.

MSys Technologies, being amongst the best RegTech service providers in the USA, helps businesses leverage RegTech solutions with confidence to navigate the complex regulatory landscape effectively, manage risks, ensure compliance, and safeguard sensitive information.

Why RegTech (Regulatory Technology) Is Needed in the USA: Navigating Compliance and Innovation

- Need for RegTech: In the United States, RegTech is pivotal due to the heavily regulated financial services sector, overseen by numerous federal and state agencies. The complexity of regulations poses challenges for financial institutions, driving the demand for streamlined solutions to mitigate compliance risks.

- Technological Advancements: Advancements in AI, machine learning, and cloud computing have empowered RegTech firms to create innovative solutions. These technologies automate manual tasks, swiftly analyze extensive data, and preemptively identify potential risks, fostering compliance and innovation.

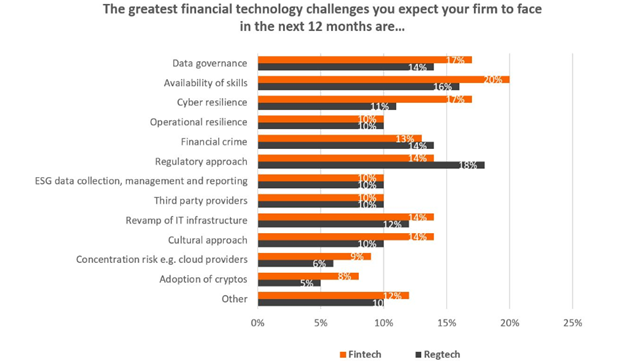

(Image 5: RegTech is the Solution to The Multiple Challenges in the Realm of Financial Technology)

RegTech Solutions Unveiling the Advantages for Blockchain and Digital Currency Regulation Blockchain and digital currencies usher in a new era of financial landscapes, and RegTech (Regulatory Technology) emerges as a vital catalyst in managing these novel domains. Here are the key benefits that RegTech solutions offer in the realm of regulating blockchain and digital currencies:

- Enhanced Compliance: Leveraging automation, data analytics, and AI, RegTech solutions empower financial institutions to navigate regulatory frameworks surrounding blockchain and digital currencies. Compliance processes are streamlined, ensuring adherence to regulatory demands.

- Improved Transparency: Blockchain’s inherent distributed ledger technology fosters heightened transparency in data management. This is pivotal in regulating digital currencies, facilitating increased openness and security.

- Cost Reduction: RegTech solutions drive cost efficiency by automating compliance operations linked to blockchain and digital currencies. Reducing reliance on manual resources translates to lower operational expenses.

- Fraud Prevention: RegTech solutions harness blockchain’s potency to combat fraud in the digital currency realm. Strengthened customer due diligence processes and work against money laundering and other illicit activities.

- Real-Time Monitoring: Real-time monitoring and reporting capabilities of RegTech solutions empower financial institutions to fulfill compliance obligations in blockchain and digital currencies. By rapidly identifying patterns, anomalies, and potential risks, proactive measures are taken to mitigate compliance challenges.

MSys Technologies as a Partner: MSys Technologies stands among the best RegTech service provider in the USA, offering advanced FinTech engineering and consultative services. Their expertise empowers financial institutions to navigate regulatory complexities effectively, embrace RegTech benefits, and drive operational excellence while maintaining compliance. Proficient in both RegTech solutions and blockchain technology, MSys Technologies enables organizations to ensure compliance, streamline processes, and harness blockchain’s potential securely and efficiently.

Regulatory Bodies and Regulations Influencing the RegTech

Industry

The rapid evolution of RegTech is firmly molded by a complex interplay of extensive regulations orchestrated by various regulatory bodies. This soup-to-nuts of regulatory norms embed their profound ramifications in every operational architecture that RegTech comes to shape. It acts as a diverse, broad-spectrum guideline outlining facets of processing, storage, and transmission of personal and financial data. In this list are included eminent regulations such as Payments Services Directive 3 (PSPD3), Payments Services Directive 2 (PSPD2), General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), each with its ample amounts of directive principles, fortifying data management protocols and consumer privacy.

Payment Services Directive 3 (PSD3)

PSD3 is a European Union directive that aims to enhance consumer protection and promote innovation in the payments industry. It introduces new requirements for payment service providers, including RegTech firms.

PSPD2

Payments Services Directive 2, or PSPD2, revolutionizes how payments work within the European Union. It’s designed to greatly enhance repayment efficiency and dynamically allows expanded power to consumers, providing innovative methods to pay.

GDPR

Forming the essence of privacy-driven endeavors within the European Union is the General Data Protection Regulation. GDPR indisputably proliferates personal data protection measures, with an acute focus on how organizations process and hold data.

CCPA

Californian law delivered the California Consumer Privacy Act to the privacy sphere with noticeably GDPR-inspired constituents. The core essence of CCPA underlines the Californian consumer’s rights relating to knowing about data collection and data selling practices, as well as granting rights for data refusal, access, and destruction.

While specific to their region, these strong regulatory bodies and their associated regulations dictate pivotal tunings of RegTech design by ensuring every aspect corresponds with compliance-worthy moves. Organizations across the world investing in RegTech solutions find themselves consistently updating and adapting.

Federal Reserve Board (USA) and Central Bank Digital Currency (CBDC)

In the panoramic scope of financial regulations, monumental entities stand firm—the Federal Reserve Board being one in the USA, playing a pivotal role in dictating terms of liquidity and credit controls and holding conservatorship roles. Given their influential power, when connected with the nascent concept of a Central Bank Digital Currency (CBDC)— a potentially regulated digital form of a nation’s fiat money—, the interpretive course of fiscal interactions goes through a great revolution. When CBDC entrusts its implementation on technology-like characteristics-enhanced blockchains, an explosive requirement surge for a pivotally agile and advanced regulatory undertone becomes imminent. Preparation for such definitive mandates becomes almost essential for carving out a competitive edge in the industry. Not apprehending this enactment would be solely inviting a regulatory snub, thus ensuring one’s readiness via incorporating highly versed RegTech practices holds immense significance.

In conclusion, though the landscape shelters extreme chromesthesia, it is important to keenly align one’s philosophical approach in evaluating the innovative and regulatory playground to minimize reputational, financial, and operational risk. By properly considering these major bodies and their associated regulations, businesses embarking on their journey with RegTech can avoid compliance hesitations, fortify their movements, and take profound advantage of the promised RegTech peaks this landscape beholds.

At MSys, we understand the effect these regulations can have on a RegTech enterprise’s successful implementation and how ever-evolving standards can occur as obstacles in core strategies. Our team is updated in deciphering complex narratives, allowing for utmost fluidity whilst making corresponding alignments within solutions and compliance in the face of this transformation. Ascend the heights of your RegTech journey with MSys, effectively overcoming stringent regulatory lanes and rising above to conquer operational excellencies beyond mere compliances. Secure your institutions’ future now, with the peace of impeccable regulatory ascertains promised by MSys Technologies.

AI and RegTech: Automating Compliance and Improving Risk Management

In a relentless pursuit of coherent compliance and risk management, Artificial Intelligence (AI) pairs with RegTech, crafting a digital alliance and revolutionizing the very core of legacy regulatory processes. AI’s proficiency, attuned with its self-effective algorithms and machine-learning capabilities, fortifies the compliance procedures and elevates their managing efficacies to all-new surpluses.

Within the understated confines of semantic and sentiment analysis, predictive modeling, or natural language processing capabilities – AI earns stride in inching RegTech a level higher in its compliance-fulfilling play. Unresembling anyone else, AI carves for itself recognition eminent enough to have its functionality comprehended as a unique tag – the ‘AI RegTech,’ in present times.

Automated Compliance Processes

AI’s prominence beautifully garnishes itself in automating compliance procedures inherently strenuous in blue-collar ethics. Where extensive data work forms the crux, AI enables seamless accumulation of intrinsic information and auto inputs their findings onto regulatory reports. It classifies tasks based on their individual demands for human intervention needed and lets tasks focus only on anomalies its software parameter finds challenging. Owing to this automotive blessedness, its privilege subtly percolates onto data validation and submission realms, significantly reducing the margins for human-ridden error scopes.

Improved Risk Management

Likewise, dwelling in an era of potential unforeseen fiscal risks, accompanying which can turn predicamental, enterprises find hope in AI algorithms bearing preemptive alerts on such risks. AI algorithms fine-divot to those patterns denoting persisting financial challenges, thereby enabling organizations to correspondingly remodel their setups to cut short any further risks escalating down the line. AI innovations mark substantial degrees of safety layers in financial transactions and efficiently alleviate threats of fraud in intricate lengths of their operational direction, greatly approved in the risk domain by financial institutions.

Benefits of AI RegTech Solutions

AI’s pairing with RegTech undoubtedly falls into a category bearing multifamily benefits—

- Increased Accuracy: AI reduces human error-proneness by extensively zeroing dependent manual operations and directly heightens certainty degrees across performance wheelworks.

- Reduced Costs: Automating compliance procedures effectively truncate expenses involved with perpetual verticals of workforce training and development and related HR operations—further supporting the oblique matrix of resource allocation to areas in immediate need rather than areas managed effectively by altered AI.

AI’s embrace of RegTech is not the far-off reality it may have once seemed. We’re standing at the edge of an extraordinary transformation. With these altered processes revolutionizing the sector, institutions can not only efficiently plan targeted points of intervention but operationalize proactive countermeasures to potential risks, ensuring a smoother sieve of transactional flows in the monetary landscape.

Savings dwindled through curtailing substantial volumes of non-compliance fines can then be invested in aimed pinpointed directions for overall enterprise growth—an undisputable advantage balanced on scales of cost-effectivity and accuracy. It positively ripples throughout broad operations by tactfully harmonizing intricate relationships of compliance and customer service.

AI in RegTech is more than compliance assurance—it surpasses orchestrating an accordion of predominant activities and their individualistic positioning within an organization, serving extensively in designing operational pathways and enlightening foundational chords to success. In a realm where uncertainty tends to drive chaos, AI-enabled RegTech solutions will continue to mark unbelievable narratives shaping the ultimate beacon of compliance humankind has ever managed to descript.

As industry pioneers working at the juxtaposition of innovation and compliance, MSys Technologies, being among the RegTech service providers in the USA, stands securely on its conviction of AI resting as a true enabler for advanced regulative standards while blooming unwavering triumph seeds. Partner with us to experience maximum procurement from the era’s most blessed Duos – AI and RegTech aren’t strangers to our operational thread; we dwell in their confluence, balancing equal measures of cutting-edge tech facilitation and the adhesive of rock-solid compliance touches, ensuring your continual prosperity. Rest your aspirations upon the uncompromisable; choose MSys Technologies.

RegTech 3.0: What The Futuristic Regulatory Technologies Will Look Like

As the financial industry continues to evolve and regulations become more stringent, the importance of RegTech will only grow. The democratization of compliance through RegTech solutions will enable organizations, regardless of size, to navigate complex regulatory landscapes effectively. The ongoing advancements in AI, machine learning, and other technologies will further enhance the capabilities of RegTech solutions, making compliance more efficient, accurate, and cost-effective.

Additionally, regulatory bodies are recognizing the value of RegTech and actively promoting its adoption. Regulatory sandboxes and innovation hubs have been established to foster collaboration between regulators, financial institutions, and RegTech companies. This collaborative approach aims to facilitate the development and implementation of innovative RegTech solutions while ensuring compliance with regulatory requirements.

The UK Financial Conduct Authority’s (FCA) regulatory sandbox has facilitated the testing of innovative products and services by over 100 firms in a controlled environment, all under the watchful eye of regulators. Similarly, the USA’s Consumer Financial Protection Bureau (CFPB) has introduced a regulatory sandbox to foster innovation in consumer financial services. This sandbox serves as a secure testing ground for companies to trial new offerings without exposing themselves to regulatory enforcement actions. Additionally, the CFPB provides a no-action letter policy that furnishes regulatory certainty to firms experimenting with pioneering products and services. When it comes to navigating these regulatory sandboxes and innovation hubs, MSys Technologies is your trusted partner. We, being among the best RegTech service providers in the USA, guide enterprises through the process of developing and implementing inventive RegTech solutions while ensuring seamless compliance with regulatory prerequisites.

Best RegTech Companies in the USA

The RegTech industry is bustling with innovation, and several companies in the USA are leading the charge to help financial institutions adhere to regulatory requirements. Here’s a glimpse of some of the top RegTech companies, their distinctive offerings, and how they aid compliance:

| RegTech Company | Headquarters | Unique Offerings | How MSys Technologies Can Add Value for RegTech Companies |

| Ascent | Chicago, Illinois | Cloud-based regulatory compliance software across various sectors. | Deeper customization of compliance processes, enhancing precision and flexibility. |

| Chainalysis | New York | Cryptocurrency investigation and compliance solutions for law enforcement agencies and regulators. | Expertise in FinTech engineering, AI, and blockchain, enhancing effectiveness. |

| Forter | New York | Decision-as-a-service technology for risk reduction and theft prevention. | Integration of technology and strategy for stronger risk management mechanisms. |

| Hummingbird | San Francisco Bay Area | Anti-money-laundering technology provides comprehensive compliance solutions. | Technical expertise in optimizing anti-money laundering solutions. |

| PaymentWorks | Waltham, Massachusetts | Automated digital onboarding solutions for enhanced security and compliance. | Unparalleled consultation pathways through MSys Technologies’ project expertise. |

| Alloy | New York | Platforms combating fraud through identity controls. | Optimized processes and innovative solutions through MSys Technologies. |

| Exiger | New York | Innovative technology for procedural error prevention and organizational standards. | Navigating the regulatory landscape, creating robust governance frameworks. |

| Symphony AyasdiAI, Part of SymphonyAI (Learn more about them here – https://www.netreveal.ai/) | California | AI-powered pattern identification and process streamlining. | Amplification of AI-driven solutions through MSys Technologies’ expertise. |

| Sift | San Francisco, California | Interactive deliveries with user-centric processes. | Synergy with MSys Technologies’ technical insights. |

| BehavioSec | San Francisco, California | Behavioral biometrics for enhanced security in the financial industry. | Augmentation of expertise through MSys Technologies’ proficiency in AI. |

As a premier RegTech service provider in the USA, MSys Technologies plays a pivotal role in navigating the intricate regulatory landscape. With proficiency in RegTech services, alongside cutting-edge FinTech engineering and consultative services, MSys Technologies empowers organizations to enhance compliance processes, elevate efficiency, and ensure unwavering regulatory compliance.

Conclusion

RegTech’s propensity to evolve the regulatory landscape within the financial industry encompasses a promising future, with landmark developments in its panorama rapidly underway. As we continue to venture further into the depths of this technology-oriented revolution, businesses will need distinguishable partners like MSys Technologies, among the best RegTech service providers in the USA. We bring a blend of FinTech engineering savvy and tech innovation designed to guide you competently through the ever-evolving compliance terrains coupled with unrivaled precision and efficiency. Reach out to us today and explore how our team of experienced professionals ensures you robustly meet regulatory standards while harnessing the full potential of the RegTech revolution. Your compliance doesn’t need to play catch-up with technology; with MSys Technologies, it can lead the way to an empowering financial hood that champions innovation in equal measure as it does adherence. Let’s jointly architect a brave narrative of economic ascent.