Bumpy Ride Ahead for FinTechs in Consumer Lending Reveals the Fed

Audio : Listen to This Blog.

Introduction

The FinTech industry has played a critical role in providing credit to low- and moderate-income borrowers over the past decade. However, recent economic changes, including higher interest rates, have put pressure on these companies’ operations. A report by the Federal Reserve Bank of New York revealed that FinTechs are facing new challenges and are adapting their strategies to maintain their position in the consumer lending market. Stay tuned as we embark on a turbulent adventure unraveling the “Bumpy Ride Ahead for FinTechs in Consumer Lending…” space in the United States.

Evolving Economic Landscape for FinTech

Rising Interest Rates and Changing Demand

FinTech lenders have thrived in an environment of historically low interest rates, which has allowed many consumers to have excess cash. However, with interest rates on the rise, FinTechs are now facing the challenge of adapting their lending practices to account for changing economic conditions. The demand for loans remains high, especially among low- to moderate-income individuals, but economic headwinds make it more difficult for FinTechs to sell loans to institutional investors. This situation has led to a decline in loan originations and a higher bar for borrowers.

Over the past decade, significant advancements in financial technology have brought forth a new breed of lenders in the personal loan arena—known as FinTech lenders. While traditional lenders such as banks, thrifts, credit unions, and finance companies still play a crucial role in providing personal loans to consumers, FinTech lenders have emerged as a formidable force, capturing a notable share of the market. In this article, we offer an overview of the FinTech sector based on two relatively new data sources.

According to the Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax data, as of the end of 2022, the total value of personal loans, encompassing installment loans and various other types of loans used for purposes such as debt consolidation, medical bills, vacations, and significant purchases, stood at $356 billion, accounting for approximately 10 % of non-revolving credit. Of this amount, FinTech-issued loans amounted to around $50 billion or 14 % of personal loans. These loans are typically unsecured and predominantly carry fixed interest rates.

Stricter Credit Standards and Diversification

In response to the changing economic environment, FinTechs are raising their credit standards for personal loans to low- and moderate-income borrowers. In addition, many FinTechs are expanding their offerings beyond personal loans to other financial products to reduce credit risk and diversify their revenue streams. This includes cross-selling additional services such as financial advice and wellness programs, to existing customers.

The U.S. consumer credit regulatory environment is dynamic, intricate, and multifaceted, especially in relation to nonbank lender-issued personal loans. Two critical regulatory factors that profoundly impact the personal loan landscape are interest rate ceilings and banks’ ability to export interest rates. Furthermore, the 2015 ruling in Madden v. Midland funding has left its mark on the FinTech sector. This ruling restricted loans originating from FinTech– bank partnerships in New York and Connecticut, nullifying loans with interest rates exceeding the usury rates in those states if sold to nonbank entities—a pivotal aspect of the FinTech– bank partnership model.

Although some FinTech lenders have recently transitioned into becoming banks , at their core, these institutions remain nonbanks. Consequently, they are subject to interest rate ceilings, which curtail their profitability in states with low consumer finance rate limits. In contrast, banks can circumvent these regulatory restrictions by leveraging the 1978 Marquette ruling, which enables national banks to charge interest rates permitted by their home state, regardless of the borrower’s state of residence. Research by Elliehausen and Hannon (2023) demonstrates that FinTech lenders collaborate with banks to navigate around low interest rate ceilings, resulting in a disproportionate focus on near-prime and low-prime consumers situated in states with low consumer finance rate limits. This business model, characterized by partnerships with banks, influences how FinTech-issued loans are reported to credit bureaus, leading to the dispersion of FinTech loans across different sectors within the CCP data alongside traditional lenders.

The intricate interplay between regulatory elements, interest rate ceilings, and the FinTech– bank partnership model has significant implications for the operations and reporting of FinTech lenders. While some FinTech lenders have transitioned into banks to mitigate the impact of interest rate ceilings, their origins as nonbanks subject them to these restrictions in states with lower consumer finance rate limits. In contrast, banks enjoy the freedom to charge interest rates permitted by their home state, regardless of where the borrower resides. As a result, FinTech lenders strategically collaborate with banks to navigate around these limitations, enabling them to tap into the near-prime and low-prime borrower segments in states with lower consumer finance rate limits.

The unique business model of FinTech– bank partnerships not only shapes the regulatory landscape but also influences how FinTech-issued loans are categorized and reported by credit bureaus. This dynamic contributes to the dispersion of FinTech loans across various sectors within the CCP data, blurring the traditional boundaries between FinTech lenders and traditional financial institutions.

Understanding the regulatory complexities and evolving landscape of FinTech lenders is essential for comprehending the rise and impact of these technological innovators within the personal loan space. The data sources discussed here shed light on the market share, characteristics, and regulatory challenges faced by FinTech lenders, providing valuable insights into this rapidly growing sector.

As the personal loan landscape continues to evolve, driven by technological advancements and regulatory developments, it will be fascinating to observe how FinTech lenders adapt and shape the future of consumer lending in the United States.

Analyzing the Business Model of FinTech Lenders

Supply Landscape of FinTech-issued Personal Loans

To gain insights into the business model of FinTech lenders, we delve into the supply landscape of FinTech-issued personal loans and scrutinize the data from Mintel Comperemedia, which provides monthly acquisition offers for personal loans. These offers serve as a measure of credit supply and offer valuable insights into the market.

Mintel randomly selects approximately 4,000 consumers from a pool of 1 million and records all offer details in its databases. These data allow us to categorize the offers by lender type, enabling a comprehensive analysis of the supply landscape. In 2022, over 1.4 billion unsecured personal loan acquisition offers will be sent to consumers. FinTech lenders, in partnership with specialist banks, dominated the unsecured personal loan supply landscape with 35% of the offers. Finance companies followed with 27%, and banks, including LendingClub Bank, N.A., accounted for 26% of the offers. FinTech lenders without bank partners accounted for a smaller share of the solicitations at 7%. The remaining offers came from payday lenders, credit unions, and other institutions.

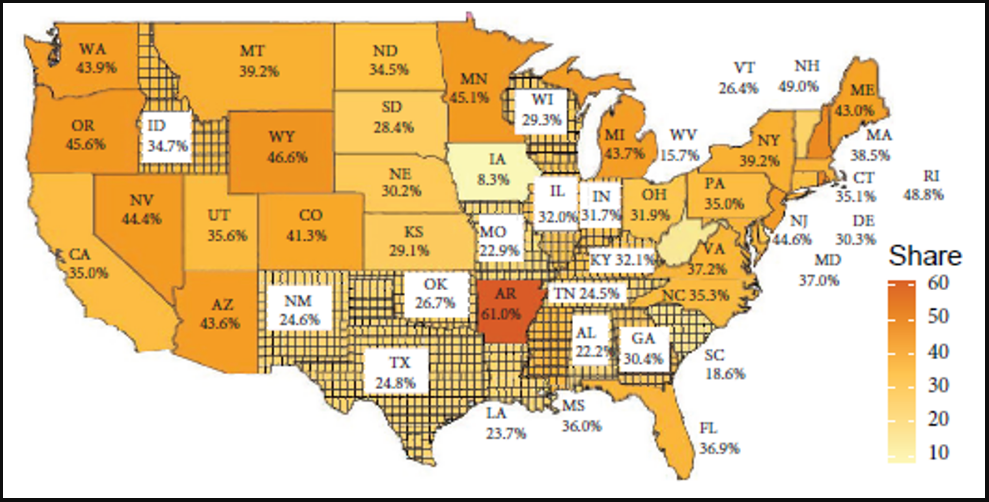

Analyzing the total solicitation mail volume over the period reveals an interesting trend. When FinTech lenders partner with specialist banks, they concentrate their mail offer solicitations in states with low consumer finance rate ceilings. This concentration allows them to circumvent state usury laws and target marginal consumers in states with low consumer finance rate ceilings because of the banks’ ability to export their home state interest rates.

Figure 1. Concentration of FinTech– Bank Partnership Mail Volume in Low Consumer Finance Rate Ceiling States

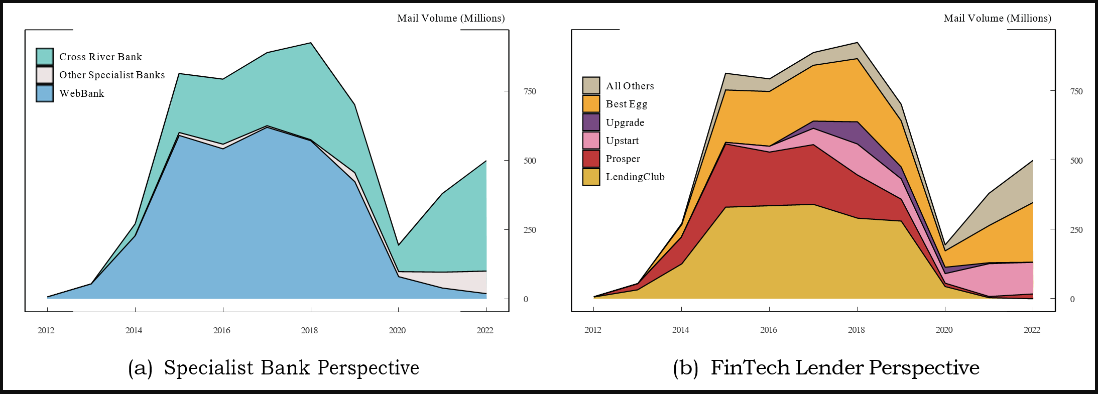

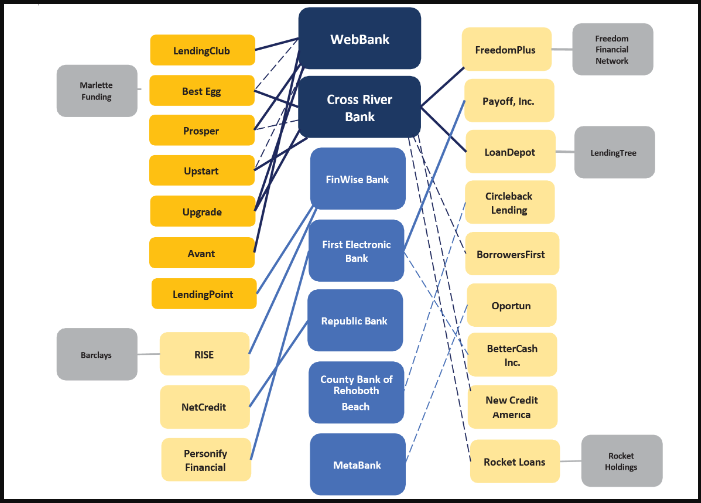

Furthermore, the data from Mintel enables us to identify the main banks that enable FinTech companies to access markets that would otherwise restrict non-bank presence. The notable participation of market leaders such as WebBank and Cross River Bank, along with other banks such as First Bank of Delaware and Goldman Sachs Bank USA, highlights the significance of these partnerships.

Figure 2. Analysis of Mail Volume in FinTech– Bank Partnership Offers

Examining the presence of FinTech companies in partnership structures reveals that their presence is less concentrated than that of partner banks. LendingClub, before becoming a bank, had the largest share of offerings, followed by Best Egg and Prosper. Upstart and Upgrade had smaller shares of offerings. This distribution reflects the diverse landscape of FinTech partnerships.

The mechanism behind FinTech– bank partnerships is crucial for understanding how these loans are reported to credit bureaus. When these partnerships occur, the bank becomes the “true lender” by making the loan on behalf of the FinTech company.

Figure 3. Visualizing the FinTech– Bank Partnership Landscape

Impact on FinTech Origins

Shift in Market Share

According to the Federal Reserve System’s report, FinTechs accounted for a larger percentage of personal loan originations than banks and credit unions in 2021 and 2022. However, in 2023, there was a significant shift in market share, with the percentage of total unsecured personal loans originated by FinTechs falling to 26.5% from 38% in the previous year. Meanwhile, banks and credit unions saw an increase in their market share, making 55.7% of personal loans in the second quarter of 2023.

Challenges for Individual FinTech Companies

Individual FinTech companies have also felt the impact of the changing economic landscape. For example, Oportun, a company that has historically targeted low- and moderate-income borrowers, experienced a decline in personal loan originations and an increase in its annualized charge-off rate. To cut costs, Oportun laid off a significant portion of its corporate staff and ended its recently launched buy now/pay later partnership. Similarly, Upstart, another FinTech lender, saw a decrease in loan originations and tightened its approval criteria, resulting in less than 10% of applicants being approved.

In response to these challenges, FinTechs have been exploring different strategies to remain relevant and continue serving their target market. One approach is to roll out new products and services to cross-sell to existing customers. By deepening their relationship with consumers through financial advice and wellness services, FinTechs can provide additional value beyond lending.

Furthermore, some FinTechs are expanding into new business areas, such as auto lending and home equity line of credit loans, in an attempt to diversify their revenue streams. However, the transition into these new sectors may take time and may not fully offset the decline in personal loan originations. In addition, FinTechs are leveraging alternative data sources, such as utilities and telecom payment history, rental payments, and income and employment information, to enhance their underwriting and credit decisioning processes. While alternative data can provide a more comprehensive picture of a borrower’s creditworthiness, it presents challenges for low- and moderate-income borrowers, as their utility payments and cash flow may fluctuate.

Finding the right balance between expanding access to low- and moderate-income borrowers and managing risk is a persistent challenge for both FinTechs and consumers. It is an ongoing effort to address the inclusion versus exploitation scale when serving these demographics.

Conclusion

The FinTech industry has faced significant challenges in consumer lending due to changing economic conditions, including higher interest rates and evolving market dynamics. FinTechs are adapting their strategies by raising credit standards, diversifying their offerings, and leveraging alternative data sources. While these adjustments help FinTechs navigate the current landscape, they must remain agile and innovative to continue providing credit to low- and moderate-income borrowers. By embracing new opportunities and refining their business models, FinTechs can maintain their relevance and support the financial needs of underserved communities.

Among this dynamic FinTech continuum, MSys Technologies stands ready to support and empower FinTechs and lenders with our technological prowess and 360-degree FinTech Product Engineering Services. We understand the importance of overcoming challenges and seizing opportunities and weave a fort of trust in the digital realm, transforming your business processes for the better with our state-of-the-art services. Let us be your trusted partner in conquering the hurdles of the financial service industry. We have proven expertise in harnessing and operationalizing the untamed power of technology for global engineering teams, pushing boundaries, and defying gravity. With the agility of a nimble acrobat, we navigate the tightrope of complex product engineering challenges, striking the perfect balance between security and convenience, empowering FinTechs.

If you have a technology problem, we have it covered. Together, let’s unlock the gates of FinTech engineering possibilities and bring your visions to reality. Join hands with MSys Technologies, and together we can create a future where innovation flourishes and tangible realities take shape.