How the Evolution of APIs is Shaping Up the Embedded Finance Revolution

Audio : Listen to This Blog.

Introduction

The future of agile financial services based on machine-to-machine technologies will likely be driven by APIs. The evolution of APIs is shaping up to become one of the most important trends in FinTech today, and it will impact everything from bank accounts to loans.

FinTechs are disrupting traditional financial services. In fact, FinTechs have already begun to change the way we do business and how we think about finance.

The most obvious example of this is credit cards—FinTechs such as PayPal, Venmo, and Square Cash disrupted how consumers pay for things by allowing them to make purchases with their smartphones instead of carrying cash or handing over checks. So the days when you had to go through an inefficient system of checks and cash are gone!

The importance of APIs in the future of finance is becoming increasingly apparent, and indeed this is how the evolution of APIs is shaping up the embedded finance revolution. How we think about financial services has changed dramatically over the past decade, with many companies shifting from being solely intermediaries to helping customers manage their own funds and make informed decisions on what products are best for them. This shift embarks a significant change in how we interact with banks, brokers, insurers, and other financial institutions when interacting with them – they still exist, but they’re no longer just there as an intermediary between us and our money; rather, they’re there because we want them there!

The financial industry is undergoing a significant transformation as digital technologies continue to reshape the way financial services are delivered. At the heart of this transformation are the evolution of APIs and their role in shaping the Embedded Finance Revolution. APIs have emerged as a critical enabler of innovation in FinTech, providing a standardized means of connecting various systems and devices and driving digital transformation in banking, payments, and other financial services.

Embedded finance is a new paradigm emerging in the financial industry, where financial services are integrated directly into the products and services of non-financial companies. This integration is made possible by using APIs, which enable seamless communication between various systems and devices, and allow for the creation of innovative financial services that are adaptable, flexible, and responsive to changing customer needs.

As financial institutions continue to embrace digital transformation and seek to deliver more innovative and agile financial services, the role of APIs in Embedded finance is becoming increasingly important.

Embedded finance has become incredibly popular recently, with industry experts like Angela Strange and Matt Harris making bold predictions about its future. Strange has stated that “Every company will be a FinTech company,” while Harris believes that the Embedded Finance market could reach a staggering $3.6 trillion in the next ten years in the US alone. While financial products themselves haven’t changed much, they are now being distributed digitally, allowing clients to access them in new and convenient ways.

This blog will explore the role of APIs in shaping the Embedded Finance Revolution and how they drive FinTech innovation, digital transformation in banking, and API-driven payments in Embedded Finance. We will also look at the benefits of Embedded Finance APIs, the future of Embedded Finance and APIs, and how APIs drive disruptive innovation in finance, particularly through Open Banking & BaaS.

Reimagining Finance: How APIs are Fueling Disruptive Innovation Through Open Banking, Banking-as-a-Service (BaaS), Orchestrating Next-Gen Core Banking and Beyond

In recent years, APIs (Application Programming Interfaces) have emerged as a powerful tool in the financial industry, driving disruptive innovation through Open Banking, Banking-as-a-Service, and Next-Gen Core Banking. This section will explore how APIs are transforming the financial landscape and driving innovation in these three key areas.

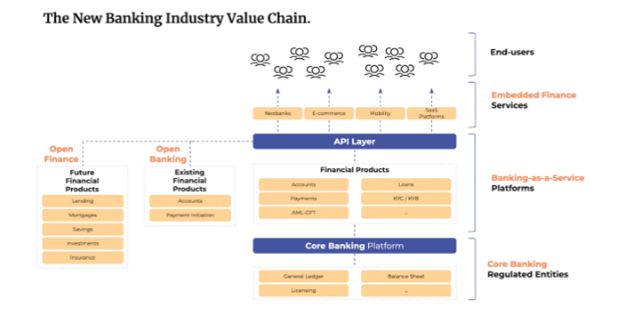

1.Open Banking offers APIs to sell financial Products

Open Banking, a concept that emerged over a decade ago, has gained momentum in recent years due to the Payment Services Directive 2 (DSP2). By providing access to data and third-party payment services, Open Banking has become a way to bring new financial service providers to the market and allow new technologies and innovation in banking services. With Open Banking, budgeting apps can import an individual’s financial history and create a personalized budget. Lenders can analyze an individual or business’s financial data to assess their financial situation. Open Banking has opened many opportunities for FinTech companies to use existing financial products to create new services and functionalities.

2.Banking-as-a-Service (BaaS) platforms allow brands to embed financial Services

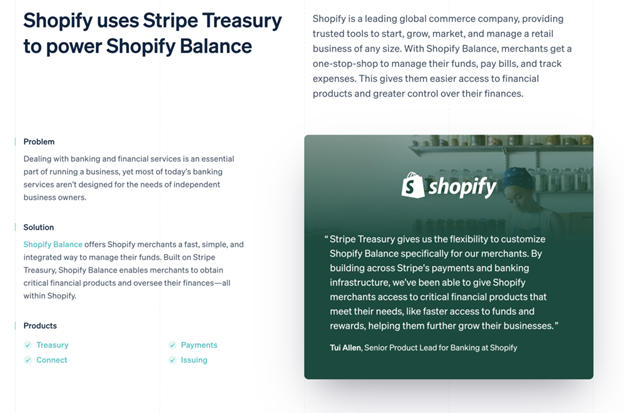

Banking-as-a-Service platforms break down financial services into consumable APIs that businesses can use to create solutions. This has allowed for e-commerce with banking, as seen in Shopify Balance x Stripe Treasury. However, some BaaS providers only offer the capacity to create new financial products and require the user to find a banking partner for the necessary license, such as issuing credit cards. Traditional banks have taken the initiative to embed themselves in the BaaS space, with players like BBVA and Goldman Sachs among the first to enter this new market. BaaS can offer strategic value in developing customer segments, speeding up successful market entry, and reducing operating and distribution costs when launching a new business activity.

3.Core Banking Platforms supply back-end systems and enable the orchestration of financial Services

A Core Banking Platform is a back-end system that manages all financial transactions daily. It processes payments, updates bank accounts and financial files, and sits at the heart of a bank or financial institution, as well as of the Banking-as-a-Service platform providers who offer their bank license as part of their service. Next-generation Core Banking Platforms have an orchestration layer and APIs to connect to the functionalities and functions financial institutions need to offer financial services. This capacity to orchestrate facilitates the coordination and embedding of components while connecting them to Core Banking accounts. This approach allows Core Banking Platform users to build, embed, change, and develop more quickly.

The Rise of Embedded Finance APIs: How They’re Leading the Charge

The API is a software interface allowing the software to interact with others. APIs allow for easy integration of new functionality into existing applications while providing developers with an easy way to integrate their code into the system. This makes it possible for developers to create applications that can be used on multiple platforms without having to rewrite all their code every time they want to create something new with an API (as opposed to performing some porting process). While there are many different types of APIs today, this article will focus solely on embedded finance APIs because they’re currently at the forefront of innovation within this industry and could have huge impacts on its future development if we take advantage of them now!

Following are some key points on the role of APIs in shaping the Embedded Finance Revolution and how they are driving FinTech innovation, digital transformation in banking, and API-driven payments in Embedded finance:

Seamless Integration: APIs enable seamless integration of financial services into non-financial products and services, which is the core of Embedded Finance.

Tailor-Made Products: APIs allow for creation of new financial products and services that are tailor-made to customers’ needs.

Driving FinTech Innovation: APIs are driving FinTech innovation by providing standardized connectivity between various systems and devices.

Enabling Digital Transformation: APIs are enabling digital transformation in banking by creating new digital channels for banking services.

API-Driven Payments: API-driven payments in Embedded Finance are becoming increasingly common, particularly in emerging markets.

Access to Data: APIs provide financial institutions with access to a wider range of data sources, which is critical for developing insights into customer behavior and preferences.

Innovation in Open Banking: APIs are driving innovation in Open Banking, which is a regulatory framework that allows third-party providers to access banks’ data and services through APIs.

Real-world use case scenarios include the success of FinTech companies like Square and Stripe, which have leveraged APIs to enable seamless payments processing for merchants, and the use of APIs by traditional banks to offer new digital services to customers. Indeed, the role of APIs in shaping the Embedded Finance Revolution cannot be overstated, and their impact will continue to be felt in the financial industry for years to come.

Embedded Finance Unleashed: How APIs are Redefining Customer Experiences

Banks increasingly rely on APIs to provide new services and deliver enhanced customer experiences. And it’s about more than growing their business or cutting costs. Banks are also using APIs to transform themselves into digital businesses that can compete with their national counterparts in the global economy.

APIs allow banks to build customer-centric apps that connect with customers’ existing financial accounts, personal data, social networks, and other platforms – without costly infrastructure investments or changes at the operational level required by traditional banking systems (like ATMs).

For example, A bank could turn an existing mobile app into a “smart” solution by integrating an API from another company that allows users to download credit score updates in real-time as they go through transactions on their phones – allowing them access to additional information about potential sources of funds like loans or credit cards; this could mean faster approval rates when applying for loans online!

The financial services sector has traditionally been a tough nut, with established banks and regulatory barriers blocking new entrants. However, APIs have changed the game by enabling FinTechs and non-financial brands to unbundle banking products and create financial services prioritizing customer convenience. Consumers and businesses now expect to manage their finances digitally and even prefer non-banking apps to store payment information.

Enterprises like Shopify are taking advantage of this shift by leveraging API technology to extend their financial service offerings. For instance, Shopify built its platform using API Stripe Treasury, which enables merchants to manage funds, pay bills, and track expenses from one place. This adds a layer of convenience for merchants and opens up a vast database of potential users for financial products that are easily embedded into the Shopify system.

APIs are no longer just technical interfaces; they’re essential products with various applications, including acquiring more data, improving customer satisfaction, creating new revenue streams, and diversifying service offerings. They’re a tool for differentiation that enhances the customer experience and showcases the identity of banks and FinTechs.

APIs have ushered in a new era of innovation in financial services, particularly in four main areas: Open Banking, Banking-as-a-Service, Core Banking, and Embedded Finance.

Where Will Embedded Finance Innovation Be In 20 Years?

As the world of finance continues to evolve, APIs will be at the center of that change. This is not a surprise—APIs have already been used by financial institutions and third-party vendors around the world for years to provide access to their data, APIs are now ubiquitous in most organizations, and they’re used by every industry player on Earth.

But these days, there’s more going on than just simple access: we’re also seeing innovation taking place around how APIs are being used, with exciting new possibilities emerging around how they can be used together across multiple industries or even within one company itself (think IBM Watson).

It’s clear that this is just the beginning of what’s coming next; we’re only just beginning to scratch at these possibilities—and so far, we’ve only scratched lightly!

API-Led Machine-to-Machine Technologies: The Future of Agile Financial Services

The future of agile financial services based on machine-to-machine (M2M) technologies will likely be driven by APIs.

As financial institutions continue to embrace digital transformation and seek to deliver more innovative and agile financial services, it is clear that API-led M2M technologies will play an increasingly important role in shaping the future of the industry. By leveraging the power of APIs to create seamless and secure connectivity between various systems and devices, financial institutions can create a truly agile and responsive financial services ecosystem that is capable of delivering innovative services to meet the evolving needs of customers.

API-led M2M technologies allow financial institutions to connect various systems and devices, enabling seamless and secure real-time data exchange. This allows for the creation of innovative financial services that are adaptable, flexible, and responsive to changing customer needs.

One of the key benefits of API-led M2M technologies is their ability to improve the efficiency of financial services. By enabling seamless communication between various systems and devices, APIs can automate processes and reduce manual intervention, reducing errors and increasing speed and accuracy.

Moreover, using APIs in M2M technologies can enhance the security of financial services. In addition, APIs provide a secure and standardized means of data exchange, which can help to reduce the risk of data breaches and cyber-attacks.

APIs are the key to the future of finance, as they allow for the creation of new financial services and products. These new offerings can then be distributed to users through different channels (i.e., mobile apps or web interfaces), which allows more people access to them at an affordable price point—allowing them to be utilized by small businesses and consumers alike for everyone’s needs from different places around the world (even if those places have never heard about each other before) could now come together under one roof online 24/7/365!

Wrapping It Up

While there is still much to be done, APIs are the future of financial services. In fact, our ability to create algorithms that can generate these kinds of applications may be what brings us into a new age of computing. In this way, the evolution of APIs is shaping up as a mission-critical part of how we interact with technology and each other in the coming decades.

At MSys Technologies, we know APIs are the superheroes of finance’s disruptive innovation. Our team of FinTech experts works round the clock, developing cutting-edge solutions that incorporate the latest API technologies while adhering to our innate four core pillars (4As), viz. agility, access, accuracy, and availability to infuse business and technical ingenuity and to ensure the deliverance of end-to-end FinTech engineering services that are scalable, cost-effective, flexible, fault-tolerant, and architected like customized capes – each tailored to meet the unique needs of our clients.

Are you ready to be the shining beacon of finance and stay ahead of the curve with state-of-art services? Then partner with us and witness our magical FinTech services suite – advanced and efficient, from customized open Banking integrations to streamlined digital banking services.

So, what are you waiting for? Let’s suit up and co-build the Justice League of cutting-edge FinTech services to revolutionize the new dawn of embedded finance.